It has been made mandatory for the citizens of India to complete and submit an Income Tax Return (ITR) to the Income Tax Department of India in accordance with their incomes. It contains details about their financial standing and the taxes they must pay for that fiscal year. An ITR can be filed in two ways: offline or online via e-filing, which involves filing the tax return digitally via the Internet.

In this article, we will be discussing the top five ITR filing websites that have become famous and are readily taken into account to facilitate a swift and hassle-free working process as to what role these websites play while catering to the needs of the individuals, whether or not they offer customer support, safety and security concerns related to the sites, charges related to the ITR filing process, and much more. Read on!

Top 5 Websites for ITR Filing in 2023

The top 5 ITR filing websites have been mentioned below. The basic job of these websites is to facilitate the easy and hassle-free filing of Income taxes. Not just these, but they come along with a bunch of other features and options related to the area of Income Tay payments and other related issues.

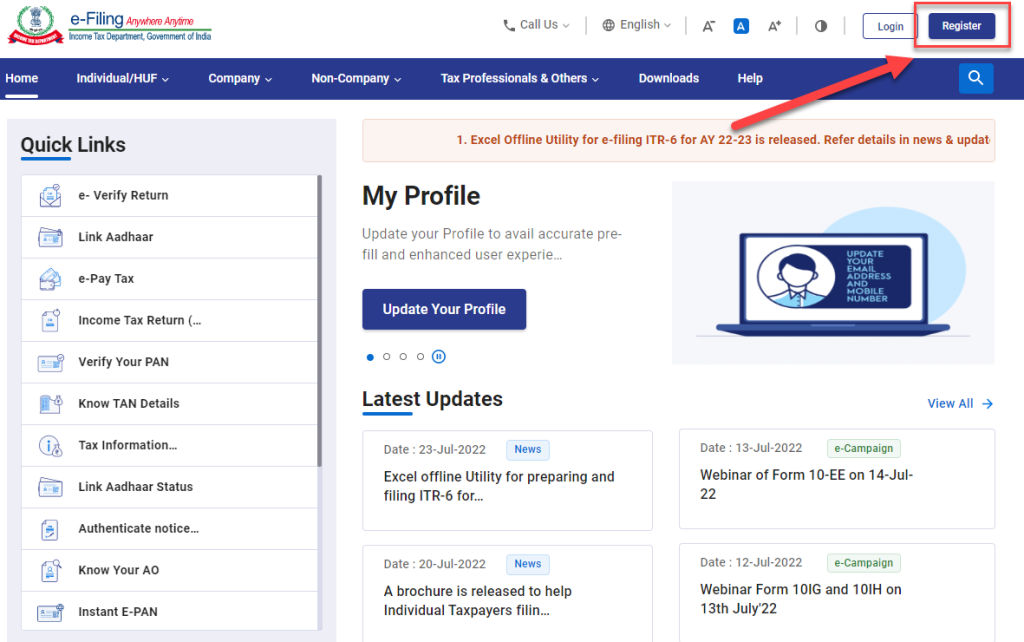

1. Income Tax India Official Website

The Income Tax India Official Website is https://www.incometaxindiaefiling.gov.in/. It happens to be a go-to portal for Indian people as well as businesses to manage their income tax concerns. This easy-to-use website provides an all-encompassing resource for every type of tax-related data, service, and resource. Taxpayers can easily file their financial income tax returns online via the website. One of the sole purposes of this site is that it easily ensures a straightforward rapid process. It provides a detailed step-by-step guide for filing ITR.

Aside from offering returns, the website offers an extensive range of services and features. Users have access to tax calculators to determine their financial obligations, initiate online payment of taxes, and monitor the progression of their returns by downloading various tax forms. They can also stay up to date on the newest Income Tax Department notices, circulars, and recommendations.

Also Read: Link Pan with Aadhaar: How to Link Your PAN with Your Aadhaar Card Online

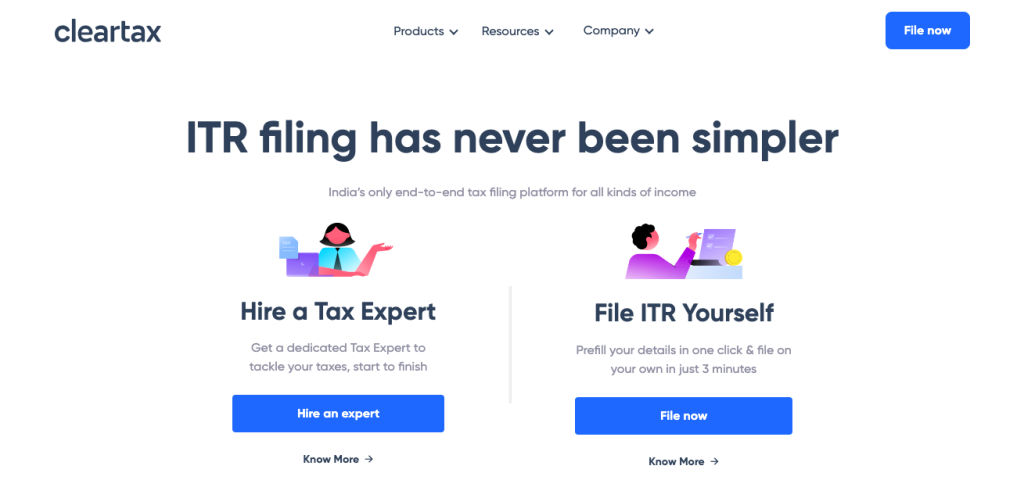

2. Clear Tax

Clear Tax is a famous online platform in India that provides a number of income tax filing and other compliance-related services. It boasts a user-friendly layout aimed at making an easy and efficient experience related to the submission of income tax filings for both individuals and companies.

What sets aside the website Clear Tax from other ITR filing websites is that it provides both complimentary and paid services, enabling people to decide on the one that most effectively fulfils their needs. It also accelerates the tax filing experience and supports taxpayers in ensuring accuracy and compliance with options such as pre-filled paperwork, automated calculation, and immediate validation. Clear Tax also offers its users a chance for expert support and guidance, making it an accessible and credible option for income tax-related concerns.

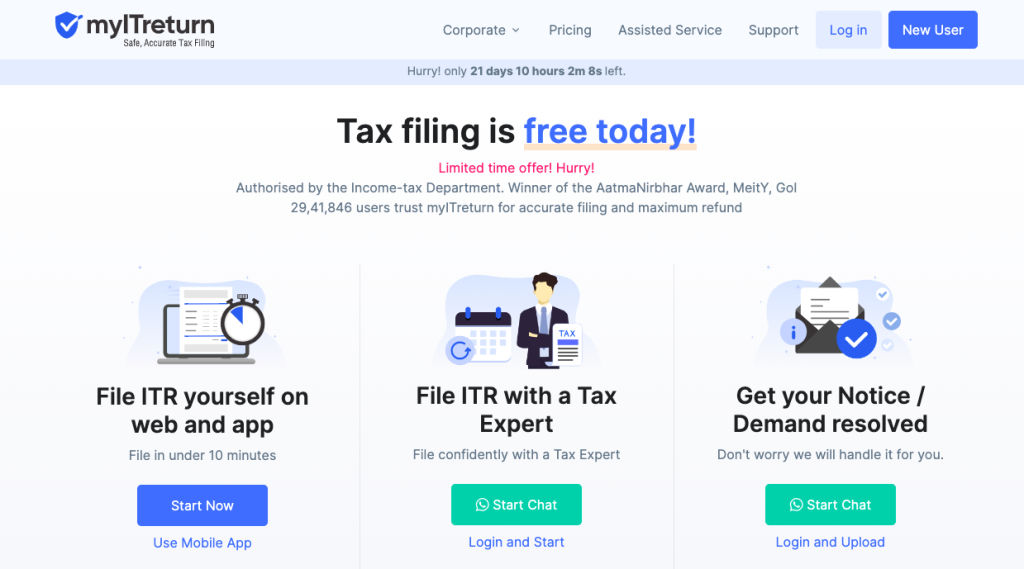

3. MyITReturn

MyITreturn is an authorized e-return gateway registered with the Government of India’s Income-tax Department. It supports individuals in submitting their Indian income-tax filings and has been recognized by the Income-tax Department as an established service provider. It has also received the AatmaNirbhar Award from MeitY, the Government of India.

To make tax filing easier for customers, the website adopts a step-by-step Q&A methodology, guaranteeing that no crucial information is overlooked. Furthermore, the machine learning algorithm and the backend team collaborate to make sure the precision of the results. These measures are put in place to make tax filing easier and to maximize potential tax refunds.

MyITreturn, which has an established user base consisting of 29,41,846 people, streamlines the tax filing method by assuring correctness and giving personalized tax-saving suggestions and assistance from experts. It provides an all-encompassing approach for a variety of income tax-related requirements.

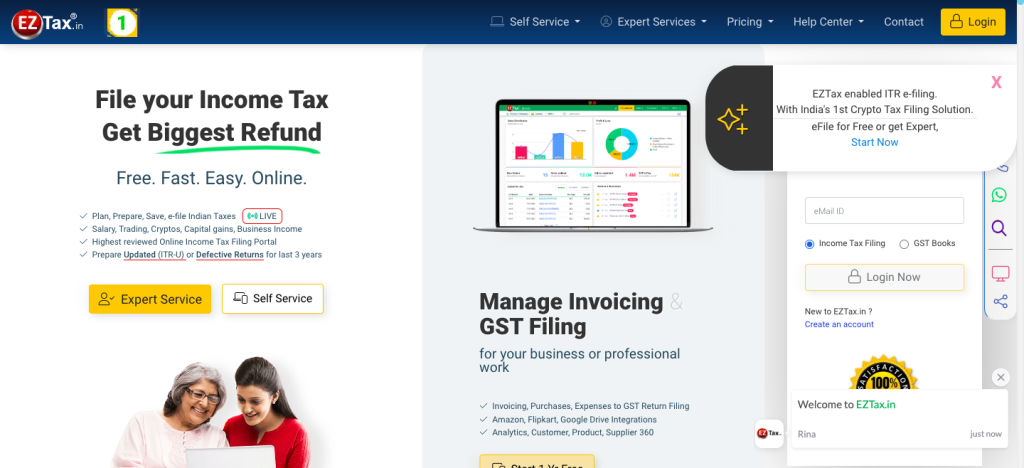

4. EZTax

EZTax.in offers software and expert services to help with a variety of tax-related issues, such as income tax and Goods and Services Tax (GST). Users can use the software or services provided by EZTax for activities such as submitting income taxes and compliance, GST registration and legal compliance, GST accounting, tax planning and consulting services, establishing new enterprises in India, and everyday business or company compliance.

The Indian IT Department has authorized it as an entirely free online service for submitting Income Tax Returns (ITR). This permission allows ezTaxReturn to automatically fill in part of the information and electronically submit your ITR. In addition to the free service, ezTaxReturn provides cheap tax expert support to ensure proper tax calculations. Not just this but ezTaxReturn has also won the trust and happiness of its users, with an exceptional rating of 4.9 stars out of 5 from over 38,000 people.

5. TaxSpanner

TaxSpanner.com is a highly regarded and popular website in India that provides services for preparing accounts books and filing TDS, GST, and Individual Income Tax Returns (ITR) online. It is cloud-based, making it simple for users to use and work with the website.

TaxSpanner.com assures that there are certainly no mistakes in the filing process by using automatic input of data and sophisticated reporting. The income tax department has authorized it as an E-Return Intermediary (ERI), which implies it has official clearance to handle tax submissions.

TaxSpanner.com, India’s leading e-filing provider, continues to be providing electronic filing services since 2007. When compared to other similar services, TaxSpanner.com consumers can save up to 49% on filing fees. To meet the individual demands of consumers, the website also provides multiple payment options, such as yearly, bi-annual, and quarterly alternatives.

All these websites are categorized as the leading online accountancy platforms and all these individual websites aim to assist people as well as companies with the GST return submission process. E-filing has advantages for taxpayers. It enables users to obtain real-time information on a dedicated website confirming the receipt and acceptance of their tax returns. The tax return is acknowledged immediately, which means it gets processed more quickly.

Factors to Consider When Choosing ITR Filing Websites

There are a bunch of factors that should be kept in mind during the choosing of ITR Filing websites, and the individuals should select them according to their respective demands. A few of the important factors include:

- User-Friendly Layout: The users should select a platform having an easy-to-use layout that allows them to easily navigate and carry out the tax filing procedure. To make filing less difficult, the website ought to have simple directions and intuitive resources.

- Security measures: Security should be a primary issue while selecting an ITR filing website. Look for websites with security safeguards. These security safeguards ensure that your information is secure while you file your income tax forms online.

- Customer support: When selecting an ITR filing website, it is indeed extremely important to consider an option that aims to deliver a reliable customer support system. To address any inquiries or issues that the user might encounter during the tax filing process, it is important that the website comes equipped with a great customer service structure.

- Additional services: The reputation and reviews of a particular website also matter significantly. Users should carefully examine the feedback forums of each website to assess their reliability, efficiency, and overall user experience. Additionally, users should look for built-in validation checks and error correction mechanisms that minimize the likelihood of mistakes and errors. These additional features should be considered important factors during the website selection process.

FAQs:

1. Do these websites cater to all types of taxpayers, including salaried individuals and business owners?

Yes, these 5 mentioned ITR filing websites cater to a wide range of taxpayers, including salaried individuals and business owners. These websites are intended to meet the diverse demands of various taxpayer types.

2. Are these websites safe and secure for filing income tax returns online?

Yes, all these websites are safe and secure for the income tax returns filing process. Since they are equipped with encryption technology that makes sure that the data provided by the users is authorized under a top-class security structure.

It’s important to note that while these platforms are designed to be secure, it’s also your responsibility as a user to take certain precautions:

- Use Strong Passwords: Create strong, unique passwords for your account and avoid sharing them with anyone.

- Keep Software Updated: Keep your operating system, browser, and antivirus software up to date to protect against security vulnerabilities.

- Beware of Phishing: Be cautious of emails, messages, or links that ask for your personal or financial information. Always verify the authenticity of the communication before providing any sensitive details.

- Use Trusted Devices and Networks: Avoid using public computers or unsecured Wi-Fi networks when accessing your tax information.

By following these best practices and using official government-approved websites, you can help ensure a safe and secure online filing experience for your income tax returns.

3. What are the charges for using these ITR filing websites?

Most of these websites are free of cost, and the individuals can fill their ITR without being charged a respective sum, but under certain circumstances, these websites also offer paid services as well in the form of premium packages that aims to deliver some additional features such as great assistance offered to the customers, easy tax calculations, and a robust support system. Users can select these premium packages based on their unique needs and preferences, benefiting from the additional features provided by the ITR filing website.

4. Are there any government-approved ITR filing websites?

Yes, these are government-approved ITR Filing websites and fall under the category of being completely legal and in compliance with the rules set by the Income tax department of India. Also, the Income Tax Department has an official government-approved website for filing Income Tax Returns (ITRs). The official website is called the Income Tax e-Filing Portal. You can access it at: https://www.incometaxindiaefiling.gov.in

This portal allows individuals to electronically file their income tax returns, check their tax credit status, download various forms, and perform other tax-related activities. It’s important to use the official government portal to ensure the security of your personal and financial information while filing your taxes online.

5) Do these websites offer customer support in case of any issues during the filing process?

Yes, all of the above-mentioned five websites are equipped with an effective customer support structure. The users can freely contact the customer support staff for any query related to the ITR Filing process, and their problems will surely be addressed by the appointed people.

Here are some common ways in which customer support is provided:

- Online Help Center: Most tax filing websites have an online help center or a Frequently Asked Questions (FAQ) section that provides answers to common queries and issues. Users can often find step-by-step guides, explanations of different sections, and troubleshooting tips.

- Live Chat: Some websites offer live chat support, allowing users to interact with customer service representatives in real-time. This can be helpful for getting immediate assistance with specific problems.

- Phone Support: Many tax authorities provide a helpline with a dedicated phone number where users can call to speak with customer service agents. This is particularly useful for more complex issues or if users prefer to communicate over the phone.

- Email Support: Some platforms offer email support where users can send their questions or concerns and receive responses from support staff.

- Webinars and Tutorials: Some platforms provide webinars, video tutorials, and educational materials to guide users through the tax filing process.

When using these support services, it’s important to verify that you’re interacting with official representatives from the tax authority. Be cautious of fraudulent emails, websites, or individuals posing as customer support agents. Always use the official contact information provided on the tax authority’s website to ensure you’re getting accurate and reliable assistance.