Airtel Payments Bank, the first payments bank approved by the Reserve Bank of India (RBI) in 2016, has steadily grown into a major digital banking player in the country. Following recent RBI sanctions on Paytm Payments Bank, many users are seeking alternative digital-first banking solutions. If you’re one of them, here’s how to easily open an Airtel Payments Bank account directly from your smartphone.

How to open Airtel Payments bank account online

You can quickly open a new Airtel Payments Bank account online using the official Airtel Thanks app. It is available on both Android and iOS platforms. These are the documents and prerequisites that you will need to open an Airtel Payments Bank account.

- Aadhaar Card (linked to a mobile number)

- PAN Card

- Working mobile number

Aadhaar Card and PAN Card are mandatory to open a new Airtel Payments Bank account. Your Aadhaar Card must be linked to a mobile number for the eKYC process. Note that you can have different mobile numbers for your Airtel Payments Bank account and Aadhaar, but ensure that the Aadhar-linked number is available to receive OTPs during the account opening process.

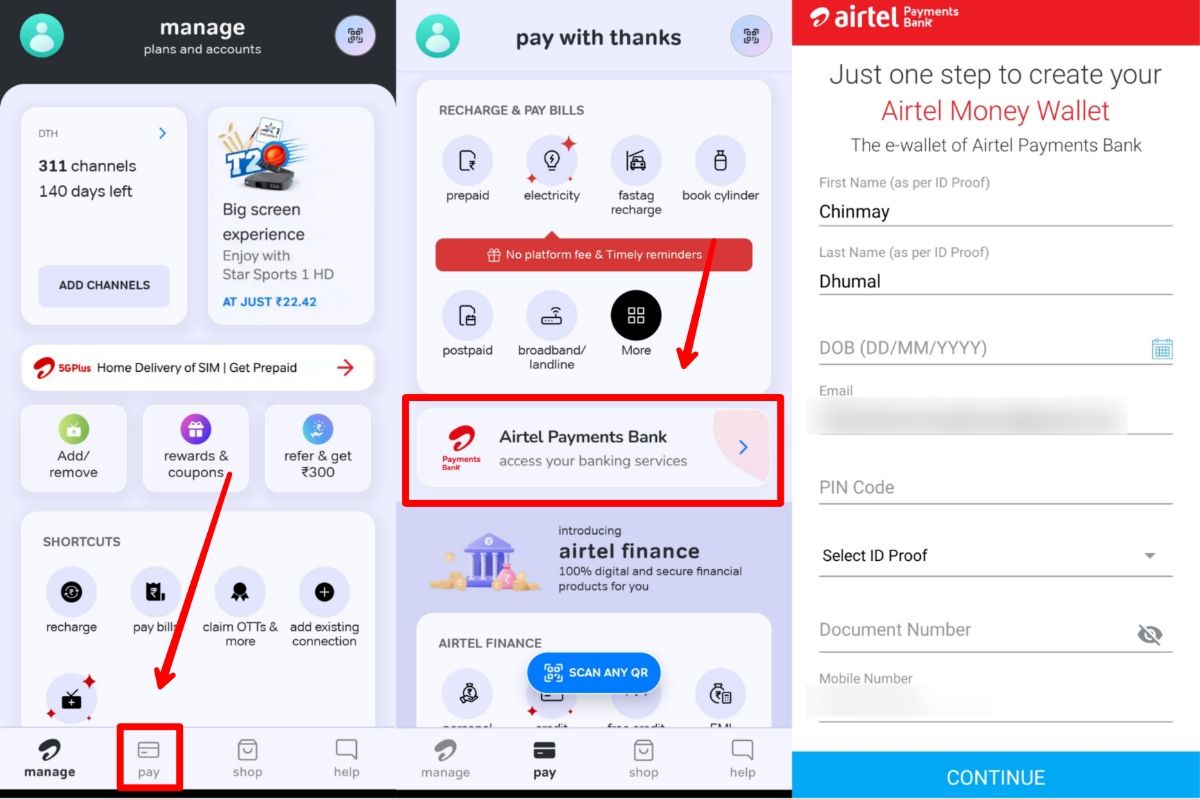

To open a new Airtel Payments Bank account, you must activate your Airtel Money Wallet first. Here’s how you can do that.

Step 1: Open the Airtel Thanks app on your Android or iOS device.

Step 2: Navigate to the Pay section, and select the Airtel Payments Bank option.

Step 3: Enter your personal details which include your name, date of birth, address, etc. and then select Continue.

Step 4: Create an mPIN for the app, which will be used as a login password to access your wallet.

Your Airtel Money Wallet will now get activated. Now follow these steps to open your new Airtel Payments Bank account.

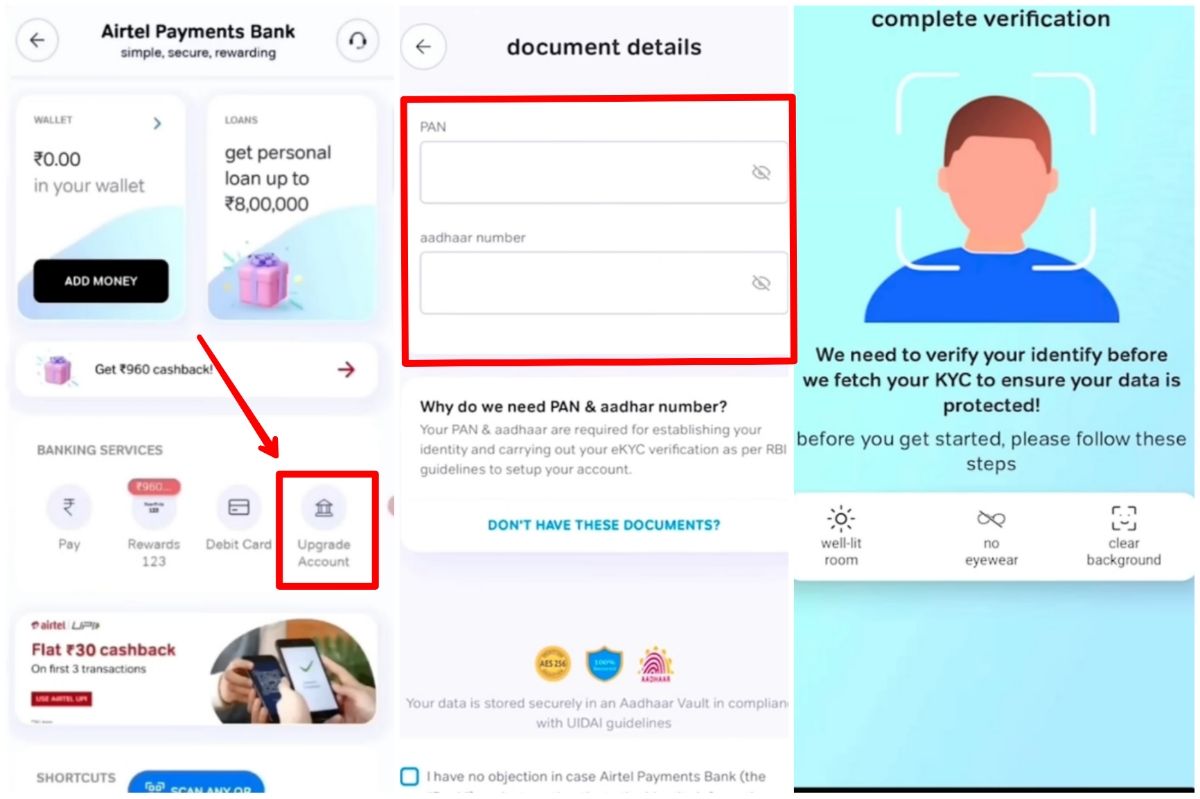

Step 1: Open the Airtel Thanks app, and go to the Pay section.

Step 2: Now select the Upgrade Account option which is placed below the wallet section.

Step 3: Enter your Aadhaar Card and PAN Card details to start your eKYC process.

Step 4: The app will now ask you to click a selfie from your smartphone, complete this step.

Step 5: Enter additional personal details like your occupation, marital status, etc. Once you fill in all the details, select Proceed.

Step 6: Airtel Payments Bank will now ask you to make a deposit of at least Rs 1 as initial funding. You can complete this step by selecting any UPI app on your phone like PhonePe, Google Pay, Paytm, etc. This is a mandatory step and you cannot skip this.

After completing the funding, Airtel Payments Bank will review your application. In most cases, your Airtel Payments Bank account will get approved and activated within 24-48 hours.

However, sometimes due to technical difficulties, Airtel may also ask you to schedule a video call for KYC. This is completely normal. When this happens, select an appropriate time slot for your video KYC.

Keep ready your Aadhaar Card, PAN Card, a blank piece of paper, and a pen. Once the agent joins the video call, follow their instructions to complete the KYC process. After the call, your Airtel Payments Bank account will be activated within 48 hours.

Note that Airtel Payments Bank charges you Rs 118 (including GST) as Account Facilitation Charges, or in simple words, account opening fees. You are required to pay these fees once your account gets activated.

How to open Airtel Payments Bank Account Offline

You can also open a new Airtel Payments Bank account offline. For this, you can visit any nearest Airtel Store across India with your Aadhaar Card, PAN Card, and a working phone number. Airtel’s banking agents will then help you with the process of your account opening. You can locate the nearest Airtel store by from the official website.

Note that opening your Airtel Payments Bank account online or offline does not affect the functioning of your account. As long as you complete the full KYC, your account will have access to all features. Let’s explore them.

Benefits and Features of Airtel Payments Bank

Airtel Payments Bank is approved by the RBI and offers benefits within the guidelines of the regulatory body. Here are some top features of the Airtel Payments Bank account.

- Zero Balance Account: You don’t have to maintain any minimum balance in your account.

- Earn Interest: Airtel Payments Bank Account provides an annual interest of 2% on account balances of up to Rs 1 lakh. If you deposit an amount over Rs 1 lakh, then Airtel Payments Bank will create a fixed deposit (FD) with any partner RBI-authorized bank offering interest rates as high as 7%.

- Free Virtual Debit Card: You also get a free virtual debit card with your Airtel Payments Bank account. This card can be used for online shopping, bill payments, etc. just like using a normal debit card for online transactions.

- UPI Services: You can link your Airtel Payments Bank account to any UPI app such as PhonePe, Google Pay, Paytm, etc. and use it for UPI payments.

- Optional Physical Debit Card: You can also get a physical debit card for your Airtel Payments Bank account. However, it comes with annual charges of Rs 354 including GST.

Note that Airtel Payments Bank also has Annual Subscription Charges of Rs 118 per year. Users are required to pay these charges even if they don’t actively use their account. If your account balance is less than Rs 118 during the time of the annual fee payment, then your account balance will turn to zero.

Hence, you must consider this cost before opening a new Airtel Payments Bank account.

Airtel Payments Bank vs Paytm Payments Bank

The Paytm Payments Bank has been sanctioned by the RBI for failing to comply with regulatory guidelines. Hence, several Paytm users are looking for an alternative, and the Airtel Payments Bank is the closest fit. Let’s compare both of them.

| Features | Airtel Payments Bank | Paytm Payments Bank |

| Interest Rate | 2% annual (credited quarterly) |

2% annual (credited quarterly) |

| Annual Charges | Rs 118 | Nil |

| Minimum Balance Requirements | No Minimum Balance Required (Zero Balance Account) |

No Minimum Balance Required (Zero Balance Account) |

| Virtual Debit Card Fees | Nil | Nil |

| Physical Debit Card Fees | Rs 354 per year | Rs 295 per year |

| UPI Services | Yes | Yes |

| Bill Payments | Yes | Yes |

| Bank Transfer Support | Supported | Supported |

| Cheque Book | No | No |

Both Paytm and Airtel serve as Payments Bank which offers the same set of features as per RBI. They can accept maximum deposits of up to Rs 1 lakh, with an interest rate of 2% on the account balance. Both payments banks offer a free virtual debit card, UPI services, bank transfers, and a digital passbook.

Hence, the Airtel Payments Bank is a good replacement for Paytm Payments Bank users, as the latter has been suspended now. However, the user interface of Paytm Payments Bank was more user-friendly, compared to Airtel.

The biggest difference between the two is the annual charges. While Paytm Payments Bank was completely free to use, Airtel Payments Bank levies an annual fee of Rs 118. So if you think that this charge is justifiable for all the features it offers, then Airtel Payments Bank is a good and reliable digital bank to consider.

FAQs

What is Airtel Payments Bank?

Airtel Payments Bank is a digital bank owned by the Bharti Group, the parent company of Airtel. It is an RBI-approved bank that focuses on a digital-first approach instead of having physical bank branches. Airtel Payments Bank can only accept deposits from users, but it cannot lend money to other users in the form of credit or loans.

Is Airtel Payments Bank safe to use?

Airtel Payments Bank is completely safe to use as it is regulated by the Reserve Bank of India. Money deposited in the account is protected by the Deposit Insurance and Credit Guarantee Corporation of India (DICGC).

Does Airtel Payments Bank offer additional benefits to Airtel SIM users?

In terms of banking features like interest amount, the Airtel Payments Bank does NOT offer any extra benefits to Airtel SIM users. However, the bank sometimes offers recharge discounts to Airtel users occasionally.

Do I need an Airtel Payments Bank account for Airtel Fastag?

Yes, you either need an active Airtel Money Wallet or an active Airtel Payments Bank Account to get an Airtel Fastag.