Unified Payments Interface or UPI has become a popular mode of digital payments for mobile users in India. This contactless payment option works both on smartphones and mobile phones. And over the years, we have seen UPI become versatile, in a way that you can actually use a credit card to link it with your bank account.

RuPay has recently made it possible for users to add its credit card to UPI via other apps like Paytm, BHIM UPI and Mobikwik among others. But most of you are wondering how the linking happens on these third-party UPI apps and what else you need to know about this payment method, in terms of any charges and which banks are offering this support right now.

Also Read: How to Create UPI ID in Google Pay, Paytm, PhonePe, Amazon Pay Payment Apps

How to Link Credit Card to UPI via Paytm

Paytm is one of the more widely used payments apps for UPI in the country, so it is obvious that the same people, especially those with the RuPay credit card would want to know how they can link it with UPI.

- Open the UPI app and head over to Bank Accounts section from the top-left

- Now you have to use the UPI account registered with your mobile number

- Select a four-digit UPI passcode that will authorise your UPI payments

- Click on the + icon at the bottom-right to add the new credit card

- The details for your bank-registered credit card will appear

- Authorise the card via OTP to link it to your UPI ID

- Your RuPay credit card is now linked to Paytm UPI

How to Link Credit Card to UPI via BHIM UPI

BHIM UPI started the whole UPI revolution in the country in 2016 and since then it has evolved and matured to become a reliable payment app for millions. Here’s how the BHIM app allows you to link the RuPay credit card to UPI.

- Use or set up a UPI account with your bank registered mobile number

- Select a four-digit UPI passcode that will authorise your UPI payments

- Open the UPI app and head over to Bank Accounts section from the top-left

- Click on the + icon at the bottom-right to add the new credit card

- Search for your bank registered credit card

- Authorise the card via OTP to link it to your UPI ID

- Your RuPay credit card is now linked to BHIM UPI

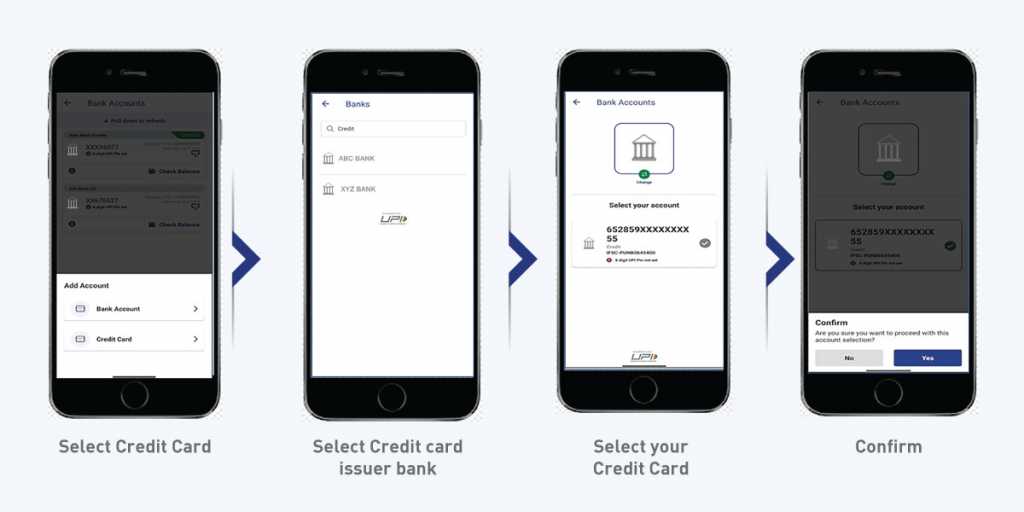

How to Link Credit Card to UPI via Mobikwik

MobiKwik has also just started accepting UPI payments through a linked credit card and these steps will help you make the payments.

- Use or set up a UPI account with your bank-registered mobile number

- You have to choose a four-digit UPI passcode to authorise your UPI payments

- Open the UPI app and head over to Bank Accounts section from the top-left

- Click on the + icon at the bottom-right to add the new credit card

- Search for your bank-registered credit card

- Authorise the card via OTP to link it to your UPI ID

- Your RuPay credit card is now linked to MobiKwik UPI

FAQs

1. What are the Charges for Using Credit Card via UPI?

There is no charge for making payments with your credit card via UPI.

2. Which all banks are currently live for Credit Cards on UPI?

As of now you have four Indian banks that support linking a RuPay Credit Card to UPI. These are Punjab National Bank, Union Bank of India, Indian Bank and HDFC Bank.

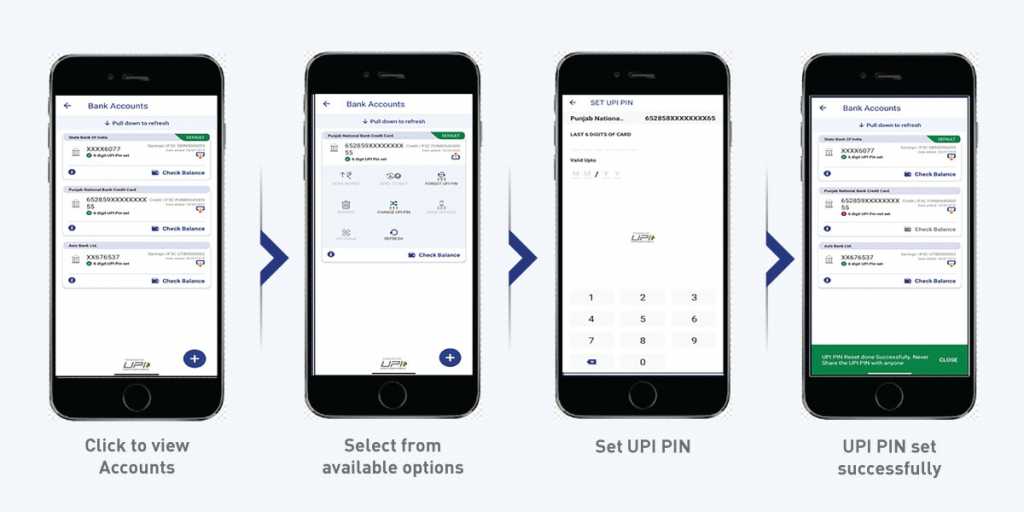

3. How can I get to see my available balance and outstanding on BHIM app?

You can easily check for the available balance through the BHIM app. Follow these steps to get the details:

- Select the credit card for which you need the details

- Click on ‘Check Balance’ from the drop-down menu

- Confirm the card ID using your UPI PIN

- You will get the available balance and outstanding payment of your credit card

4. Can I link my Visa/ Mastercard Credit Card on UPI?

No, the facility to link credit cards on UPI is limited to the RuPay credit cards for now.

5. What are the number of transactions allowed from linked Credit Card on UPI?

NPCI has not set any limit for the number of transactions done via the credit card linked on your UPI account.