Google Pay has introduced its payments soundbox in India amidst the Paytm regulatory crisis. The new soundbox will provide real-time payment confirmation for merchants, similar to speakers from rivals like Paytm, PhonePe, and more. Google Pay’s Soundbox is called ‘SoundPod’ and is now available for merchants in India who accept online payments using Google’s Pay QR code.

Google Pay SoundPod: Features

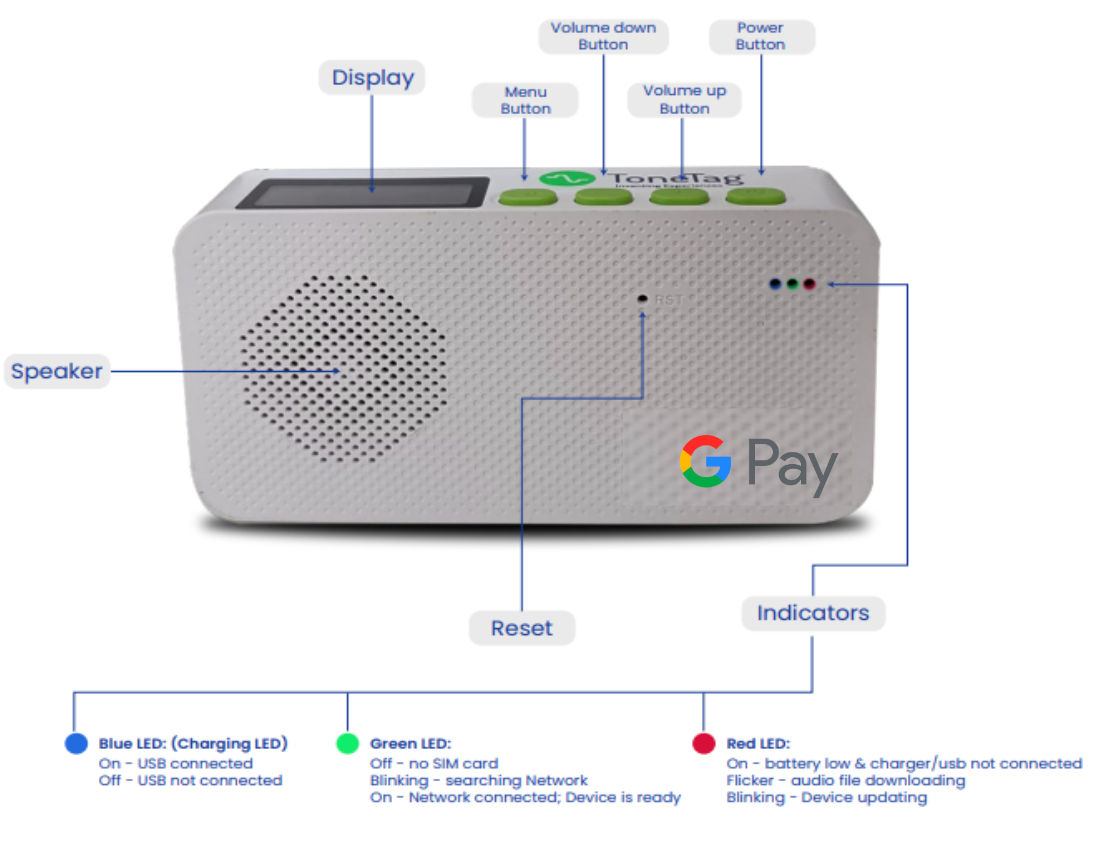

Google Pay’s SoundPod has a modern design and mini display, unlike traditional soundboxes. It comes with four buttons that can be used to adjust the volume, power the speaker, and a menu button to navigate among the options in the speaker. The Google Pay SoundPod is battery-operated and can be used when plugged in as well.

Merchants can order the SoundPod directly from their Google Pay for Business app. The soundbox is free to order, but merchants must pay a subscription fee to keep the speaker active. Google Pay is offering two plans for its SoundPod:

Daily Plan: Rs 499 one-time fee, followed by Rs 5 per day, which will be charged daily for 25 days a month. The daily fee will be charged as long as the merchant keeps using the SoundPod.

Annual Plan: Rs 1,499 for one year, which the merchant will pay upfront. Once the annual plan is purchased, the merchant will not be charged any other fees for one year, after which the plan will be renewed.

Google Pay will also provide a flat cashback of Rs 125 when a merchant completes the milestone of accepting 400 payments within 30 days. This incentive will be available to both daily plan and annual plan users.

Merchants can link any bank account with the Google Pay SoundPod. Google Pay will settle payments with merchants daily with an option to settle payments on demand.

Google Pay SoundPod is a Well-Timed Move

Google Pay, PhonePe, and Paytm account for over 90% of UPI payments in India. Among these, Paytm is the leader among merchant QR codes and was also the first in the country to introduce soundboxes, which became an instant hit.

Soundboxes are also credited with boosting UPI acceptance among smaller merchants, as they provide instant confirmation of payments as compared to manually checking the app at the merchant’s end.

However, the Reserve Bank of India recently directed Paytm to restrict its services like wallet, FASTags, and even merchant QR codes for failing to comply with regulatory guidelines. This can be troublesome for merchants who accept online payments using Paytm’s QR codes and soundboxes, as the service was expected to halt by March 15, 2024.

Paytm managed to rescue its merchant QR code division by partnering with Axis Bank. It also reassured merchants that Paytm QR codes and soundboxes will continue working even after the March 15 deadline, as confirmed by the RBI. However, Paytm’s reputation has taken a major hit, causing several merchants to shift to its competitors like PhonePe, Google Pay, etc.

While PhonePe already had its soundbox in India, Google Pay did not have its payment speaker. The ongoing Paytm crisis is the perfect opportunity for Google to introduce its soundbox. Google also recently announced that they are shutting down the Google Pay app in the USA and shifting to Google Wallet. However, the move does not affect the Google Pay app in India, which will continue functioning on the UPI framework.