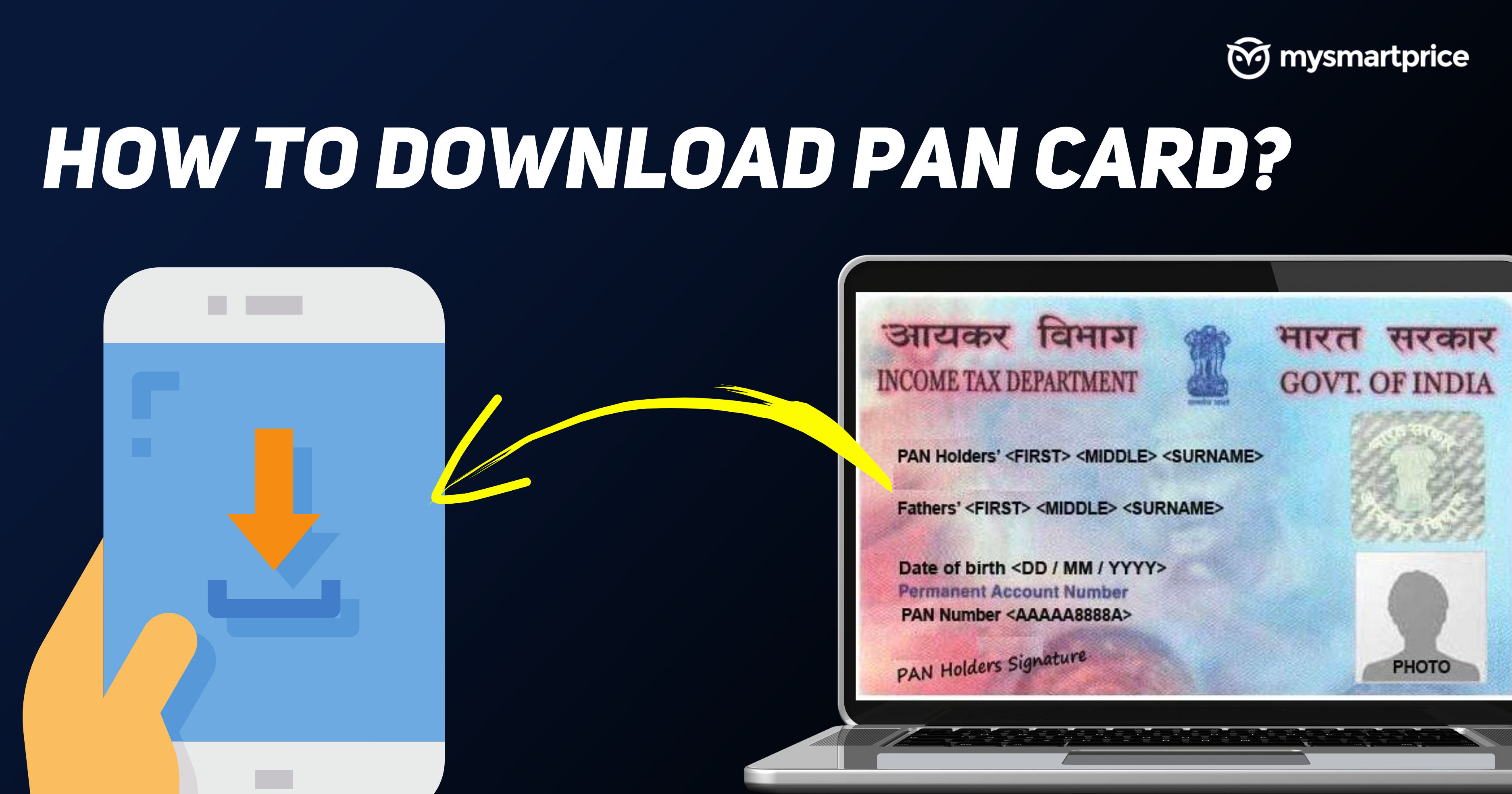

PAN, or Permanent Account Number, is a unique identifier issued by India’s Income Tax Department. Traditionally, PAN is issued as a PAN Card, but the times have changed, and we can download the PAN card online easily.

The downloadable PAN is called e-PAN, the electronic equivalent of a PAN card that you can request from various government portals to download.

The e-PAN card is the electronic equivalent of the PAN card, which contains the PAN number and the cardholder’s details. It is as valid as a physical PAN card. You can also use e-PAN card where ever the physical PAN card is accepted.

Also Read: How to Change Name in PAN Card: Online and Offline Process, Fees, Required Documents

Benefits Of e-PAN

- Proof of identity: e-PAN can be used to apply for a new bank account, open a Demat account or even apply for a new loan.

- File Income Tax: You can file your income tax using an e-PAN card instead of a physical PAN card.

- Buying or selling property: You can use an e-PAN for buying or selling property in place of a PAN card.

- For cash transactions of Rs 50,000: Any cash payment above Rs 50,000 in India now requires a PAN card as proof. You can use an e-PAN card for that as well.

Basically, you can use the e-PAN wherever a physical PAN card can be used.

Eligibility For e-PAN card

Here are the eligibility criteria for getting an e-PAN:

- You must be a citizen of India.

- Applicants must have proof of address and identity.

- Your age must be above 18.

- Only one PAN number will be allocated to a person.

Also Read: Reprint PAN Card: How to Get Duplicate PAN Card Online, Fees, Required Documents, and More

Documents Required To Download e-PAN Card

- Aadhaar card

- GSTIN (optional)

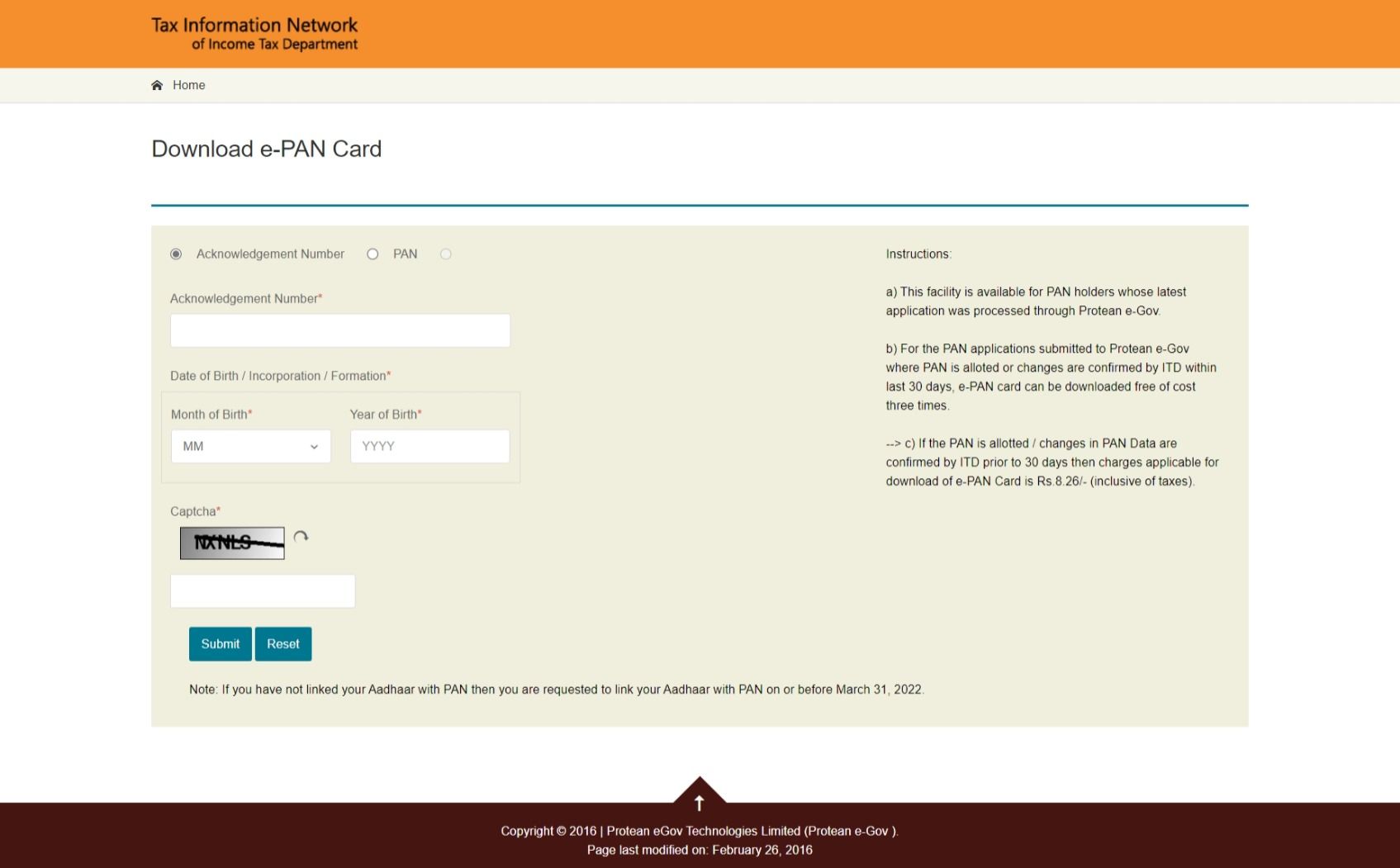

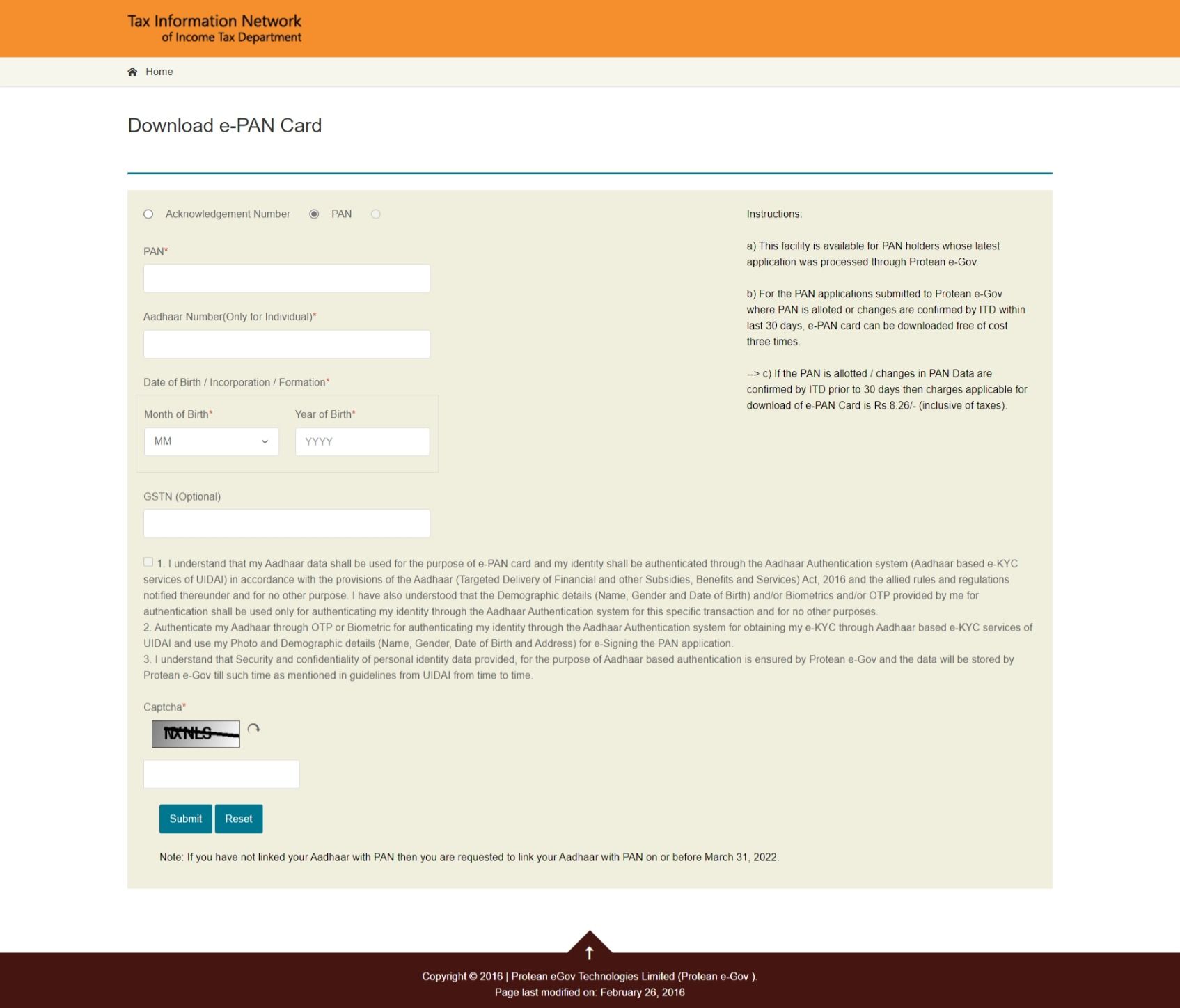

How To Download the e-PAN Card Using NSDL Portal?

You can download the e-PAN card using the NSDL Portal using the Acknowledgement number. Here’s how to do that:

- Visit the e-PAN downloading page on NSDL Portal.

- Select the ‘Acknowledgement Number’ option.

- Enter the Acknowledgement Number of your PAN card application.

- Enter your Date of Birth.

- Enter the Captcha shown.

- Accept the terms and conditions.

- Click on the Submit button.

- Generate OTP using the phone number or email.

- Make the payment if asked for.

- You’ll now see the e-PAN download status. If it is ready, you can see the Download option.

You can also download your e-PAN by using your PAN number, Aadhaar Number and birth date on NSDL Portal. Here’s how to do it:

- Visit the e-PAN downloading page in NSDL Portal.

- Select the ‘PAN’ option on the page.

- Enter your PAN number.

- Enter your Aadhaar number.

- Enter your month and year of birth.

- Enter the GSTIN if you have it.

- Enter the Captcha shown on the page.

- Accept the terms and conditions.

- Click on the Submit button.

- Select the mode of OTP you want to receive.

- Generate OTP.

- Make the payment if asked.

- You can now see the status of your e-PAN. If your e-PAN is alloted, you can download it.

Also Read: Link Pan with Aadhaar: How to Link Your PAN with Your Aadhaar Card Online

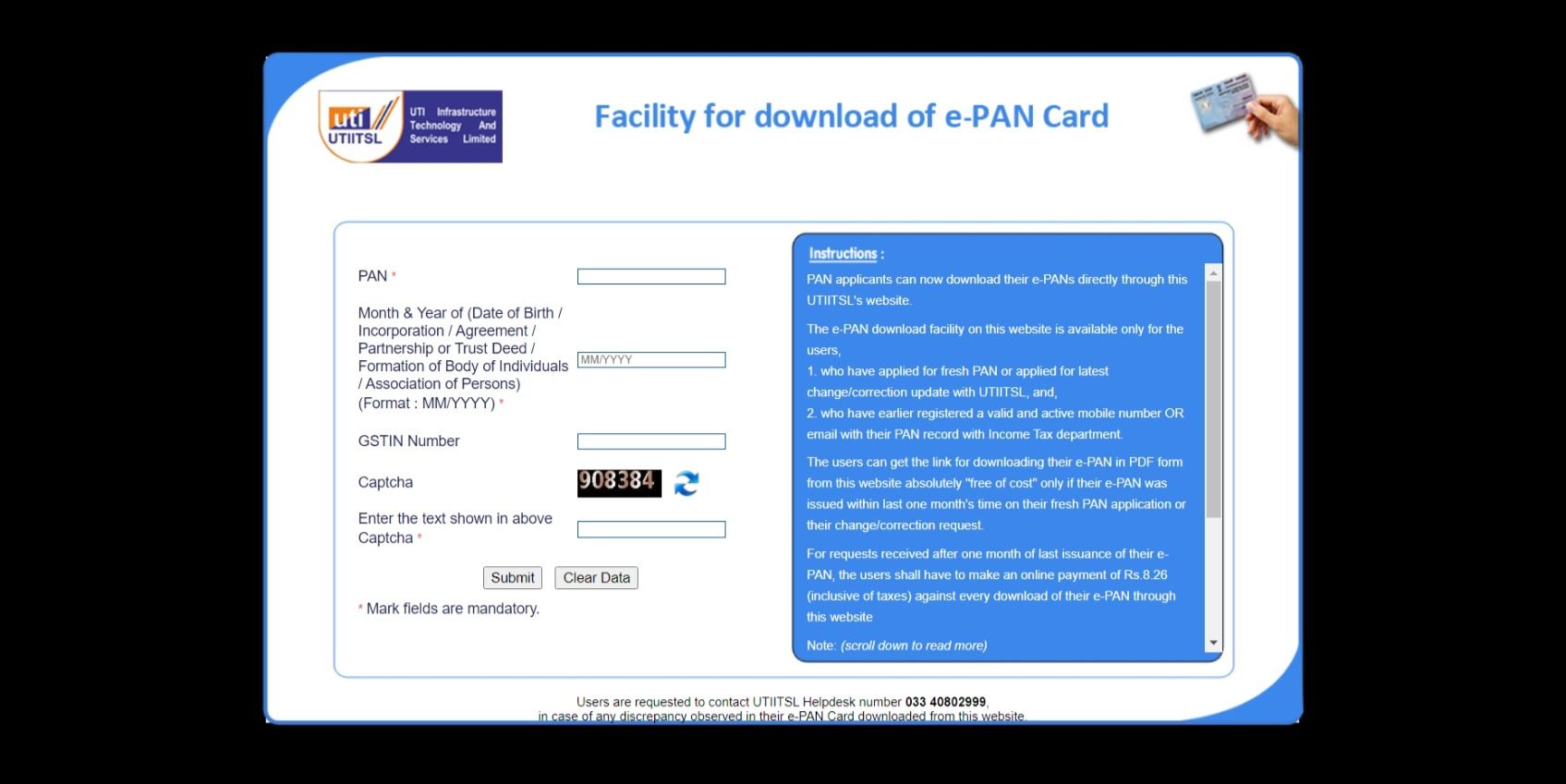

How To Download e-PAN Card Using UTIITSL?

You can download the e-PAN card using just your PAN number and your date of birth using the UTIITSL portal. Here’s how to do that:

- Visit the PAN portal on the UTIITSL website.

- Click on the Download e-PAN option.

- Here, enter your PAN number and date of birth. If you have a GST number, you can enter that, also.

- Enter the captcha on the box given.

- Click on the ‘Submit’ button.

- The next page will show the details of your PAN card.

- Check the details, enter the mode you have to verify using OTP, and click ‘Generate OTP’.

- Enter the OTP and make the payment.

- You’ll see the status of your download request now. If your e-PAN is ready, you can download it.

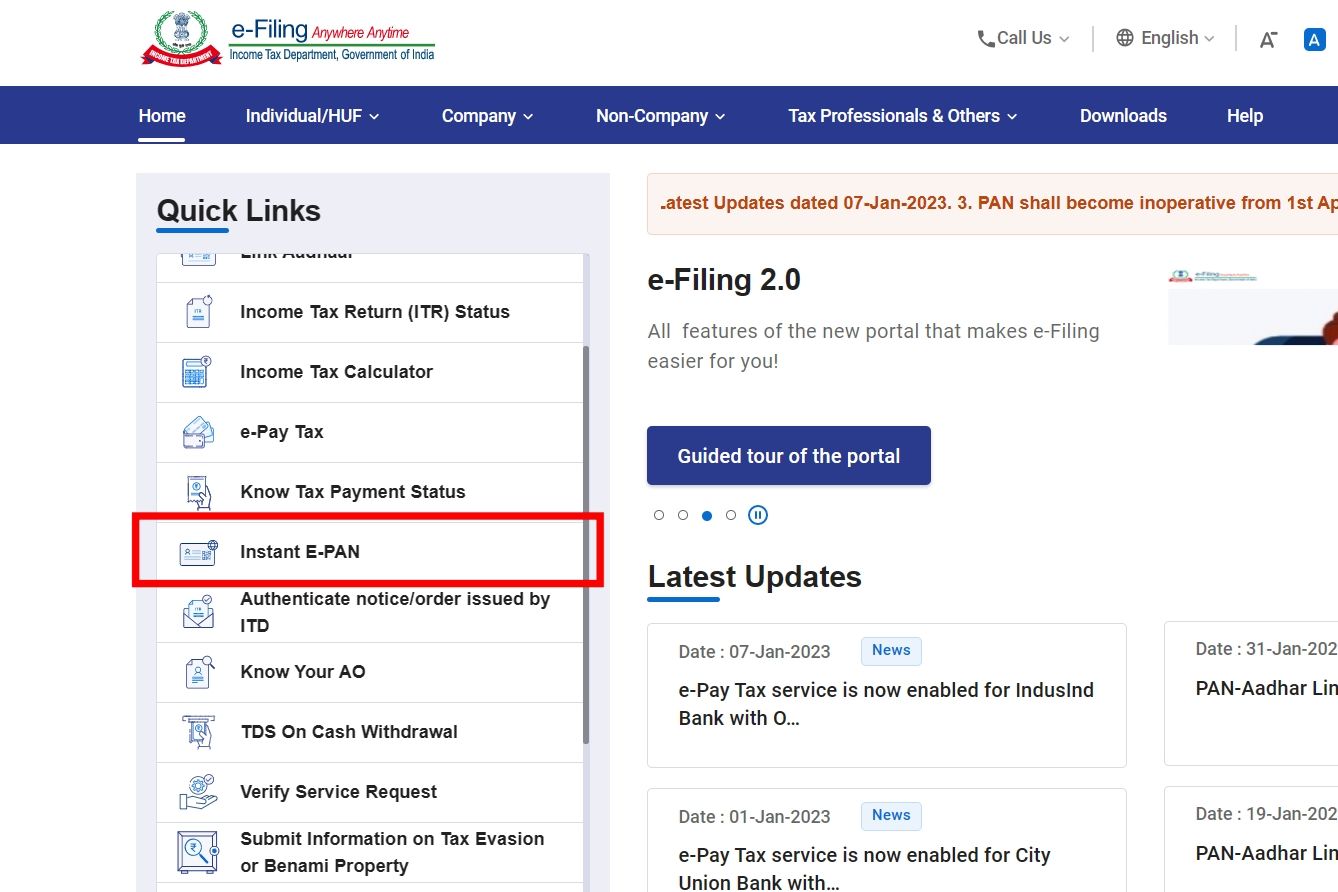

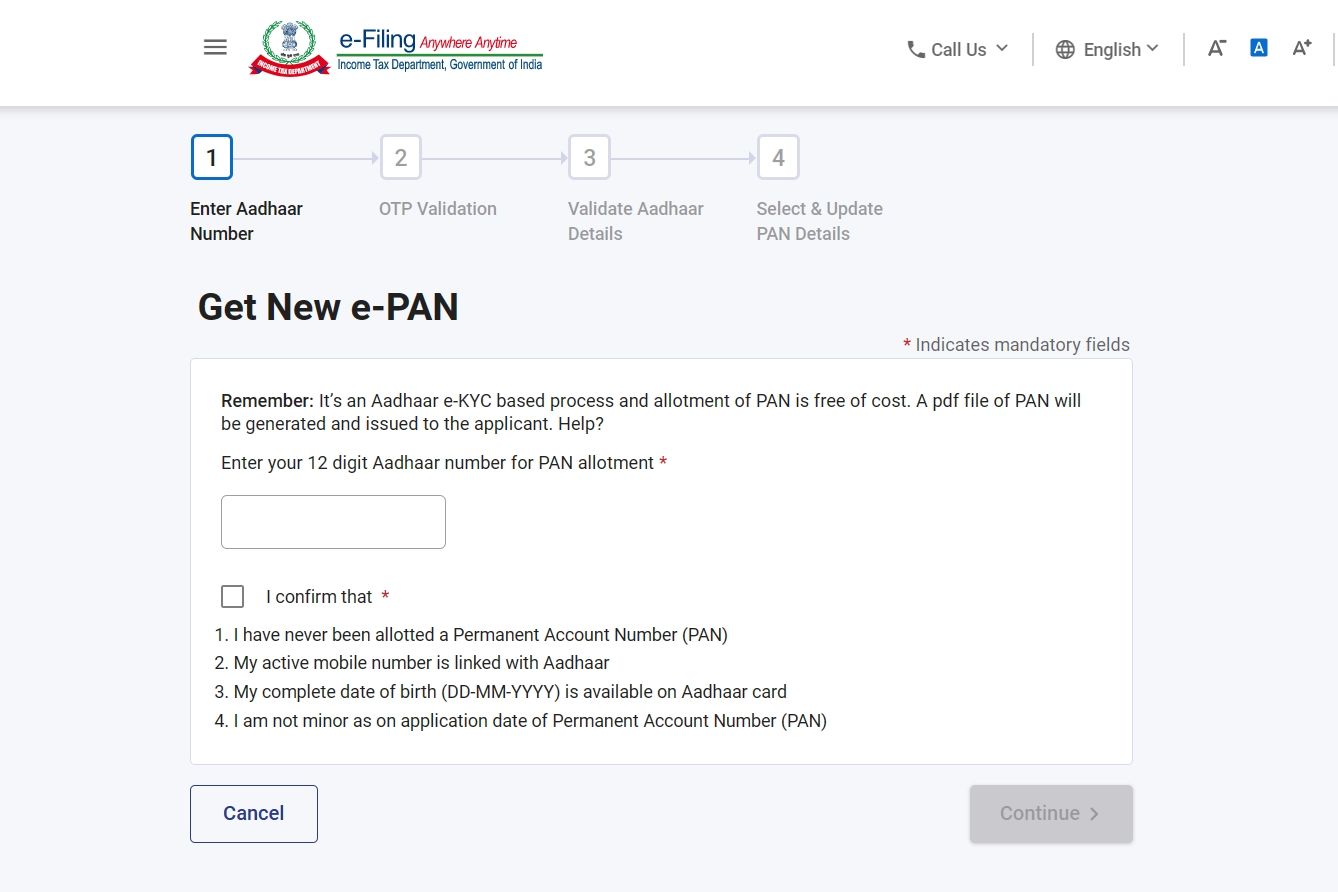

How To Get An Instant e-PAN?

If you don’t already have a PAN or PAN card, you can apply for one using the instant e-PAN service by the Income Tax portal of India. Here’s how to get it:

- Visit the Income tax e-filing portal.

- Click on the instant e-PAN option.

- On the next page, click Get New e-PAN.

- Enter your Aadhaar number on the box given and agree to the demands.

- Click on the Continue button.

- The next page is OTP validation. Consent to the terms and conditions.

- Enter the OTP you received on your Aadhaar-linked mobile number.

- Enter the OTP and click the Continue button.

- Validate your Aadhaar details.

- Click on the I Accept check mark and the Continue button.

- You’ll now get an Acknowledgement number; save it for future reference.

- Now log in to the Income Tax e-filing portal.

- On your Dashboard, click on Services.

- Now click View / Download e-PAN.

- Enter your Aadhaar number.

- Verify it with Aadhaar OTP.

- You’ll be able to see the status of your instant e-PAN request.

- Once it’s ready, you can download your e-PAN from here.

Frequently Asked Questions

1) How can I download my PAN card on mobile?

You can download the e-PAN using NSDL or UTIITSL portals by visiting these portal in a mobile web browser.

2) Can I get a PDF of my PAN card online?

Yes, in the form of e-PAN.

3) In which mobile app will I get the PAN card?

No mobile app will give you access to your e-PAN card. You need to use the NSDL or UTIITSL portals on your mobile browser.

4) Is PAN card download online free?

PAN card download after a month of applying for a PAN card is free. After that, it requires payment.

5) Can I get a soft copy of my PAN card online?

Yes, you can get e-PAN online.

6) Can I download a PAN card using my Aadhaar Card?

Yes, you can download your e-PAN if you have your Aadhaar card.

7) Is the printout of the e-PAN card valid?

Yes, it is valid.

8) How can I convert an e-PAN to a physical PAN card?

You can convert your e-PAN to a physical PAN card by applying for a physical PAN card using ePAN to Physical PAN Card option in the NSDL portal.

9) What is the difference between PAN and e-PAN?

The only difference between a PAN and an e-PAN is that the e-PAN is online, and the regular PAN card is physical. You can use e-PAN at all the places a PAN card can be used.

10) Can I use e-PAN on banks?

Yes, it is accepted by banks.

11) Is e-PAN valid for passports?

The e-PAN is valid for passports.

12) What is the use of instant e-PAN?

With instant e-PAN, you can instantly get your PAN number online without waiting for days or weeks.