India’s Unified Payments Interface, better known as UPI has now gone international after pioneering the digital payments ecosystem in the country. UPI is now available in seven countries around the world where Indians can send and receive money in foreign currency directly from their bank account. Let’s understand how you can enable and use international UPI payments using Google Pay, PhonePe, Paytm, and BHIM.

What is UPI International?

UPI International is a collaboration between the National Payments Corporation of India (NPCI) and other partner countries to allow real-time exchange of currency using the UPI framework. The system is designed to work 24×7 just like domestic UPI, making it one of the fastest ways for international money transfers. Here’s a list of countries that accept UPI International payments.

UPI goes Global!🤩

India's Unified Payments Interface goes International with launches in Sri Lanka and Mauritius!An instant, one-stop payment interface showcases 'Make in India, Make for the World'. #DigitalPayment #RuPay pic.twitter.com/EI8LBWxZCi

— MyGovIndia (@mygovindia) February 12, 2024

- Currently, UPI International is available in Singapore, France, UAE, Mauritius, Sri Lanka, Nepal, and Bhutan.

- Indian tourists visiting any of these partner nations can pay merchants directly using UPI from Google Pay, PhonePe, Paytm or BHIM.

- UPI International supports transactions up to Rs 2 lakhs.

- The money is then converted from the Indian Rupee to the local currency of that particular country and is instantly credited to the merchant.

- While International UPI is free of cost, users will be charged additional currency conversion fees from their respective banks.

- The exact charges will vary by bank. The exchange rate of currency is also decided by the sender’s bank.

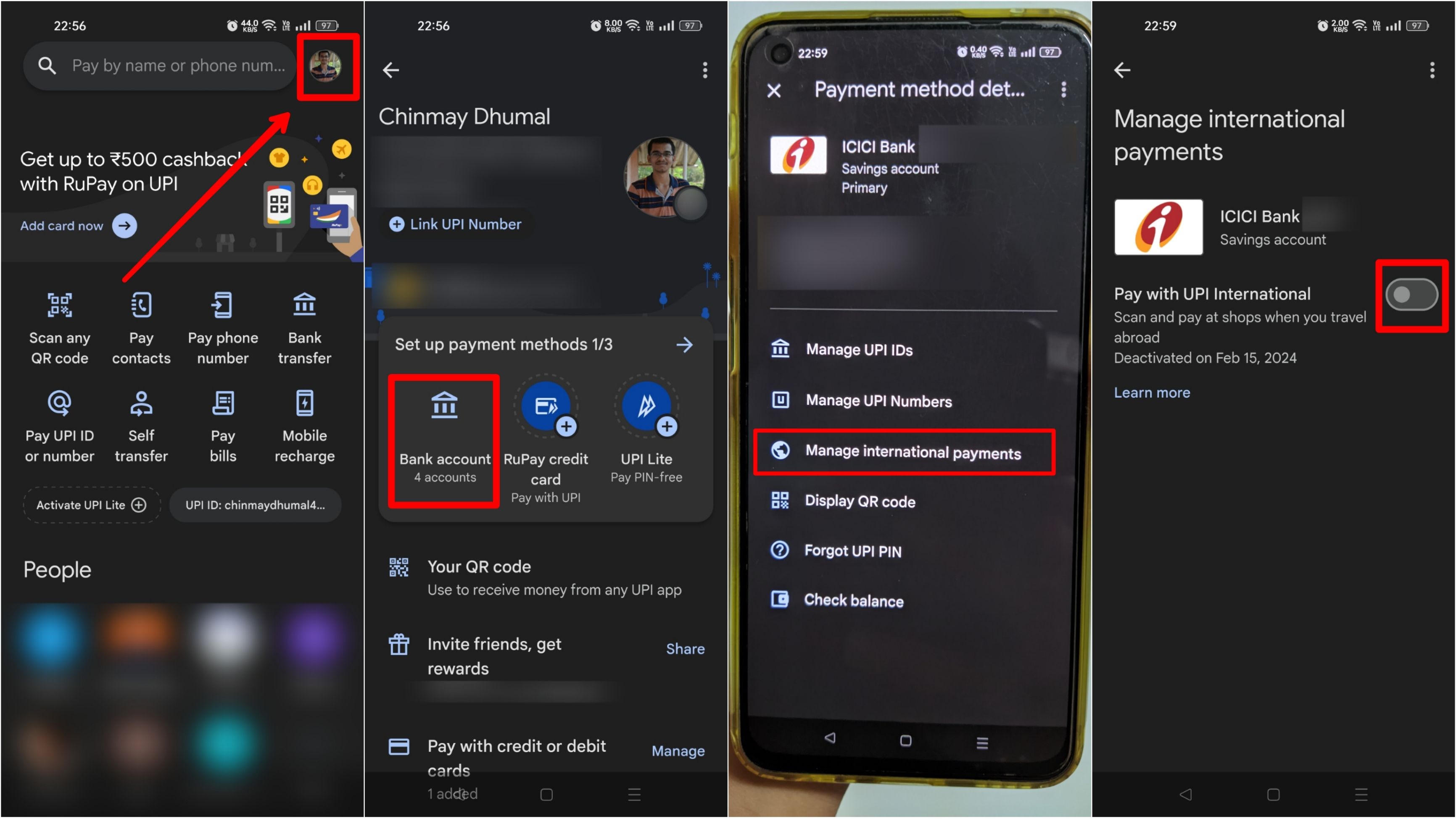

How to activate and use UPI International in GPay

Google Pay or GPay supports international UPI payments. Ensure that you are using the latest version of GPay on your Android or iOS smartphone. Here’s how you can enable it:

Step 1: Open the GPay app, and go to your profile section.

Step 2: Now open the ‘Bank account‘ option, and select the account which you wish to use for international UPI transactions.

Step 3: Open the ‘Manage international payments‘ option and enable the toggle.

Step 4: You will now be required to enter your UPI PIN to enable international transactions. Don’t worry as you will not be charged any fees for enabling this setting.

Once you complete the process, UPI international will be enabled in your selected bank account for 90 days, after which this setting will automatically get disabled.

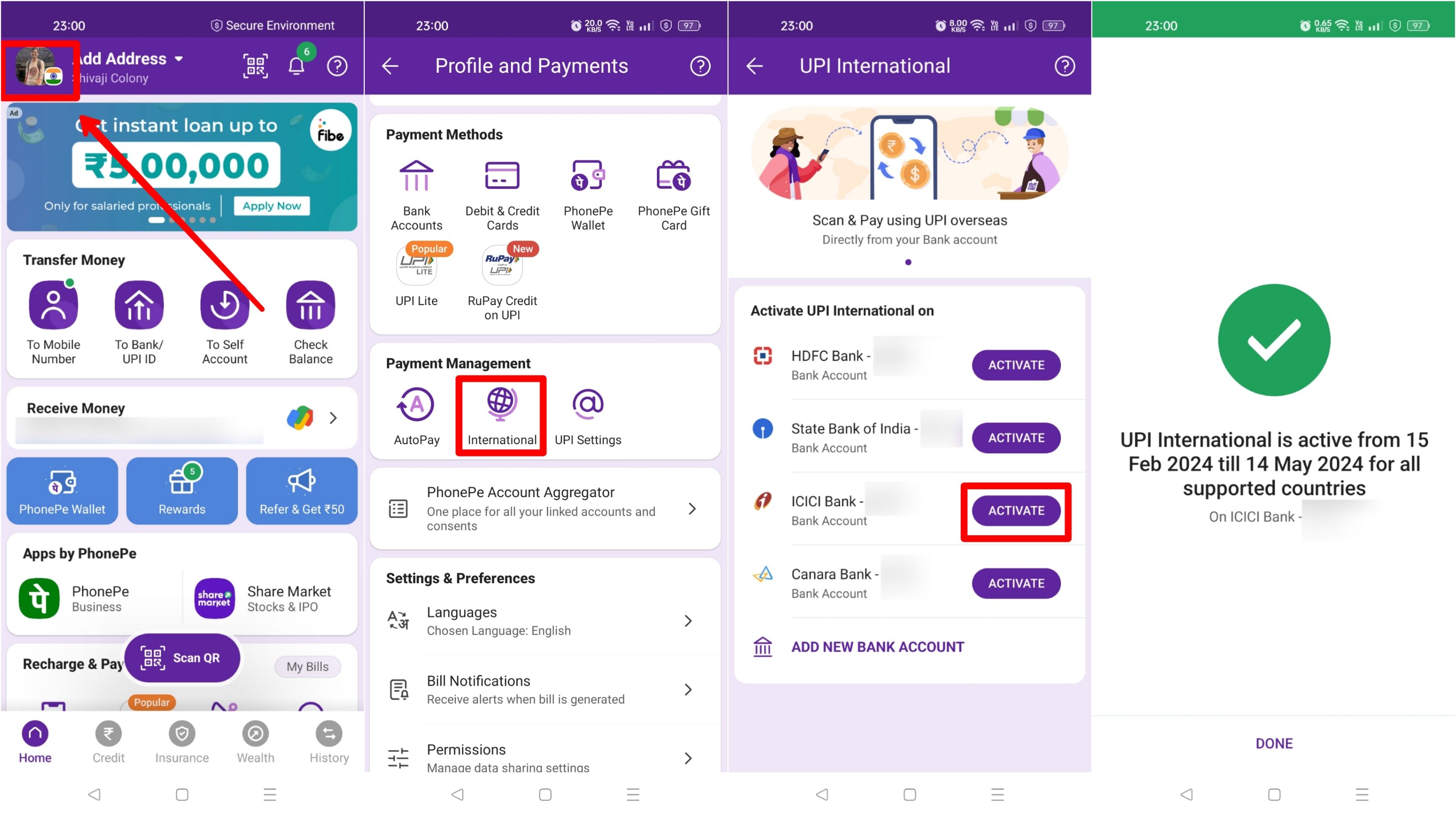

How to activate and use UPI International in PhonePe

Here’s how you can enable international UPI transactions in the PhonePe app:

Step 1: Open the PhonePe app, and visit your profile section from the top left corner.

Step 2: Scroll down and select the ‘International‘ option under the Payment Management menu.

Step 3: Choose your bank account, and select the ‘Activate‘ button next to it.

Step 4: Enter your UPI PIN to enable international transactions. Again, don’t worry as you will not be charged anything.

International UPI transactions will be enabled for your selected bank account for 90 days.

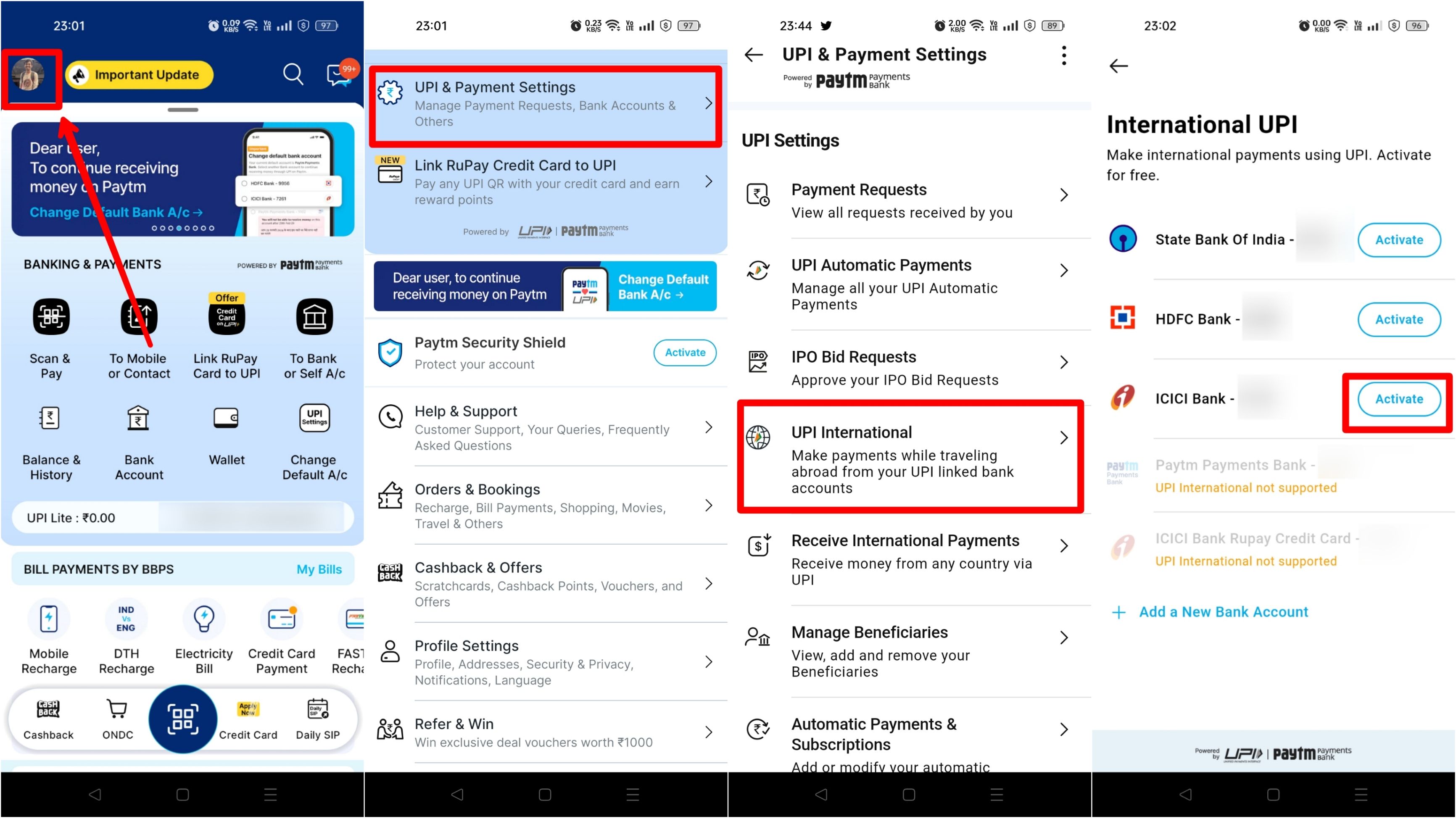

How to activate and use UPI International in Paytm

Despite Paytm’s ongoing crisis with the RBI, you can continue to use the app for international UPI transactions. Here’s how:

Step 1: Open the Paytm app, and go to your profile.

Step 2: Select the ‘UPI and Payment Settings‘ option.

Step 3: Scroll down and open the ‘UPI International‘ menu.

Step 4: Select your bank account, and enable the ‘Activate‘ button next to it.

Step 5: Enter your UPI PIN to enable international UPI transactions on your selected bank account.

Note that you should have an external bank account linked inside the Paytm app, as the default Paytm Payments Bank does not support international UPI transactions.

Although Paytm is one of the four apps that currently supports UPI International, the recent action taken by the Reserve Bank of India on Paytm might restrict the feature to some extent.

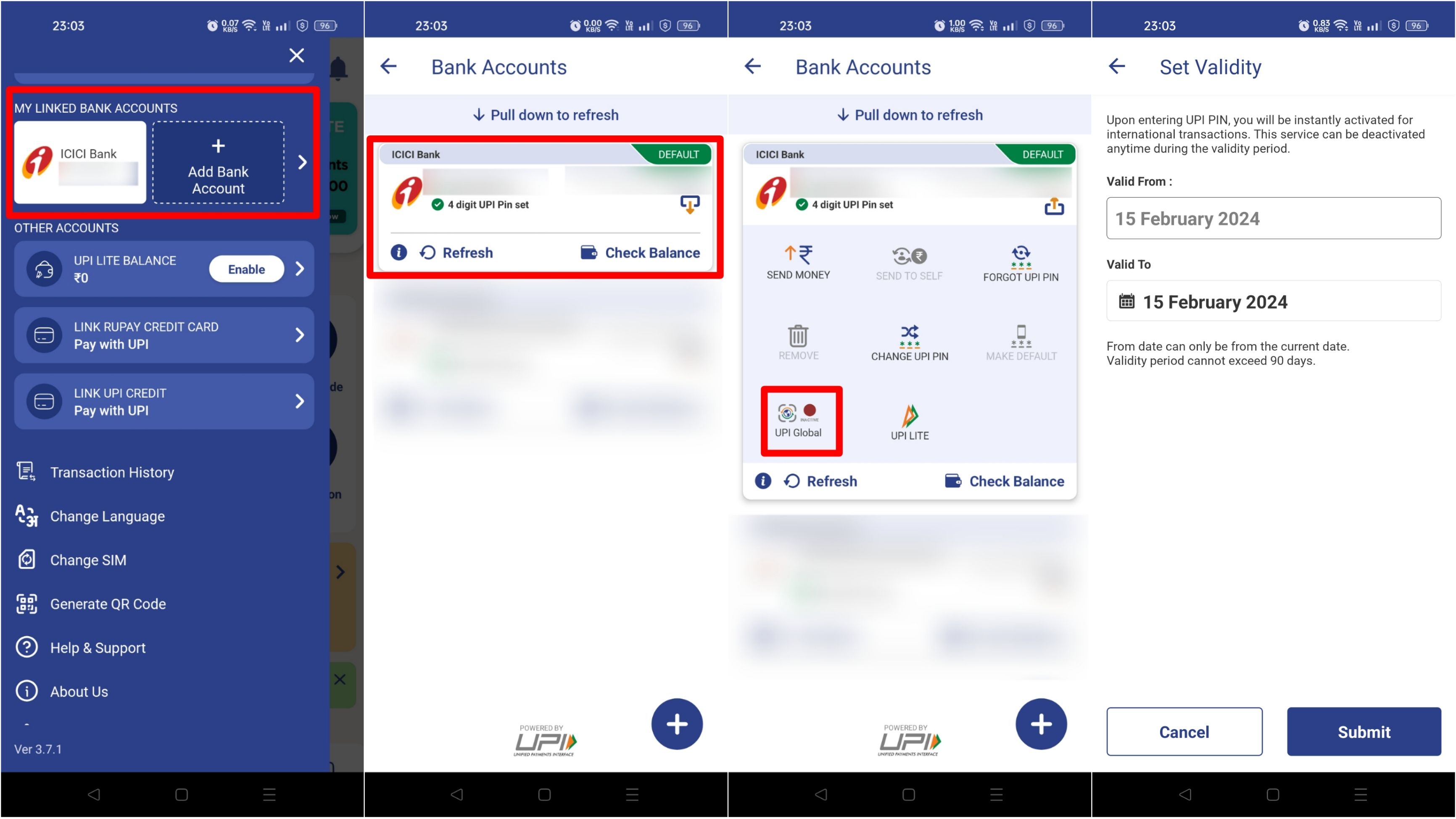

How to activate and use UPI International in BHIM

You can also do international UPI transactions using the BHIM App. Here’s how:

Step 1: Open the BHIM App, and go to your profile section.

Step 2: Select the ‘My Linked Bank Accounts‘ option.

Step 3: Now choose your bank account, after which the BHIM App will show you all the accessibility options for your account.

Step 4: Select the ‘UPI Global‘ option. Here, the BHIM App allows you to set a maximum duration to keep this setting enabled. This period cannot exceed 90 days.

Step 5: Enter your UPI PIN to complete the process.

You can notice that the UPI Global icon on your bank account will now show a green tick, compared to a red dot earlier. This indicates that International UPI is currently enabled for that account.

How to receive international transfers using UPI

Apart from sending money, users can also receive international money transfers using UPI. However, the sender can only be from the seven partner nations that currently support UPI International.

To receive international transfers using UPI, users need to share their Virtual Payments Address (VPA) which is popularly known as UPI ID. The sender needs to enter this VPA in a compatible app from their country, after which they will be able to send you money directly to your Indian bank account.

While there are no charges for receiving international money transfers, some banks may charge you a small convenience fee for this transaction. Every bank has a different policy when it comes to accepting payments from overseas, hence users are required to check the forex inward remittance charges on the official website of their respective banks.

FAQs

1. Can I use UPI while travelling outside India?

Yes, you can use UPI while travelling outside India. You can transfer money to any Indian bank account, as long as you have an internet connection. However, fund transfers to non-Indian bank accounts are only supported in seven partner countries.

2. Can I accept money from anyone using UPI International?

You can only accept international money transfers from the seven partner countries using UPI. Users can simply share their VPA to receive funds. NPCI is working to expand this network to other nations as well.

3. Which banks support international UPI payments?

As of now, every major bank like ICICI, HDFC, SBI, etc supports international UPI payments. However, smaller institutions like cooperative banks, payment banks, and small finance banks are not supported.