Starting July 1, debit and credit card users in India won’t have to save their card details with every app and service in the country, instead, you will have custom/unique tokens that are enabled by the cardholder using an additional factor of authentication.

The Reserve Bank of India (RBI) claims tokenisation will help in securing your card details, and reduce the chances of hackers getting access to your financial data. If a person does not agree to the new tokenisation method, users will have to manually enter their card details every time they have to make a payment using digital services.

Also Read: SBI: How to Activate New SBI ATM or Debit Card for Online Transactions

What is Card Tokenisation?

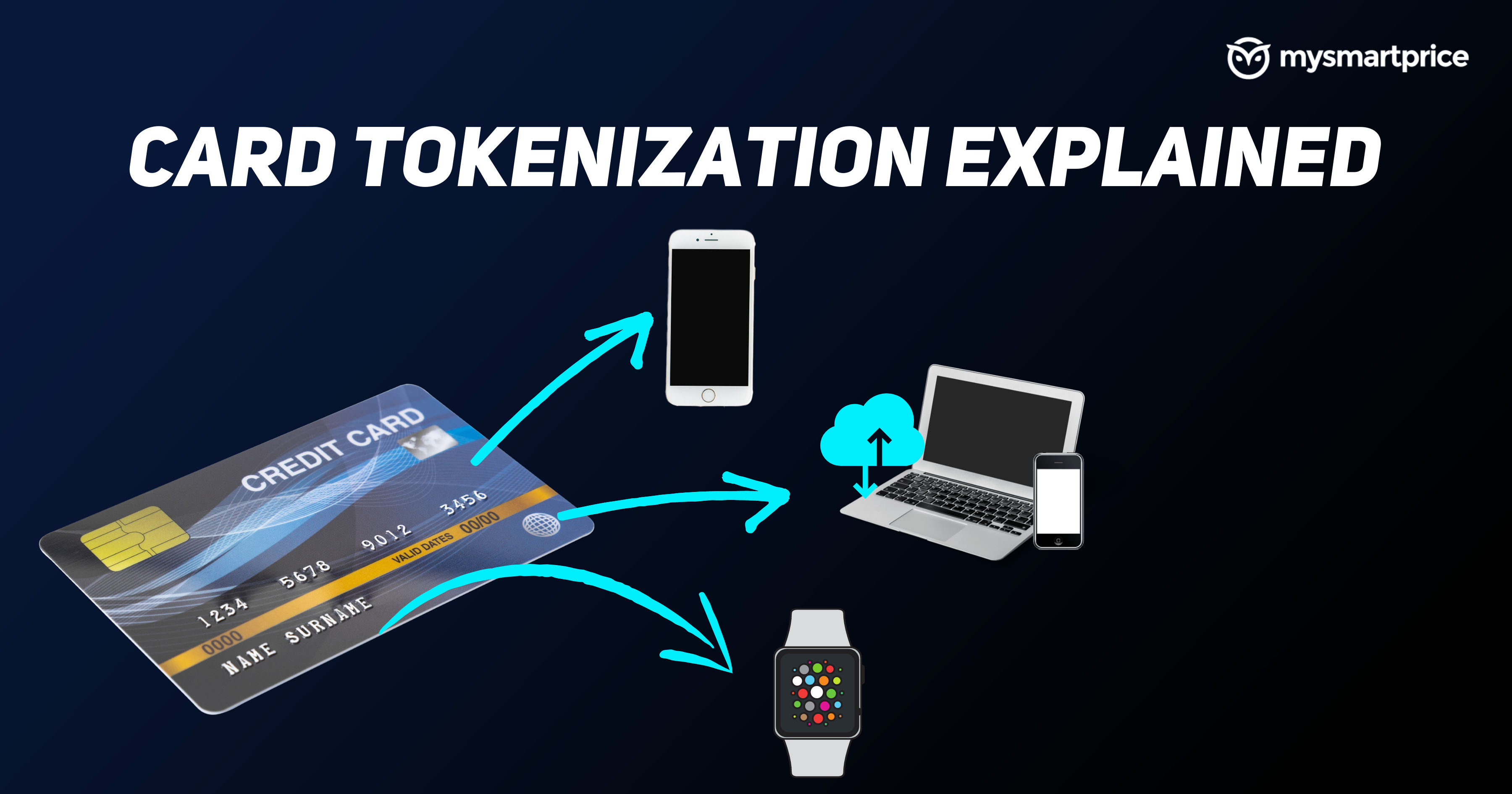

Card tokenisation is going to work as a password manager, but for your debit and credit card details like the 16-digit number, CVV number and the expiry date. From next month, all these details will be replaced by custom tokens that are predefined and nobody can access the data. Banks will have these tokens unique for each card, the person making the payment as well as receiving it. The whole process of tokens exchanging the data will make digital payments via cards safer and you can stop manually adding card details on every app.

How Does it Work?

RBI has chosen to go with the tokenisation method to keep the financial data secure and ensure that hackers are not easily able to steal confidential data in bulk and sell them to the highest bidder.

The tokens created for your debit and credit card are not stored anywhere physically or even on the internet. Earlier, you were saving card details to save time while shopping or making payments. With these tokens, you get faster and more secure access to the payment, without having to carry or remember the card details. You can only apply for tokenisation on domestic cards right now. International cards are not applicable for this mode.

Let’s take, for instance, if you shop with an ICICI Bank card on Amazon India, the token for the card and the online shopping site will be different. And when you use the same card on Flipkart, the token will change.

All the tokens are created by an authorised entity who have the required certifications and standard to store the tokens in a secure mode. RBI wants the card networks to get token requestor certified to comply with the global standards of payment.

Benefits of Card Tokenization

As we mentioned, there are quite a few benefits of opting for the card tokenisation mode for next month. The whole method of tokenisation is done free of cost, and the cardholder can use any of their cards to make the payment, as long as they are authorised by the token requestor.

You don’t have to remember these tokens, as they are securely stored on the servers, masking your debit/credit card details.

Each card has a unique token, so if a debit or credit with you expires and you get a renewal card, you have to create the token again to make payment using the newly-issued card. Customers will be given the option to view all the tokenised cards used by them, and even allow them to delete cards that are no longer used.

Potential Risks of Card Tokenisation

Most of the features that have been highlighted about card tokenisation suggest the whole adoption is meant to deliver a secure digital payment ecosystem. Having confidential payment details in the form of random tokens means you face lower chances of data leaking and leading to major financial fraud with your bank account. So, as of now, we can’t really see any major risk of opting for card tokenisation for your debit and credit card in India.