Owning a vehicle necessitates having insurance coverage to protect your assets and provide financial security in accidents, theft, or third-party damage. Ensuring your insurance is current is vital. Online platforms from your insurer or government agencies offer a convenient way to verify your coverage status. Quickly and easily check the status of your vehicle insurance, ensuring you are legally covered to drive. This article outlines the steps on how to check vehicle insurance status online, emphasizing the significance of valid vehicle insurance for any vehicle owner. Stay informed and protected by keeping track of your insurance status regularly.

How to Check Your Vehicle Insurance Status

There are several ways in which a person can check the vehicle’s insurance status easily without putting in some effort. Below mentioned are a few methods:

-

- Insurance Policy Status Check Online via IIB

- Insurance Policy Status Check Online via the Vahan website

- Insurance Policy Status check using mParivahan App

- Insurance Status check Using QR Code

- Insurance Policy Status at the RTO

Why is it Important to Check Your Vehicle Insurance Status?

It is important to check your vehicle insurance status because the insurance policy has a specified expiration date. So, it will be easy for the owner to remember the expiration date so that he/she can renew the insurance. It also helps in protecting against the damage caused to the cars. In an active insurance policy, the insurance company bears the repair costs.

What is Vehicle Insurance?

Vehicle insurance is a mode to protect owned vehicles, including cars, scooters, autos, bikes, buses, and more, against any physical damage or bodily injuries caused during accidents resulting in traffic collisions. It could also provide protection against vehicle theft and damage sustained in natural calamities, weather, keying, and many others.

What to Do If Your Vehicle Insurance Status lapses?

If your vehicle’s insurance status lapses, the owner should immediately contact the insurer and check all the available options for the renewal process. The expired policy can quickly be renewed during the grace period, which is 90 days (about 3 months).

Steps to take if you find out your insurance lapses

The steps that need to be followed if your insurance policy lapses are explained below:

- The owner needs to contact the insurer and make a request to get a layout of the process.

- You can get the required information available in the policy documents or online.

- If you want to renew the policy, the user will be asked to pay the overdue premiums, interest charges, and penalties.

Renewing your insurance policy

If the user is trying to renew his/her vehicle’s insurance policy online, then the given steps should be followed:

- Step 1: Visit the insurance company’s official website.

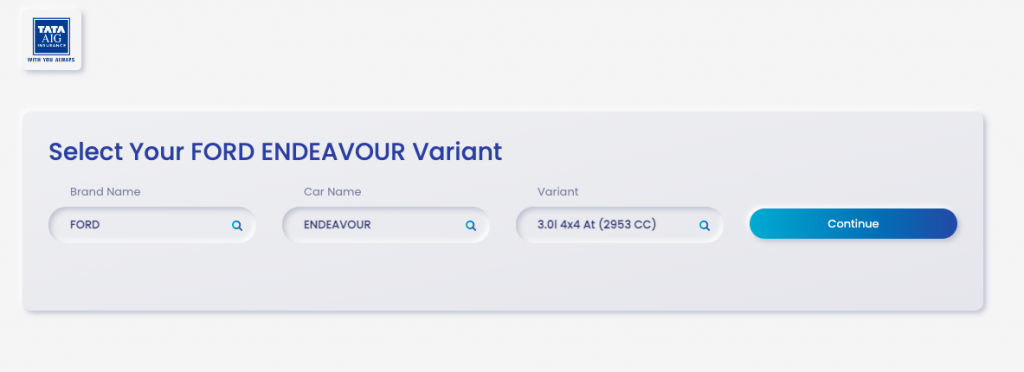

- Step 2: Search for the car insurance renewal section on the website.

- Step 3: The user must fill in the details, including the previous policy number, vehicle registration number, engine number, and chassis number.

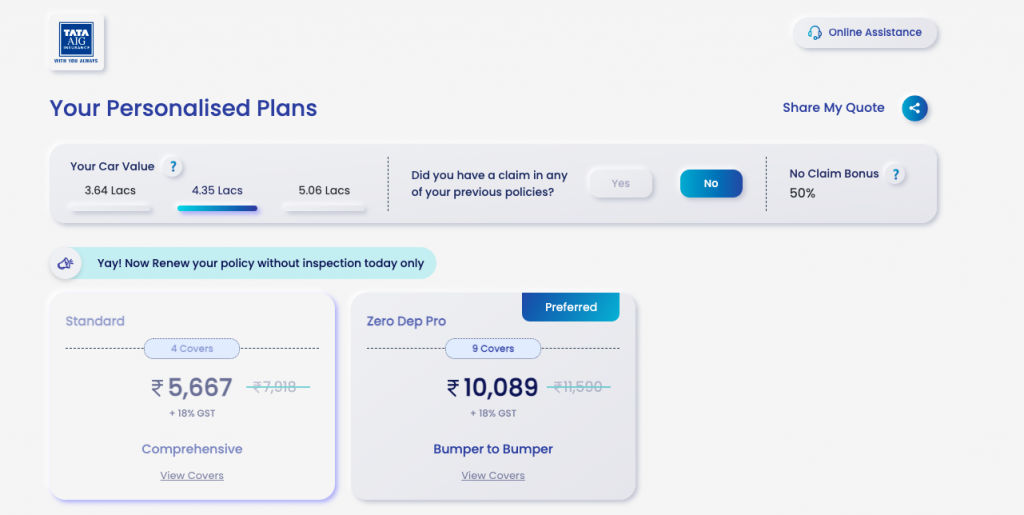

- Step 4: Look for the policy details and the policy renewal premium.

- Step 5: Proceed with the payment of the renewal fee.

Tips for Keeping Your Vehicle Insurance Up to Date

A few basic tips for keeping your vehicle’s insurance up to date are:

- The vehicle owner can purchase the mandatory covers.

- The purchaser can always opt for extensive coverage.

- You can also Customize the policy with add-on requirements.

- The vehicle’s owner should renew the policy before its expiration date.

- The user can try and save money with a No Claim Bonus.

- The user should wisely choose the insurer.

- You can also pick a digital insurer.

- We can keep in mind the insurer’s services.

- One should keep their policy handy.

- One should always try to make informed choices.

FAQs

Is it important to have Valid Vehicle Insurance?

Having valid vehicle insurance is extremely important for several reasons, some of which are:

- Legal Requirement: In India, it is mandatory to have vehicle insurance by law. If you are caught driving without valid insurance, you will face legal penalties such as fines, impounding of your vehicle, or even suspension of your driver’s license.

- Financial Protection: Vehicle insurance provides financial protection against damages or losses caused to your vehicle due to accidents, natural disasters, theft, or any other covered events. With insurance, you do not have to worry about the financial burden of repairing or replacing your vehicle.

- Liability Coverage: In case of an accident, if you are found to be at fault, your vehicle insurance will cover the damages or injuries caused to the other party. This protects you from being personally liable for any damages or injuries caused to the other party, which can be a huge financial burden.

- Personal Accident Coverage: Many vehicle insurance policies also offer personal accident coverage, which provides financial protection in case of injuries or death caused to the driver or passengers of the insured vehicle.

- Peace of Mind: Having valid vehicle insurance gives you peace of mind while driving, knowing that you are financially protected in case of any unforeseen events.

What are the consequences of driving without valid insurance?

According to Indian laws, if a person is caught driving a vehicle without authentic insurance, the driver would be charged a penalty. A fine of Rs. 2,000 will be charged to the name of the vehicle’s owner and imprisonment of up to 3 months. If the vehicle owner commits the same offence a second time, then he/she needs to pay a fine of Rs 4,000.

What are the risks of being involved in an accident without Insurance?

The risks of being involved in an accident without having valid motor insurance for the third-party liability policy then the driver will be charged with the following two cases:

- First, a criminal case for driving a vehicle negligently.

- Second is a case to get a claim where the driver involved in the case must pay compensatory money to the deceased’s family.

What are the Legal Penalties for Driving Uninsured?

The legal penalties for driving an uninsured motor vehicle vary from state to state. According to the Motor Vehicle Act, 2019, driving a motor vehicle without insurance is a serious traffic violation and can attract a hefty sum of money. The driver is supposed to pay a fine of Rs. 2000 for a first-time offence. The charge was increased earlier. The fine used to be Rs. 1000. Noted if the driver is found guilty of the same crime again, he/she is liable to pay Rs.4000 as the fine. Whereas the challan rates are different for each city. Below mentioned is the list.

- Uttarakhand: 1000-2000

- Haryana: 2000-4000

- Bihar: 2000-4000

- Assam: 2000-4000

- Delhi: 2000-4000

- Punjab: 2000-4000

- Karnataka: 1000-4000

- Uttar Pradesh: 2000-4000

Also Read: LIC Policy Status Online: How to Check LIC Policy Status Online Using Website, SMS, and More

What are the Online portals provided by insurance companies?

The three online portals available to check the vehicle’s Insurance status are:

- Parivahan Sewa Website

- RTO Website

- VAHAN Website