A CIBIL score happens to be a 3-digit number that denotes a user’s credit score. Having the range of 300 to 900, a CIBIL score is generally managed by a company that is fully engaged in keeping credit records of different individuals holding a bank account who are engaged in credit card or loan activities. Pan card is a unique identification government document that can also be utilized to check a person’s CIBIL score. Further, in the article we have talked about how to check free CIBIL score by using PAN Card online.

Steps to Check CIBIL Score by PAN Card Online

The steps involved if a person wants to check his/her Cibil score via Pan Card online are very easy and hassle-free. Just follow these simple steps given below:

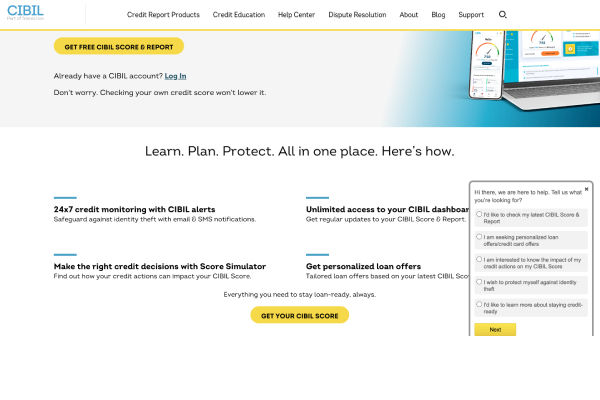

- Step 1: Visit the CIBIL’s official website.

- Step 2: Next, look for an option in the top right bar that says “Get your credit score” or go to the “Credit score” page directly.

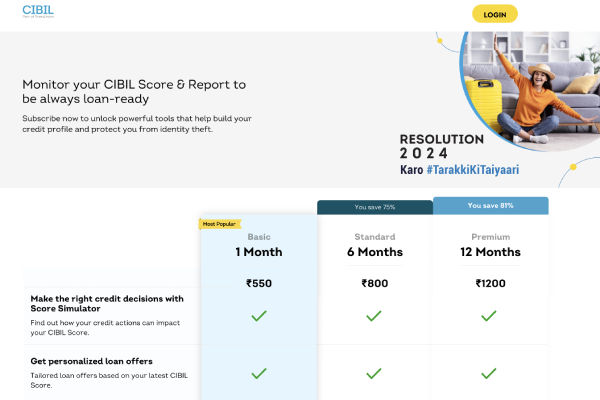

- Step 3: Opt for a subscription method if given

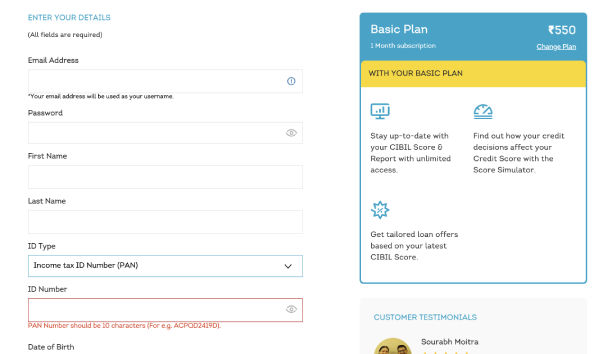

- Step 4: The user will be asked to enter his/her PAN card number

- Step 5: Fill in your date of birth and e-mail address

- Step 6: Select the respective gender

- Step 7: Fill in the captcha code provided on the screen

- Step 8: Select the checkbox reading the terms and conditions

- Step 9: Press Hit on “ Proceed to payment”

- Step 10: You can then choose a mode of delivery of the CIBIL score and report, you can either choose the online method or choose to receive an electronic copy of the same at the provided email address.

If you are already a member, login to myCIBIL, go to the ‘My Account’ tab on the top right of the screen, and click on the ‘Get your Free Report’ link on the page. This way, you can get one annual CIBIL report for free every year.

Understanding Your CIBIL Score

Credit scores range from 300 to 900, and they are categorized like this:

- 300-579: Poor

- 580-669: Fair

- 670-739: Good

- 740-799: Very good

- 800-900: Excellent

Having a higher score doesn’t guarantee approval or a specific interest rate, but it often shows responsible credit behaviour. This can make lenders more confident when you apply for credit.

Also Read: How to Apply for PAN Card Online in 2024

Factors that Affect Your CIBIL Score

Several options can affect a person’s CIBIL score, such as:

- Unsettled debts.

- Lack of variety in credit is if a person fails to have a credit mix.

- Meeting the requirements for minimum payments can result in a lower CIBIL score.

- If a person has irresponsible payment practices, then the CIBIL score can experience ups and downs.

- Outstanding debts happen to be one of the major reasons why a person can receive a bad CIBIL score.

- Length of the credit history.

- Errors were recorded in the CIBIL report.

FAQs

Does applying for a new PAN card impact your CIBIL Score?

No, applying for a new PAN card does not directly impact your CIBIL Score. Your credit score is influenced by your credit behaviour, repayment history, and other financial activities, not by the process of applying for a PAN card.

Why is my PAN card needed to check my CIBIL score?

Your PAN card is needed to check your CIBIL score as it serves as a unique identifier for financial transactions. CIBIL relies on accurate identification to compile credit information associated with your PAN, ensuring the credit score generated is based on your specific financial history.

Is checking my CIBIL score by PAN card safe?

Yes, checking your CIBIL score by PAN card is generally safe. Credit bureaus adhere to strict security measures to protect the confidentiality of your financial information. Ensure you access your CIBIL report through official and secure channels to minimize any risks.

How often should I check my CIBIL score?

It is advisable to check your CIBIL score at least once a year or before applying for significant credit, such as loans or credit cards. Regular monitoring helps you stay informed about your financial standing and allows you to address any discrepancies or potential issues promptly.

What if my CIBIL score is low?

If your CIBIL score is low, it may indicate credit-related challenges such as missed payments, high credit utilization, or defaults. To improve your score, focus on timely payments, reducing outstanding debt, and maintaining a healthy credit mix. Seeking professional financial advice can also be beneficial in devising a strategy to enhance your creditworthiness over time.

Is it a secure method to check a person’s CIBIL score via PAN card?

Yes, it is an extremely secure method if a person is trying to check his/her CIBIL score via PAN card.

What extra information should I provide while checking my CIBIL score?

A user is required to submit additional information such as date of birth, gender, name, etc while checking their CIBIL score.