In order to unify individuals’ identities, the Government recently announced that PAN cards must be linked to their Aadhaar cards before July 1, 2023. Those who failed to do so now have their PAN cards inactive. Since the PAN card is crucial for banking and finance-related transactions, you will no longer be able to perform those transactions as long as your PAN is inactive. However, there are multiple ways to get your PAN card active again.

How to Activate an Inoperative PAN Card

The Indian Government has instructed several ways in which users can activate an inoperative PAN card, including online and offline methods. One method requires you to pay a penalty, while the other method requires sending a letter to the Assessing Officer if you have already applied to link your Aadhaar and PAN cards but it has not been done yet.

Activate by Paying a Late Challan

If you missed the deadline to link your Aadhaar and PAN cards, according to the guidelines given by the government, you will need to pay a ₹1000 penalty while linking your PAN to your Aadhaar card in order to make your PAN card active. Follow the step-by-step guide below to complete the process.

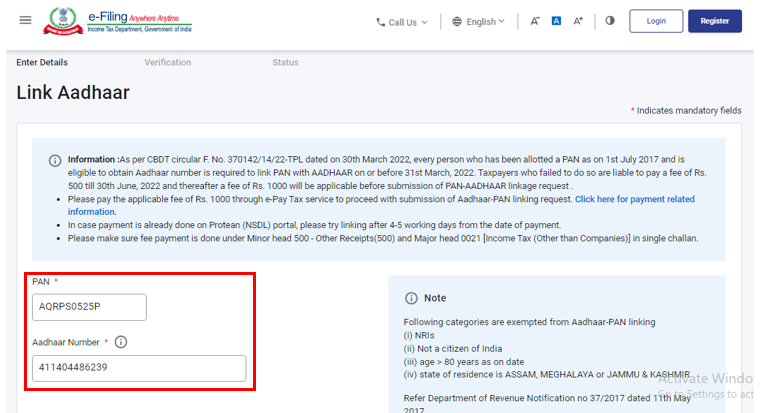

Check the PAN card linking status:

- In order to check the status of your Aadhar card and PAN card linking go Income Tax Portal

- Now enter your PAN and Aadhar card numbers

- Click on validate on the bottom right of the screen

- If you have already linked your Aadhar card with your PAN card it will show you pop up saying you have already linked

- If you have not yet linked your Aadhar and Pan card it will proceed further

To link the PAN card with the Aadhar card and Pay Challan:

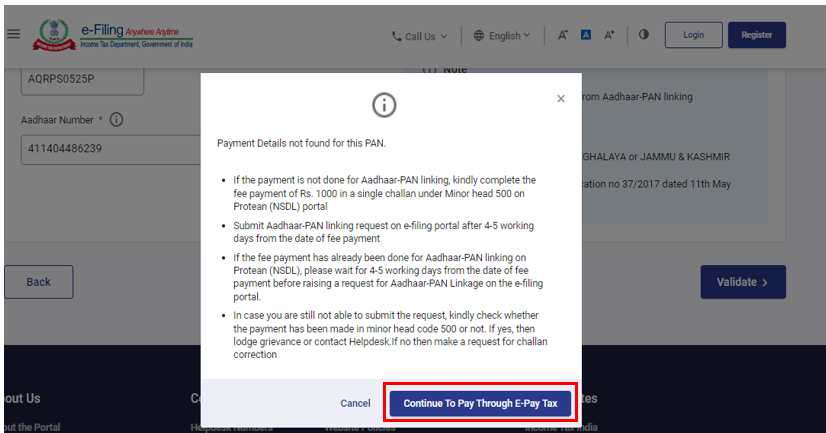

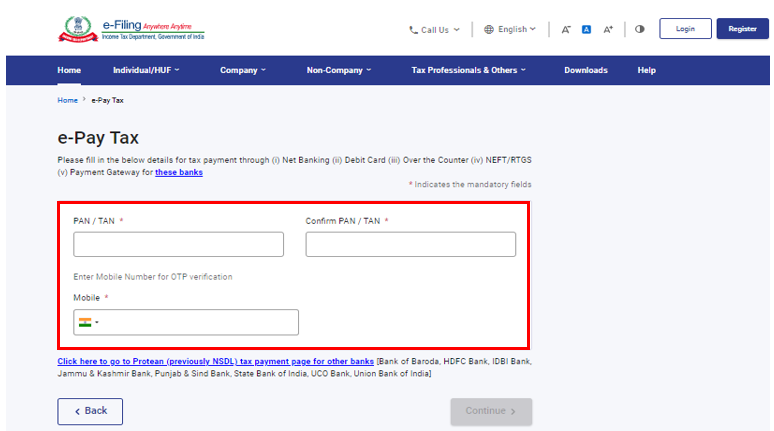

- Click on “continue to pay through E-Pay tax

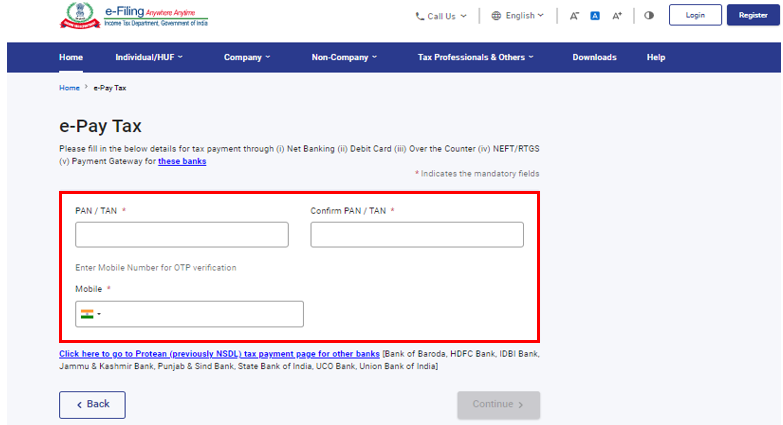

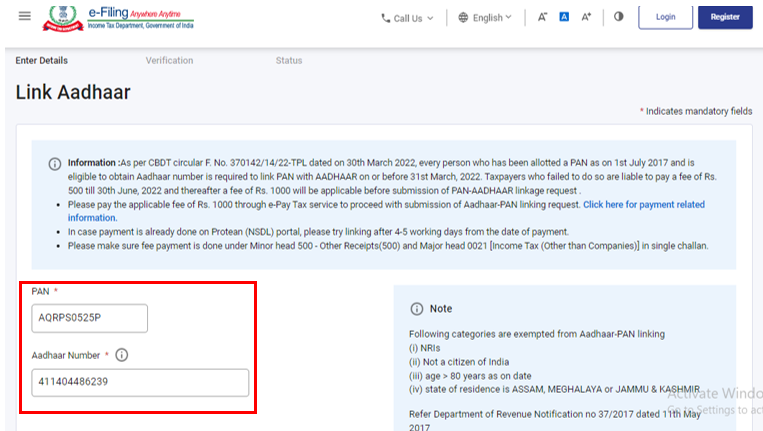

- Enter your PAN number and confirm it

- Enter your mobile number linked with your PAN card

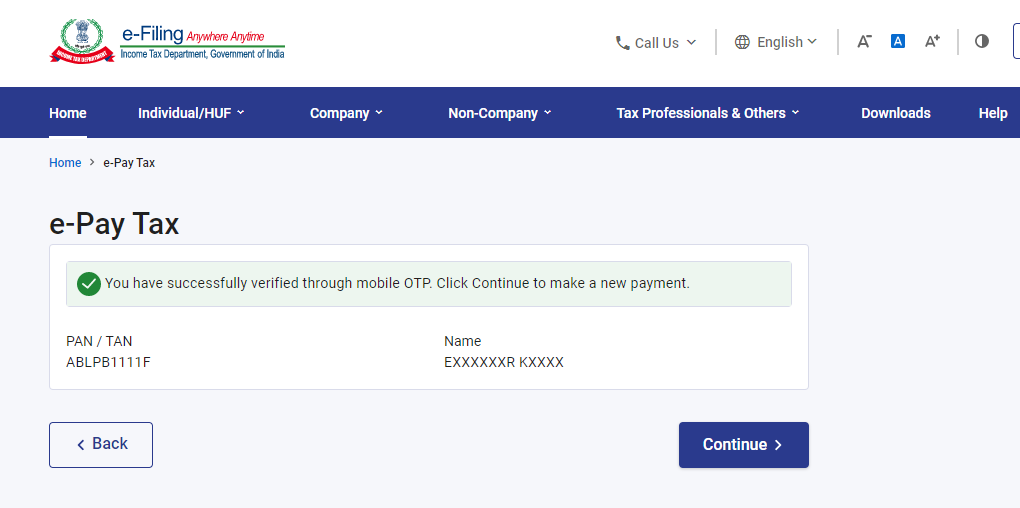

- Once you get the OTP enter it in the next screen and proceed further

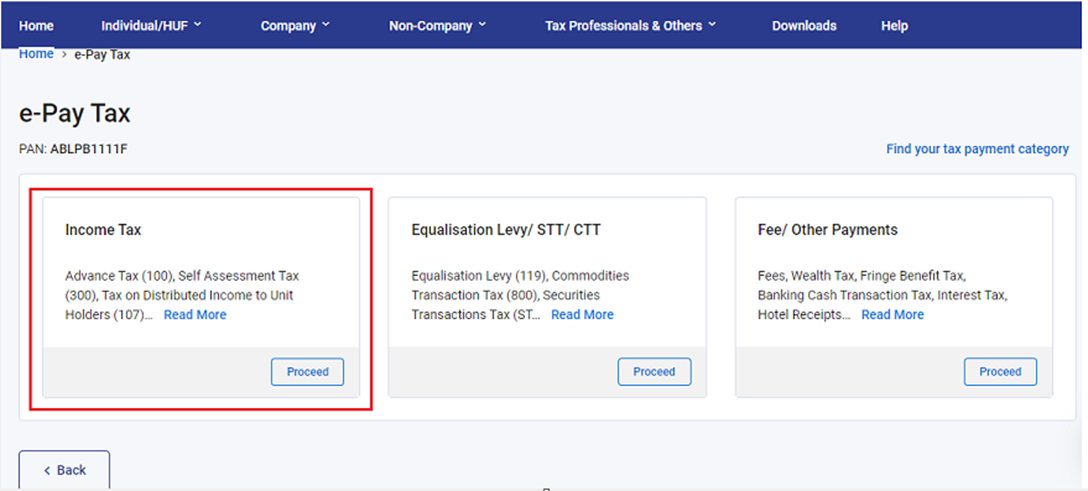

- Click continue and select “proceed” under the “Income Tax” bracket

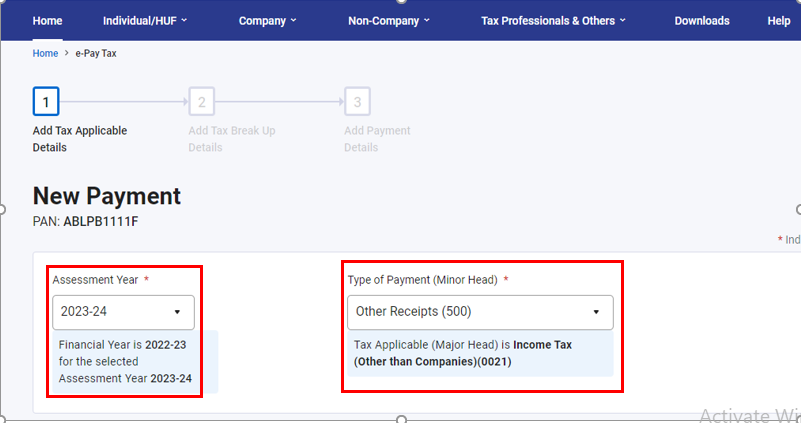

- In the Assessment year select “2022-23”

- In payment select “other Payment”

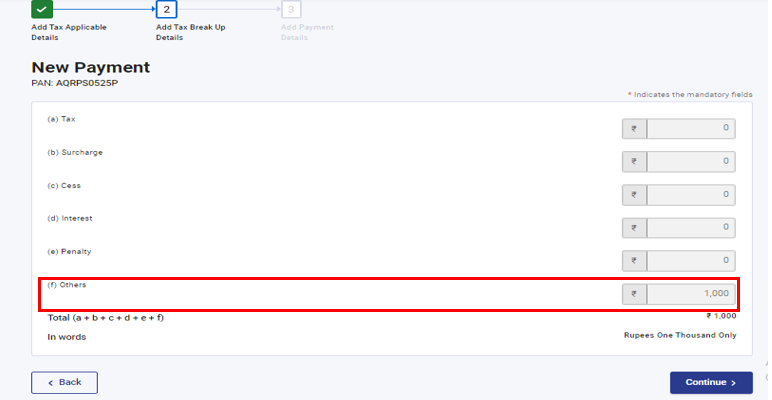

(For an adult it is ₹1000 for minors aged 16 to 18 its ₹500)

- Click continue once the applicable amount is shown

- You can pay using UPI, credit card, debit card, and direct transfer

Pay Offline Through Bank:

- Go to Income Tax Portal

- Fill in your PAN and Aadhar card number and click validate

- Verify through OTP and click continue

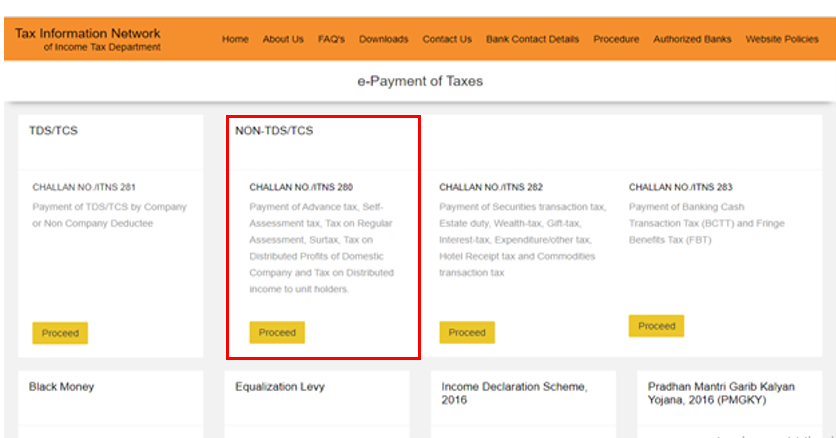

- In the payment, screen select Proceed under “NON-TDS/TCS” bracket

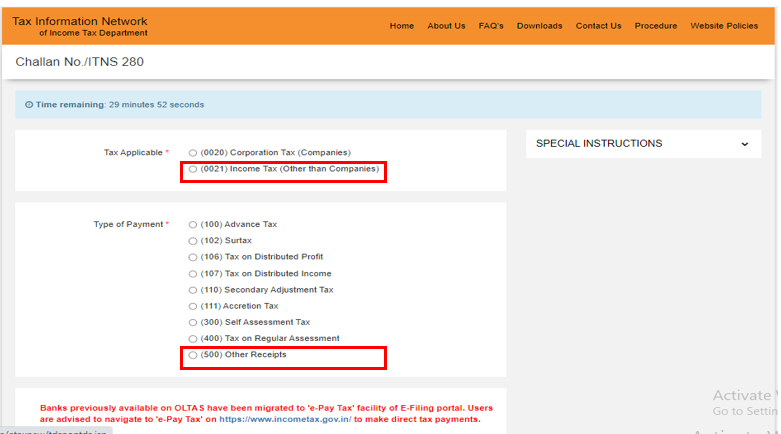

- Select Income tax (Other than companies) in applicable Tax

- Under the type of Payment select (Other Receipts)

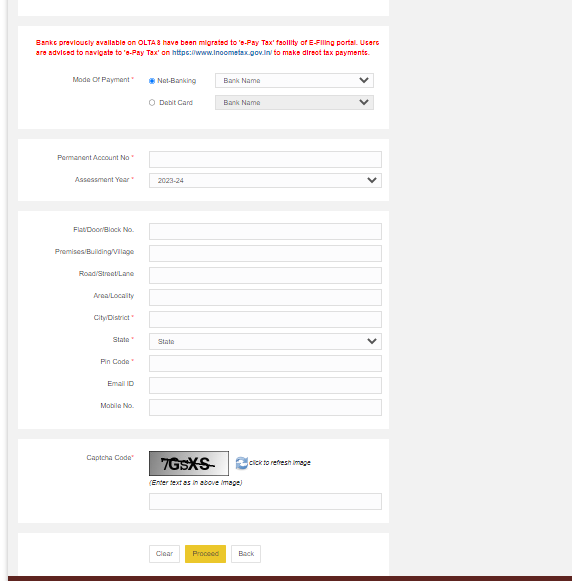

- Select Debit card payment and choose your bank

- Fill out the form that appears and print it

- Take the printed copy to the bank and pay within the next 3 working days

Write a Letter to the Assessing Officer

If you have already applied to link your Aadhaar card with your PAN card and your PAN card has become inactive due to a pending process, you can write a letter to the Assessing Officer. Here’s an example of how you can write a letter to the officer.

Letter Format:

[Your Name]

[Your Address]

[City, State, PIN Code]

[Date]

[Assessing Officer’s Name]

[Income Tax Office Address]

[City, State, PIN Code]

Subject: Request to Activate Inoperative PAN Card

Dear Sir/Madam,

I hope this letter finds you well. I am writing to bring to your attention the inoperative status of my PAN card (mention your PAN number) due to a pending process of linking it with my Aadhaar card. I had applied for the linking process well in advance; however, the activation has not yet been completed.

I understand the importance of a valid PAN card for various financial and banking transactions, and I would like to request your assistance in activating my PAN card as soon as possible.

To support my request, I have attached the following documents:

- Copy of my Aadhaar card

- Copy of the acknowledgement receipt for the PAN-Aadhaar linking application

- Any other relevant documents as required

I kindly request you review my case and take the necessary steps to activate my PAN card at your earliest convenience. I am ready to provide any additional information or documentation required to expedite the process.

Thank you for your attention to this matter. I look forward to a positive resolution and the reactivation of my PAN card. Please feel free to contact me at [Your contact number] or [Your email address] if you require any further details or clarification.

Yours sincerely,

[Your Name]

Note: Make sure to sign the letter before submitting it.

- Download the Challan after Fee payment for proof of payment before the deadline

- Prepare a self-attested copy of your PAN card

- Write a letter according to the given format, addressing the matter, and attach a copy of the challan and PAN with it

- Give the application letter to Assessing Officer at your city’s Income Tex office

FAQs

1) How to prevent a PAN card from getting inoperative?

If you want your PAN card to continue working you need to fill in your Income Tax returns each year on time and keep your Aadhar card linked to your PAN and updated.

2) Do I need to get a new PAN card if it becomes Inoperative?

No, you can write a letter to your Assessing officer to activate it after paying determined dues and late fees.

3) Will my PAN number change if my PAN card becomes inoperative?

No, the PAN number stays the same throughout its lifespan.

4) How do I get to know if my PAN is operative again?

Just log in to the official Income Tax Portal and log in using your PAN card and head over to the My Profile sanction. There you will be able to see the status of your PAN card.