Earlier this month, Disney was reportedly looking to sell its Indian assets and exit the region. It was rumoured that Disney was in talks with the Adani Group, Sun TV, and Reliance Industries, to explore potential buyout options.

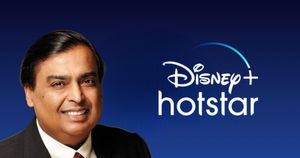

As per the latest reports, Disney is about the close a deal with Mukesh Ambani’s Reliance Group by selling a major controlling stake. Both parties are said to be in negotiations to decide the valuation of the deal.

Disney Is Close to Selling Hotstar to Reliance Industries

Bloomberg News has reported that Disney is nearing to close a multi-billion dollar deal with Reliance Industries, to sell its Indian assets. The deal could include a major part of the Disney+Hotstar OTT platform, along with TV channels like Star Sports and Star Gold.

Previous reports indicated that Disney was looking to sell its entire assets in India. However, Bloomberg says that Disney now wants to sell a controlling stake, rather than selling the Indian division as a whole.

The biggest hurdle in the deal is its valuation. Disney is demanding $10 billion for Hotstar and Star India, but Reliance Industries is valuing the deal between $7-8 billion.

So far, the Reliance Group has pushed Disney+Hotstar into the corner of the ring through JioCinema. Earlier this year, Disney+Hotstar lost the IPL streaming rights to JioCinema during the bidding process. IPL is the biggest sporting event in the country, with over 500 million viewers during a 2-month period.

Disney+Hotstar was once considered a one-stop station for all sporting events, especially cricket. However, the platform has been slowly losing its grip over its biggest asset. The only thing in favour of the Star Network is its TV rights for the home matches of the Indian cricket team, which it has secured up to 2027.

Reliance Heading Towards a Monopoly in Cricket Streaming

If the deal between Reliance and Disney goes through, Reliance Industries could soon become the single biggest player to stream cricket in the country. If that sounds strange, one must remember that the Star Group was once in the same position, where Reliance is today.

Before the entry of JioCinema, the Star Group had exclusive streaming rights for both, OTT and TV platforms for home cricket matches. The IPL 2023 was the first-ever cricketing event in India where two different media houses were responsible for streaming the same tournament, JioCinema for OTT and Star Network for TV.

JioCinema has so far followed a ‘Freemium Business Model’. The first push for the platform came last year when it streamed the FIFA World Cup 2022 for free. 6 months later, JioCinema went a step ahead and streamed the IPL 2023 for free, to all users.

JioCinema has also started pushing its paid subscription named JioCinema Premium. Just like how the company did with Jio 4G, JioCinema will soon shift content from its free tier to its paid tier in a phased manner, while driving more paid subscribers.

If the Reliance Group grabs the Disney deal, the Ambani-led company will also gain control over the TV streaming rights of cricket. Although viewers will still watch matches on Star Sports channels up to 2027, the revenue will get driven into the books of the Reliance Group, making it the next superpower in cricket streaming.

Apart from OTT, Reliance also has its reach in the TV segment for streaming sports. The company already has TV channels named Sports18 and Sports18 HD that are controlled by Viacom18, a subsidiary of Reliance.

It is worth noting that the Reliance Group and Disney have not acknowledged the deal yet. Disney still has the option to back out from the deal and retain all of its Indian assets. Both companies have so far refused to respond to the media over this topic.