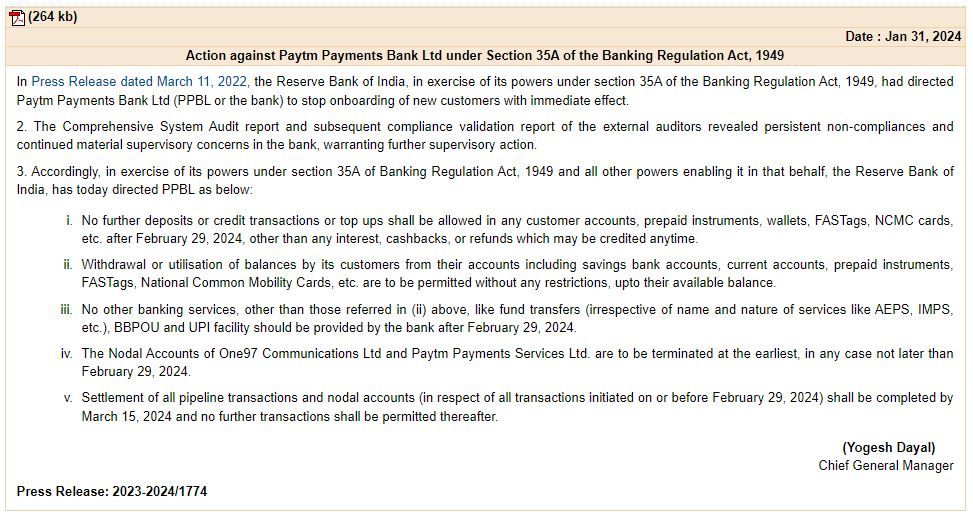

The Reserve Bank of India has ordered Paytm Payments Bank to halt all operations starting February 29, 2024. Customers will not be able to deposit money in their bank account, wallet, FASTags, NCMC cards, and other ledgers from next month. The government body has also terminated the nodal accounts of Paytm and One97 Communications, which are used by the company to process fund transfers.

The announcement was made by RBI via a press release. Back in March 2022, the RBI imposed restrictions on Paytm Payments Bank from onboarding any new customers and ordered comprehensive audits of the company. This move came shortly after Paytm’s public listing on the National Stock Exchange.

As per the new restrictions imposed by RBI, Paytm Payments Bank will not be able to accept deposits in the following services starting February 29, 2024:

- Paytm Payments Bank account

- Paytm Wallet

- Paytm FASTags

- Paytm Fuel Wallet

- Paytm Fixed Deposits

- Paytm NCMC cards

Should You Be Worried?

Not really, RBI has clarified that users will be able to utilize their existing funds, even after the deadline.

However, customers will not be able to add any new funds to their above-mentioned account types from March 1. It is indeed a big blow to Paytm users who rely on these services.

If any Paytm customer is eligible for a cashback, refund, or interest payment after the Februrary deadline, they will be able to receive the funds in their respective Paytm accounts. Customers will also be allowed to withdraw all of their funds without any restrictions.

The Grey Area

However, we do not have clarity on Paytm’s other services such as Paytm Money which offers demat services. The company also has other financial services such as loans, bill payments, ticketing, etc.

Although Paytm only acts as a service provider for these segments, their association with the Paytm wallet and payments bank could have some impact by the new RBI ruling.

RBI has also ordered to terminate the nodal accounts of Paytm Payments Bank, and its parent company One97 Communications. This means that Paytm will face significant restrictions on transferring funds to other banks in the country. This could also disrupt the functionality of merchant QR codes and soundboxes.

As of now, the RBI has not disclosed the exact reason for suspending Paytm’s operations in the country. Paytm and its founder Vijay Shekhar Sharma have also not commented on the situation yet.

Paytm’s Uphill Battle

Despite being a pioneer of India’s digital payments ecosystem, Paytm has faced a bumpy ride since its launch. The company has been fined and suspended multiple times in the past for failing to comply with regulatory guidelines. Paytm also has a negative impression among retail investors, as its share price has slumped by over 50% since its IPO in November 2021. Berkshire Hathaway, the Warren Buffet owned investment company also exited Paytm with a Rs 600 crore loss in November 2023.

To Paytm’s credit, the company has always come on top of its hurdles so far. It will be interesting to see how one of India’s first unicorns faces this new challenge to keep serving its customers.