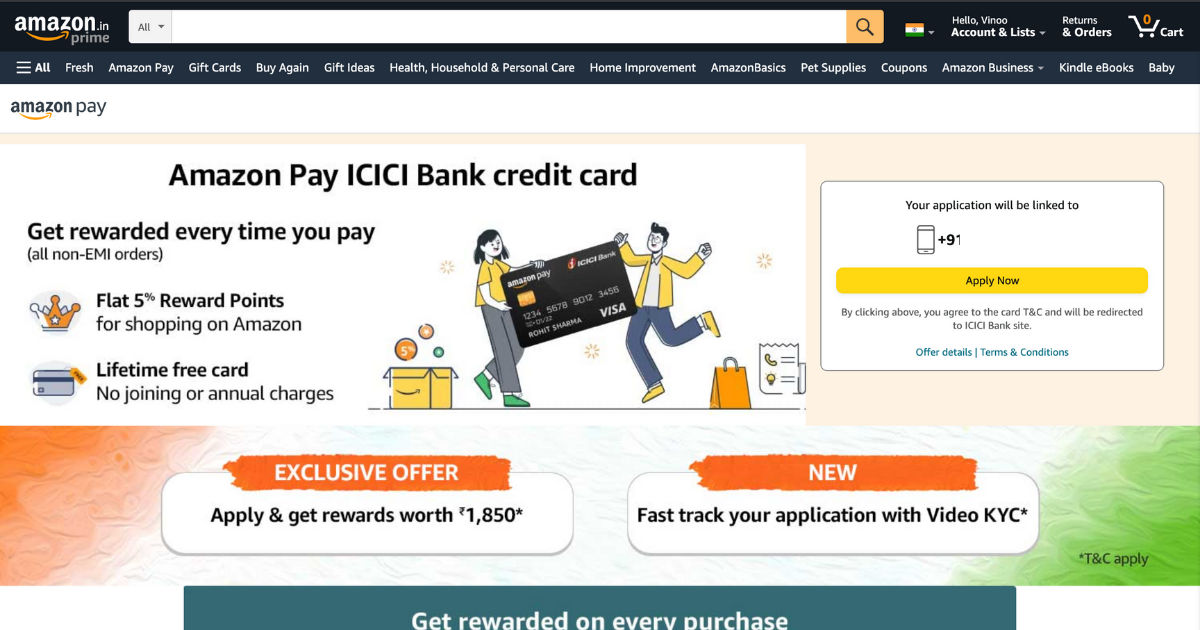

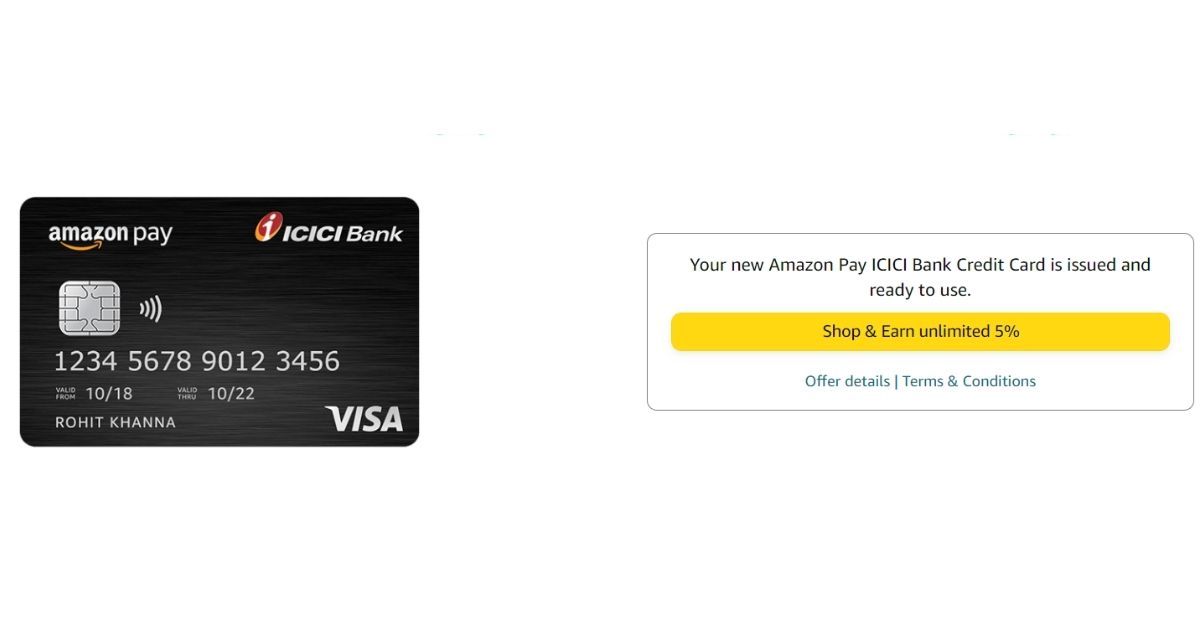

Amazon Pay ICICI Bank Credit Card is one of the most popular credit card offerings available in India. This is an exciting credit card, especially for those who love shopping on Amazon and are Prime members of the Amazon e-commerce platform. Like any other Credit card, the Amazon Pay ICICI Credit Card also offers a bunch of rewards, benefits and offers. If you are planning to consider applying for this credit card, in this guide, we will take a look at how to apply, who all can apply, benefits, and charges.

This Credit card is made in collaboration with ICICI Bank, which is one of India’s largest and most popular banks and Amazon, which is a very popular global e-commerce platform. This is a Lifetime free credit, which means you won’t have to pay anything. You can get 5% unlimited cash back (Amazon Pay balance) on purchases made on electronics if you are a Prime member. The card is not only valid for Amazon, you can also use this card for any other transactions outside of Amazon and get rewards too.

The card offers benefits for both Amazon Prime and non-Prime members, however, as you’d expect, Prime members get more benefits and rewards. To apply for this credit card, it is not mandatory to have a bank account in ICICI bank. Let’s take a look at all the features of the Amazon Pay ICICI Credit Card in detail.

Also Read: Amazon Pay Gift Card: How to Add or Redeem Gift Card and Check Balance on Amazon App and Website

How to Apply for Amazon Pay ICICI Credit Card?

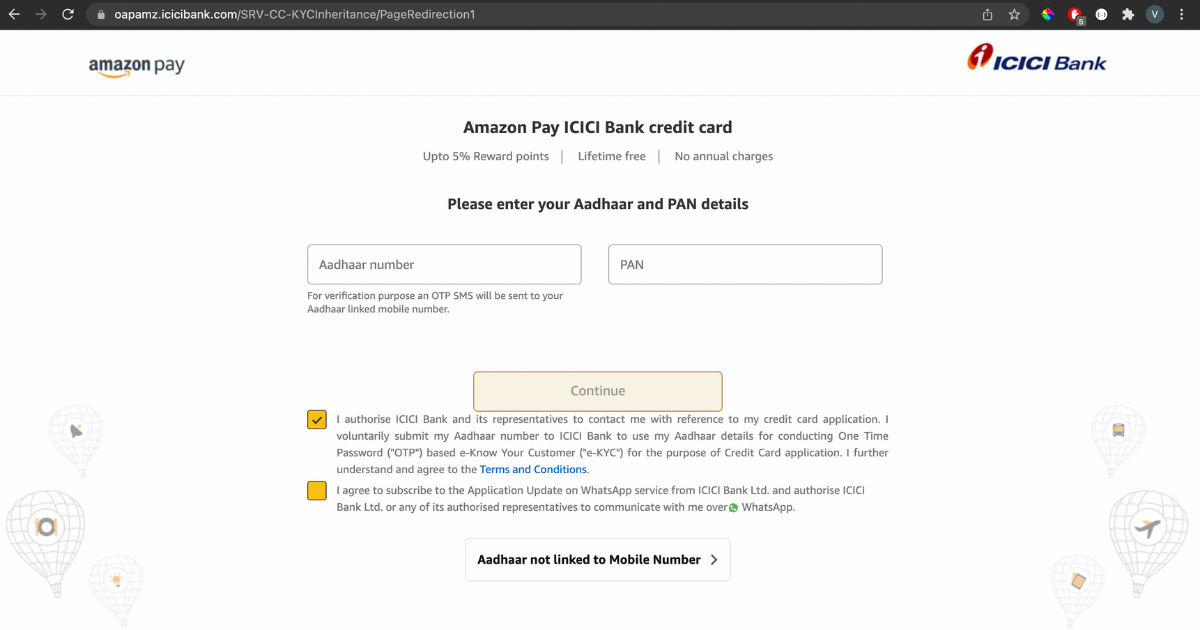

First, let’s start with how to get an Amazon Pay ICICI Credit Card. The best way to get this particular card is by applying it online via the Amazon website. To do this, you must have an account on Amazon and a valid mobile number and email address to link to your application and card. You must also provide IDs such as Aadhaar and PAN cards for the online application.

- Head to this link on Amazon

- Enter your user ID and password to which you want to link the Amazon Pay ICICI Credit Card

- Confirm your phone number, which will be linked to your application

- In the next screen, enter your Aadhaar card and PAN card number

- Click on Continue

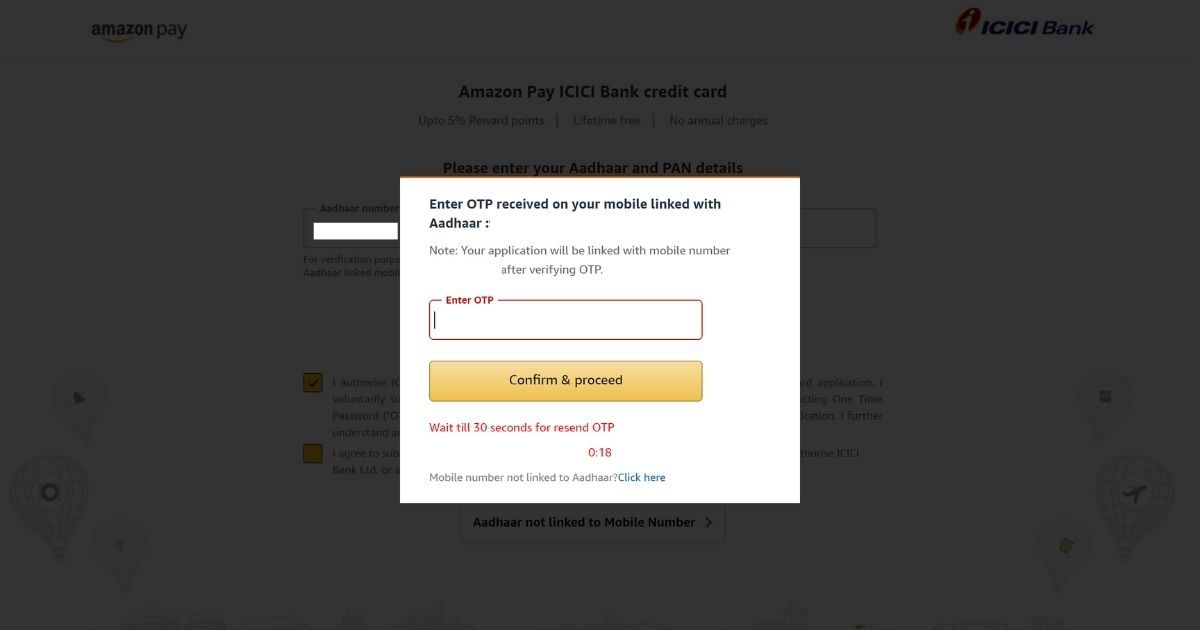

- Enter the OTP which arrived on your phone

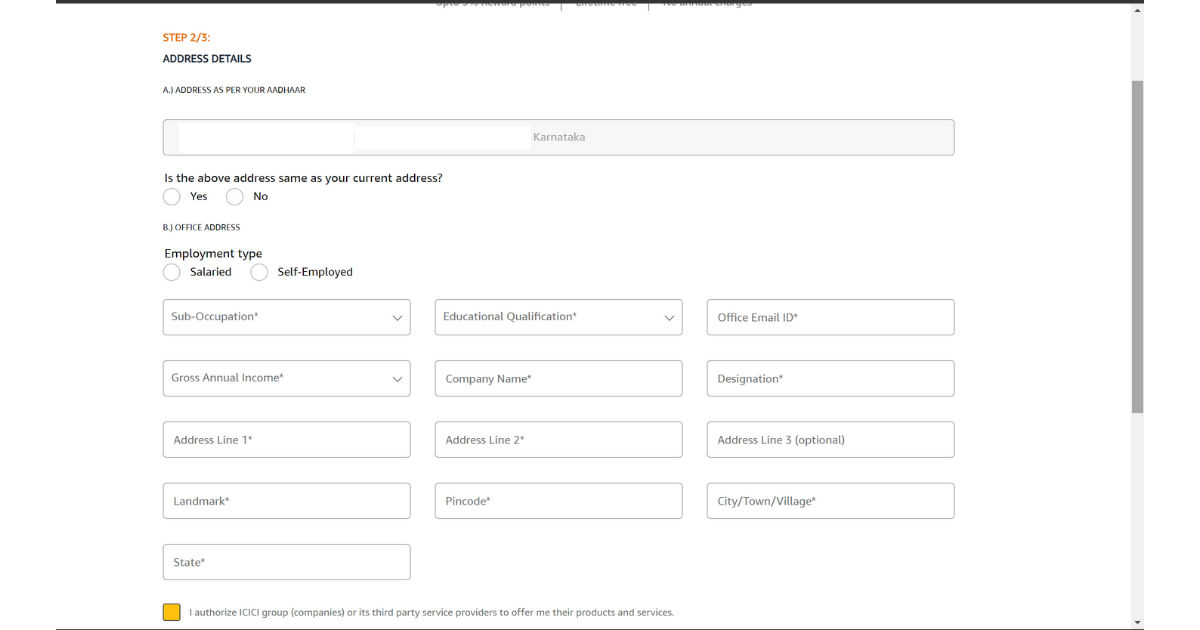

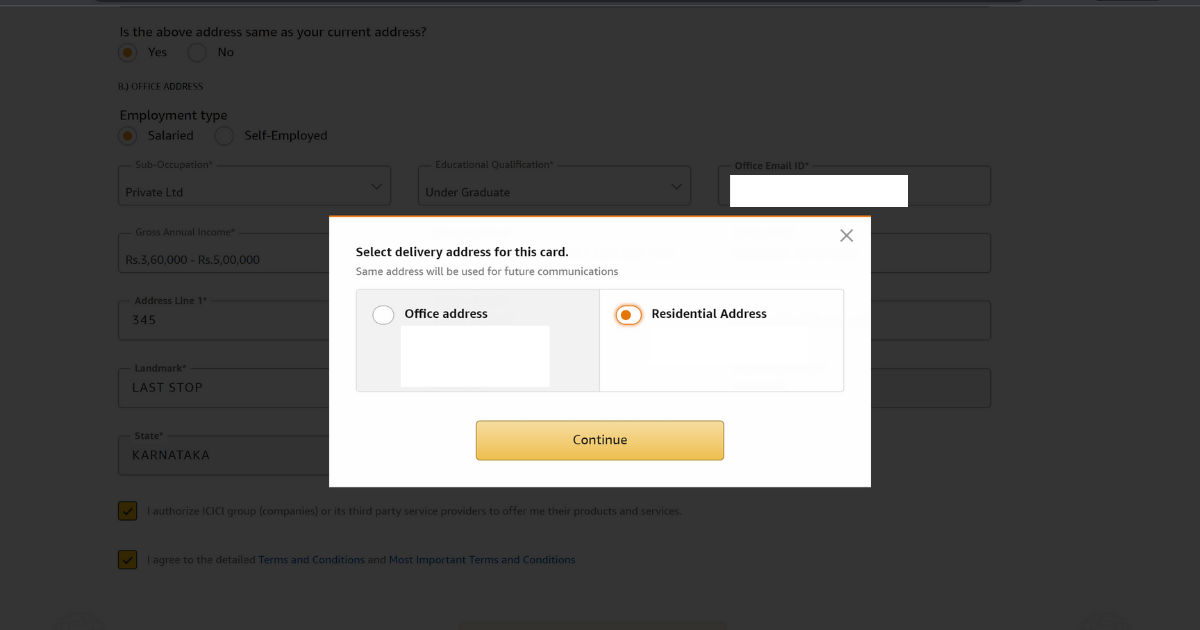

- In the next screen, you have to enter your current address, select employment type (Salaried/ Self-employed)

- Fill in details of work line company, designation, salary range, office address, and more

- Once everything is filled, click on Continue

- In the pop-up, confirm the delivery address for your card

- Click on Continue

- Based on your application, Amazon will decide if they need to do your KYC or not

- KYC can be done in two ways 一 Video KYC and In-personal verification

- Once the KYC is done, your application will be processed and approved if it meets the eligibility criteria and your documents are verified.

In case you choose in-person KYC, an executive will arrive at your home or office location and take all the necessary documents.

Note:

- In case your application has been rejected, you can again re-apply after six months

- Usually, applicants with an ICICI Bank Credit Card or ICICI Bank account do not need to go through KYC and their application will be approved instantly.

What are the Benefits of Amazon Pay ICICI Credit Card?

With Amazon Pay ICICI Credit Card, you get good reward points and each point you earn will be converted to Rs 1 and it will be credited to your Amazon Pay balance every month.

- Flat 5% reward points for prime members on mobiles, grocery, and more on Amazon (Prime members)

- Flat 3% reward points for prime members on mobiles, grocery, and more on Amazon (non-Prime members)

- Flat 2% reward points on bill payments, travels and adding money on Amazon

- Flat 2% reward points when you pay with the card for food, health, entertainment, and more outside Amazon

- Flat 1% reward points on all other payments such as grocery, dining, furniture, and more outside Amazon

- 15% savings on your dining bills at over 2,500 restaurants across India with Culinary Treats Programme

- You get a waiver of 1% on fuel surcharge payments each time you refuel

- No cost EMI options on Amazon.in (3 months and 6 months)

For example, if you purchase a phone worth Rs 50,000 on Amazon, you will get Rs 2,500 as Amazon Pay balance.

Also Read: Amazon: How to Cancel Items or Order on Amazon App and Website

How Much Rewards Points and Cashback You Will Get with Amazon Pay ICICI Credit Card?

With Amazon Pay ICICI Credit Card, there is no restriction for the number of reward points or cashback you can earn. Every reward point you earn will be converted to an Amazon Pay balance and you will get in at the end of the month.

Also Read: Also Read: Amazon: How to Cancel Items or Order on Amazon App and Website

What are the Joining Fee, Renewal Fee, Finance Charges, and Late Payment Charges on Amazon Pay ICICI Credit Card?

The joining fee for the Amazon Pay ICICI Credit Card is free and there are no annual charges or renewal charges as well. The card will remain free for a lifetime.

As for the finance charge, when there is an overdue amount, the charge varies from 3.5% to 3.8% per month or anywhere between 42% to 45.6% per year on Amazon Pay ICICI Credit Card. The same charges are applicable on interest on cash advances as well.

Here is how much the bank will charge on late payment charges on Amazon Pay ICICI Credit Card:

| Total Amount Due | Late Payment Charges |

| Less than Rs 100 | Nil |

| Between Rs 100 – Rs 500 | Rs 100 |

| Between Rs 501 – Rs 10,000 | Rs 500 |

| More than Rs 10,000 | Rs 750 |

Amazon Pay ICICI Credit Card Eligibility

To apply for Amazon Pay ICICI Credit Card, one must meet the following criteria:

- Age: 18 to 60 years

- Occupation: Salaried or Self-employed

- Minimum Income: Rs. 25,000 if ICICI Customers or Rs 35,000 for others

- Documents required: Aadhaar card, PAN card, salary slip or bank statement, latest Form 16 or ITR filing for self-employed applicants (or any other valid ID and address proof)

Also Read: Amazon Pay Gift Card: How to Add or Redeem Gift Card and Check Balance on Amazon App and Website

Frequently Asked Questions (FAQs)

Is Amazon Pay ICICI Credit Card free?

Yes, the Amazon Pay ICICI Credit Card is free for a lifetime with no joining or renewal fees.

Can I withdraw money from Amazon Pay ICICI Credit Card?

Yes, ICICI Bank gives you an option to withdraw money from your Amazon Pay ICICI Credit Card. However, you need to note that you will be charged a fee of 2.5 per cent of the transaction amount.