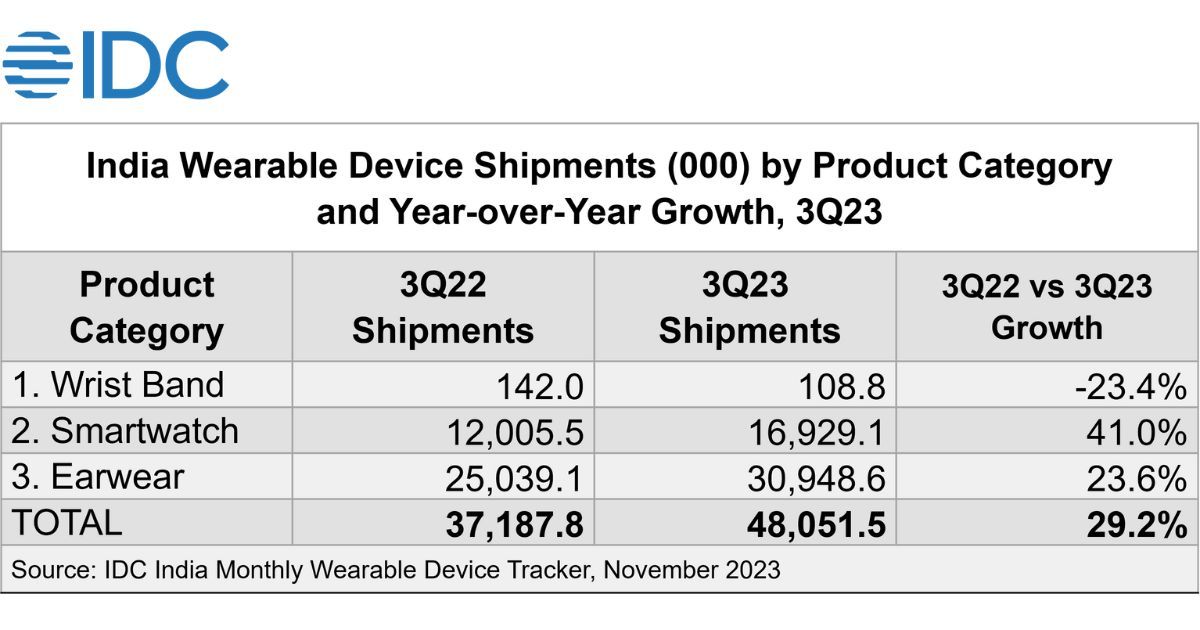

India’s wearable market is on the upswing, according to the latest data from the International Data Corporation (IDC). The report reveals a significant 29.2% YoY growth, with a whopping 48.1 million units shipped in the third quarter of 2023. This surge has pushed the total shipments for the first three quarters of 2023 to a solid 105.9 million units, surpassing the entire shipment volume for 2022.

Why the boom? Brands have been churning out new models across different price ranges and types, driving this impressive momentum. Smart rings also made their mark in Q3, alongside the usual smartwatches and earwear. It is also worth noting that the average price for wearables dropped by 20.4%, settling at US$21.7 from US$27.2.

The Share of Smartwatches and Earwear

Smartwatches stole the show, growing 41.0% YoY to 16.9 million units. Discounts and offers flooded the market, dropping the average price to US$26.7 (a 35.3% YoY decrease). However, there was a slight QoQ increase in the average price as more advanced smartwatches hit the shelves.

Earwear, though losing a bit of market share, still saw a robust 23.6% growth, shipping 30.9 million units. Truly Wireless Stereo (TWS) dominated with a 68.4% share and a strong 46.7% YoY growth. TWS and neckband prices dropped by 17.1% and 4.6% YoY, settling at US$19.5 and US$14.2, respectively.

Vikas Sharma, Senior Market Analyst at IDC India, predicts a strong finish for 2023, thanks to brands offering high-end specs at entry-level prices. Looking ahead to 2024, he expects a focus on localising features and improving the user experience.

Offline Market

Offline channels hit a record 31.5% share, a high not seen since Q1 2021, while online channels grew by 19.1% YoY. This highlights the importance of brands being everywhere, especially as they expand into smaller cities.

The rise of smart rings caught the eye, with Ultrahuman claiming a whopping 75.5% market share, followed by Pi Ring at 10.9%, and boAt at 8.2%.

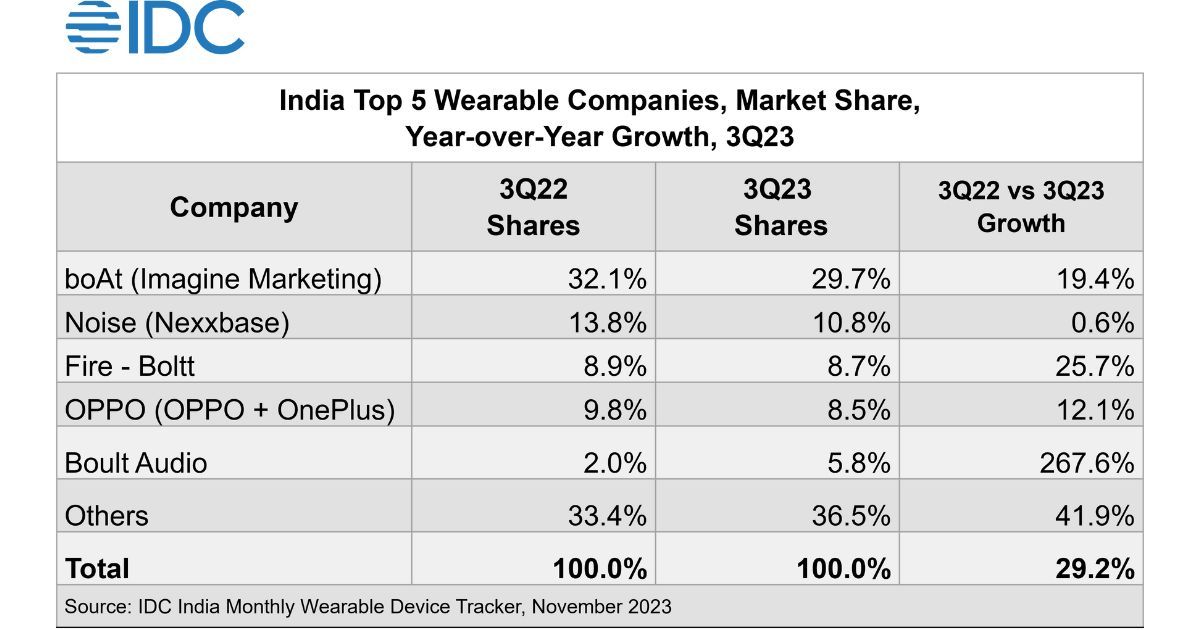

Top 5 Wearable Companies in 3Q23:

- boAt: Still holds the numero uno position with a 29.7% share, growing by 19.4%. In TWS, it led with a 37.9% share and 33.3% YoY growth, while it ranked third in the smartwatch category with a 14.2% market share.

- Noise: Holding a 10.8% share, Noise had a flat 0.6% YoY shipment growth. It was at second place in the smartwatches category with a 20.7% market share, and maintained the fourth spot in TWS with a 7.7% share.

- Fire – Boltt: With an 8.7% share and 25.7% YoY growth, Fire – Boltt stood third in the overall wearable category. It regained the lead in smartwatches with a 23.6% share.

- OPPO (OPPO + OnePlus): Securing an 8.5% share and 12.1% YoY growth, OPPO (OPPO + OnePlus) stood fourth in the overall wearable category, ranking third in terms of TWS, accounting for an 8.0% share.

- Boult Audio: Capturing a 5.8% share and experiencing a massive 267.6% YoY growth, Boult Audio stood fifth in the third quarter of 2023. It maintained its second spot in the TWS category.

The wearables market in India is booming, driven by competitive pricing and a diverse product range. As we look ahead to 2024, expect more growth with a focus on localised features to meet consumer demands.