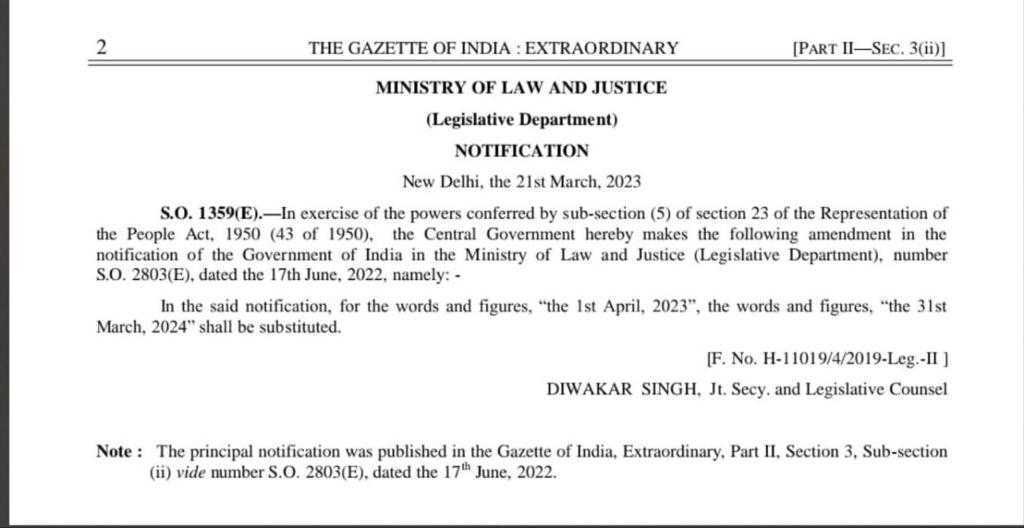

Individual taxpayers with a PAN and Aadhaar number should link on or before March 3, 2023. It is mandatory that you link your Personal Account Number and your Aadhaar number by the Government of India. If you fail to link both, your PAN number will get inoperative from April 1, 2023.

According to the Income-tax Act of 1961, all PAN holders who fail to link their PAN with their Aadhaar before March 31 will have their PAN invalidated. The Income Tax department has notified about this in a recent tweet:

Last date to link your PAN & Aadhaar is approaching soon!

As per IT Act,1961, it is mandatory for all PAN holders, who do not fall under the exempt category, to link their PAN with Aadhaar before 31.3.23. From 1.4.23, the unlinked PAN shall become inoperative.

Please link today! pic.twitter.com/aB1W4nA7G9— Income Tax India (@IncomeTaxIndia) March 18, 2023

Also Read: How to Change Name in PAN Card 2022: Online and Offline Process, Fees, Required Documents

Why Should You Link PAN Card with Aadhaar Card?

You should link your PAN card with your Aadhaar card because failing to do so before March 31, 2023, will result in invalidating your PAN card and facing many difficulties. If you do not have a PAN card, you will not be able to open a new bank account; you will face scrutiny from the Income Tax department and issues with investing in shares, mutual funds and more.

Also, failure to furnish PAN for income tax filing may attract a penalty of Rs 10,000 under Section 272N of the Income Tax Act, 1961.

How to link PAN with Aadhaar?

You can link your PAN with your Aadhaar easily using the Income Tax e-Filing Portal, But you need to pay the late fee before proceeding as the time has already passed to link the Aadhaar and PAN for free.

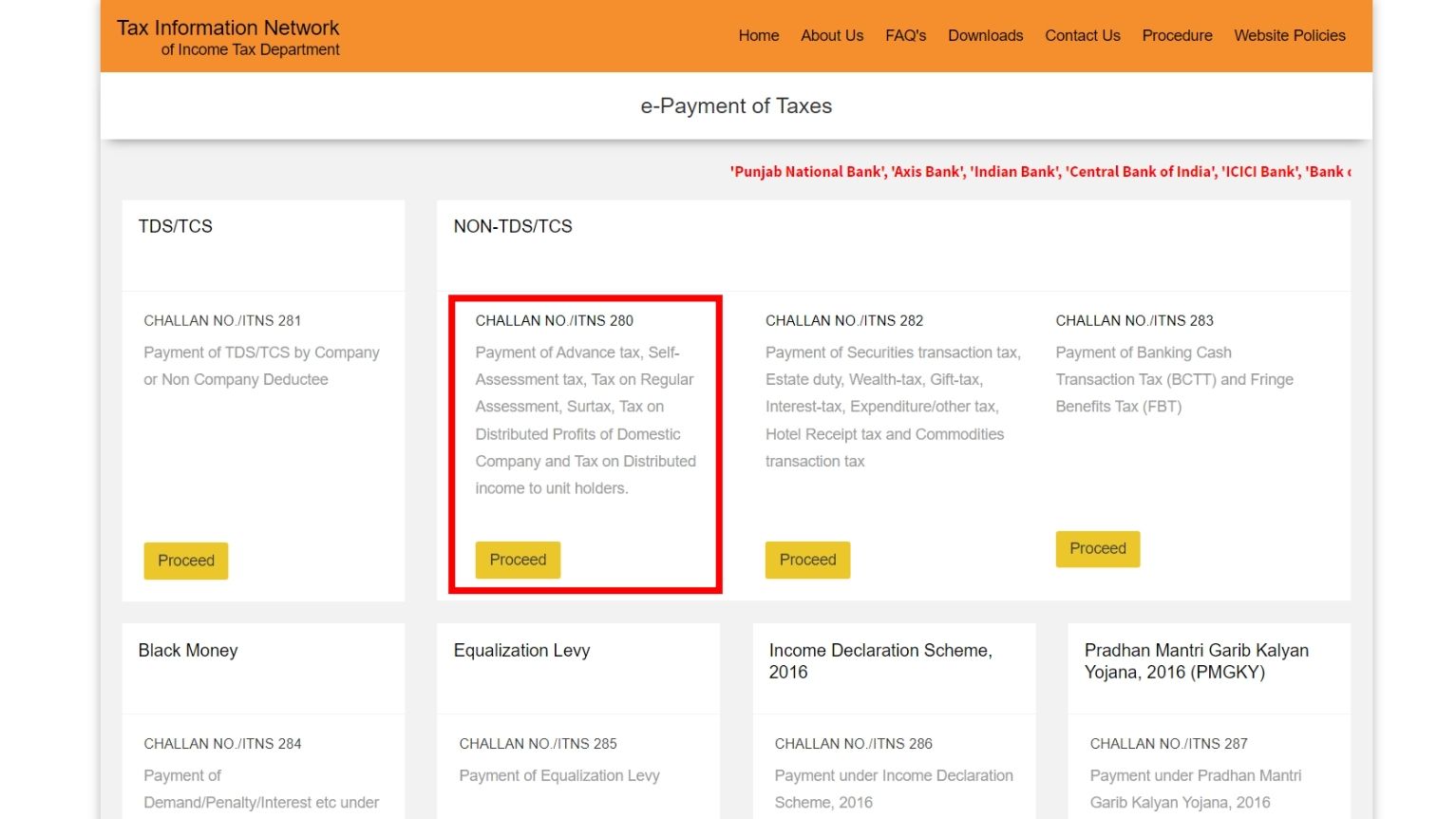

How to make payment of fee on the NSDL portal:

- Go to NSDL portal for e-Payment of Taxes: https://onlineservices.tin.egov-nsdl.com/etaxnew/tdsnontds.jsp

- Select Proceed on CHALLAN NO./ITNS 280 under NON-TDS/TCS section.

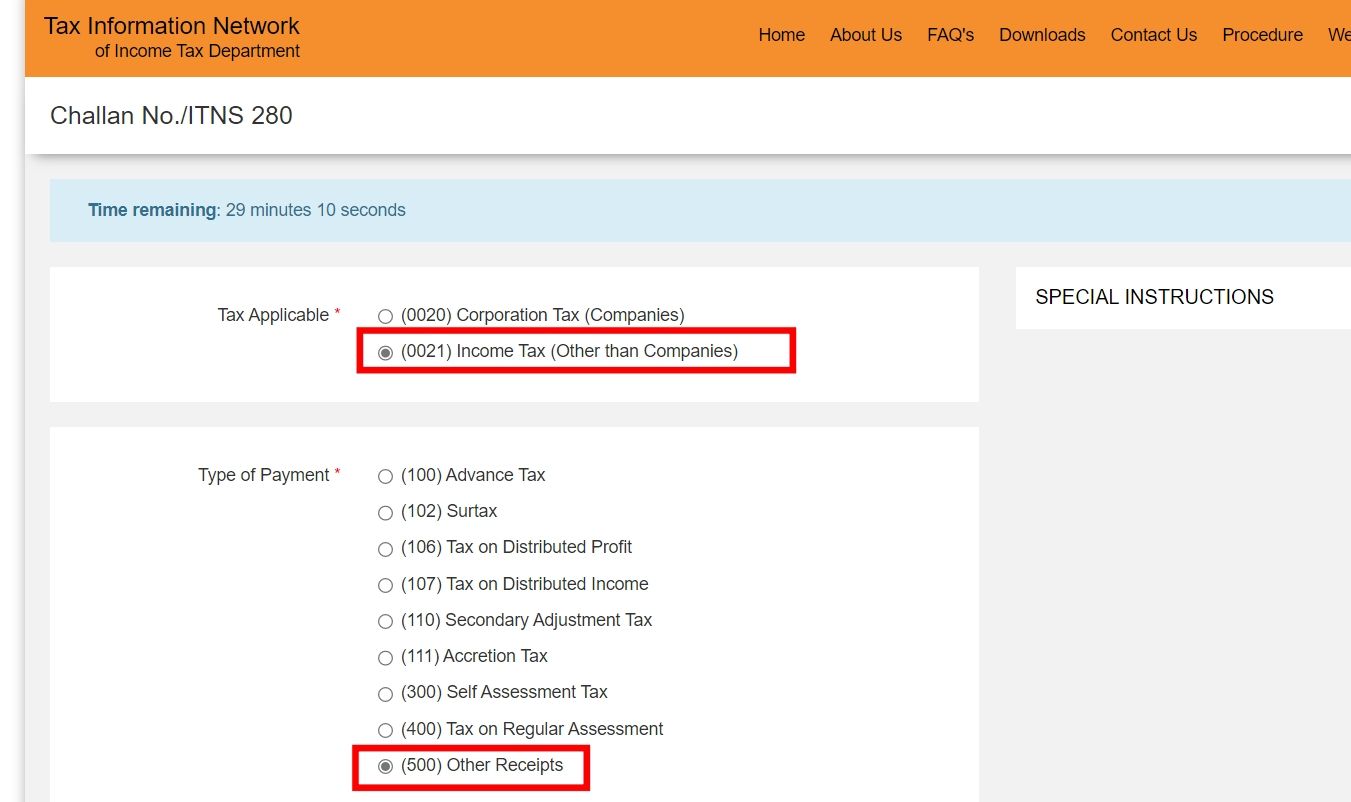

- On the next page, click Tax Applicable as (0021) Income Tax (Other than Companies) and Type of Payment of (500) Other Receipts.

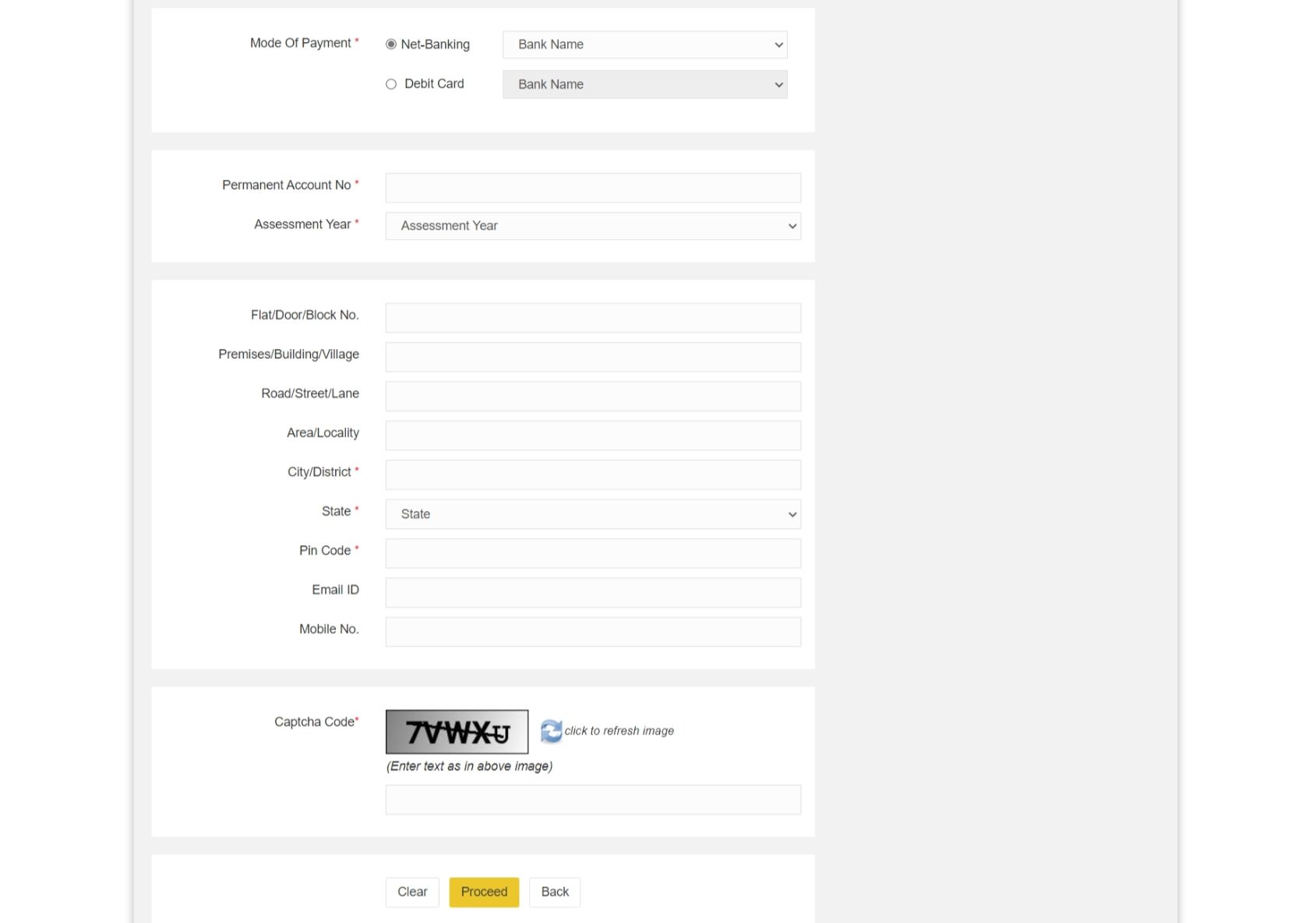

- Select the Mode of Payment of your choice. You can select Net-Banking or Debit Card.

- Enter your Permanent Account No (PAN) and the Assessment Year (The current assessment year is 2023-24).

- Enter the address, email ID and mobile number.

- Enter the captcha code and click on the Proceed button.

- On the next page, agree to the terms and conditions and make the payment.

Prerequisites for linking Aadhaar and PAN

-

- Valid PAN

- Aadhaar number

- Valid mobile number (linked to PAN)

How to link PAN with Aadhaar using Income Tax e-Filing Portal:

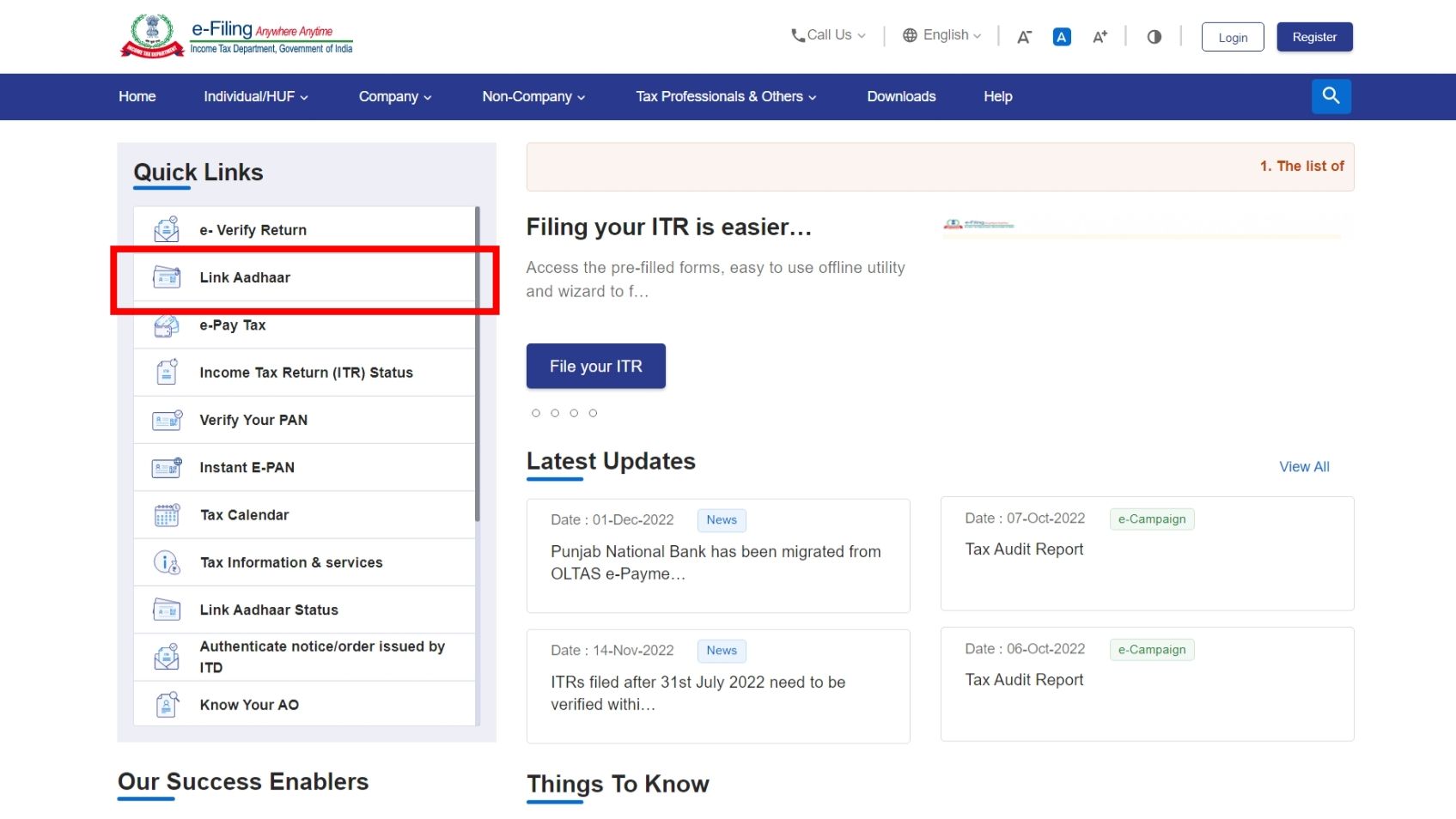

- Visit the Income Tax e-Filing Portal website: https://www.incometax.gov.in/iec/foportal/

Under Quick Links, you’ll see an option called Link Aadhaar; click it.

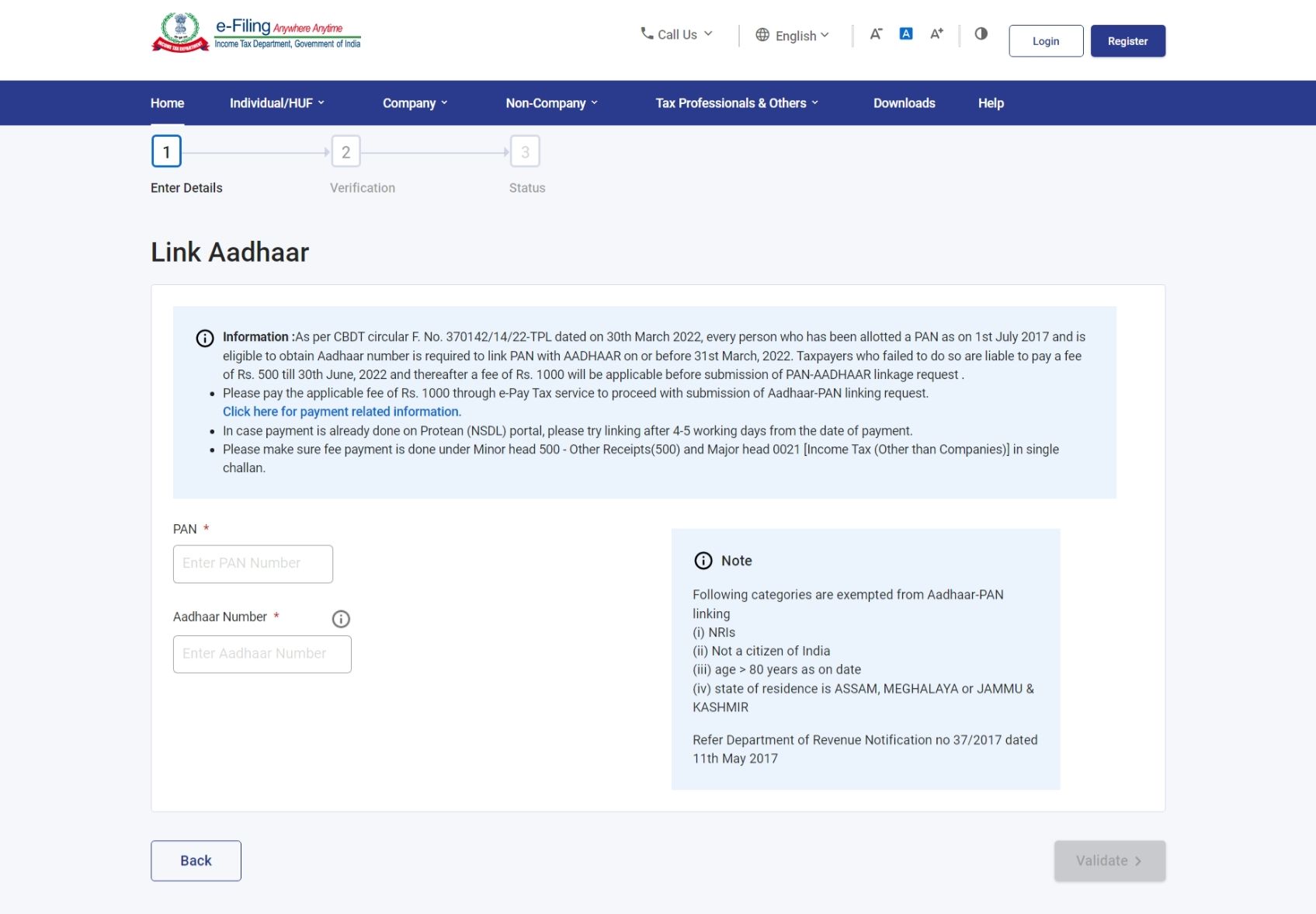

- On the next page, you must enter your PAN and Aadhaar number in the specified boxes.

Now click the Validate button.

- If you made the payment on the NSDL portal, you would see a message saying, ‘Your payment details are verified. Please click on Continue to proceed with submission of Aadhaar-PAN linking request’.

- Click on the Continue button.

- Next, you will receive an OTP for verification of PAN.

- Enter the OTP and click on the Validate button.

Check Status of your PAN with Aadhaar Online

To check the status of the PAN and Aadhaar link, follow these steps:

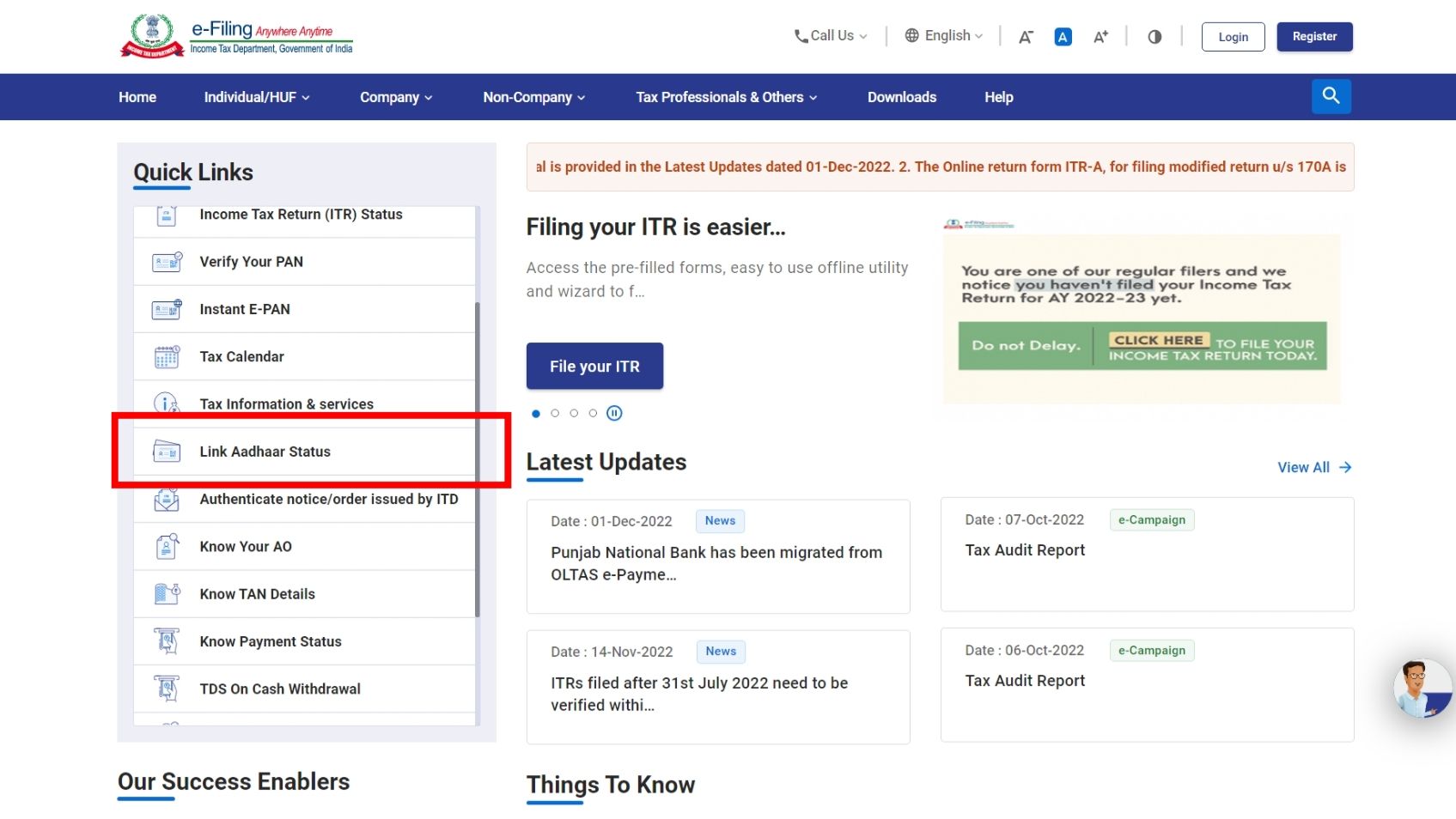

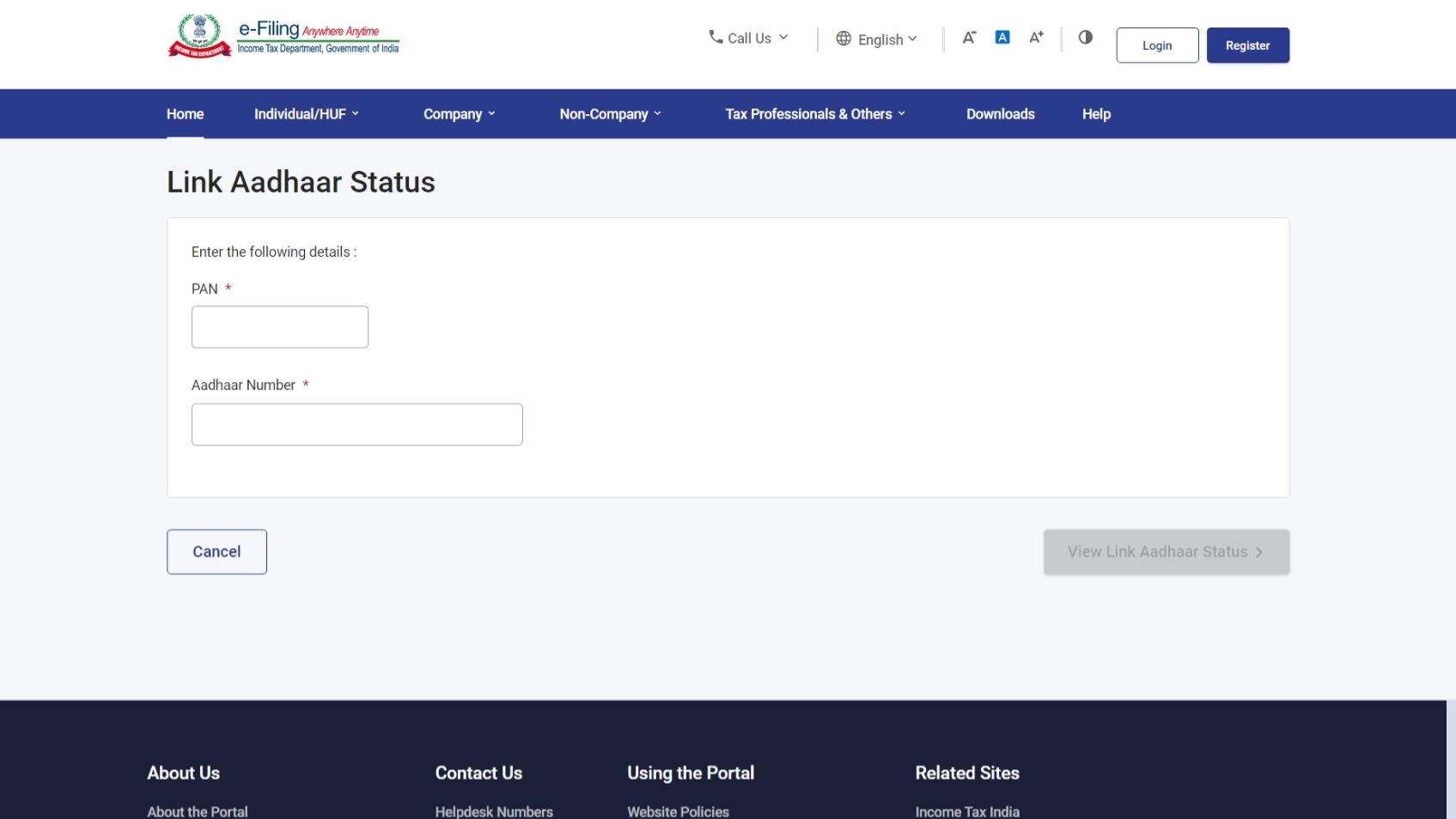

- Visit the Income Tax e-filing website: https://www.incometax.gov.in/iec/foportal/

- Under Quick Links, click on Link Aadhaar status.

- Enter your PAN and Aadhaar number.

- Click View Link Aadhaar status to view the status of the PAN Aadhaar link.

Check Status of your PAN with Aadhaar via SMS

You can also check the PAN and Aadhaar link status by sending an SMS to 567678 or 56161. Follow this format:

- UIDPAN <12 digit Aadhaar number> <10 digit PAN>

Also Read: Aadhaar: How to Download e-Aadhaar Card Online, What is the PDF File Password

Categories Exempted from Aadhaar-PAN linking.

Aadhaar and PAN linking is exempted for some people belonging to these categories:

- NRIs

- Not a citizen of India

- Age over 80 years

- State of residence is Assam, Meghalaya and Jammu & Kashmir.

You do not need to link your Aadhaar with your PAN if you satisfy these categories.

Also Read: Aadhaar: How to Download e-Aadhaar Card Online, What is the PDF File Password

Frequently Asked Questions (FAQs)

Why is there a Late Fee for Linking PAN and Aadhaar?

CBDT, or Central Board of Direct Taxes, Government of India, has extended the deadline to link PAN with Aadhaar from March 31, 2022, to March 31, 2022. However, a late fee has been added to link Aadhaar and PAN. The late fee would be Rs 500 if you linked before June 30, 2022. But from July 1, 2022, to March 31, 2022, the late fee is Rs 1000.

What is the last date to link my PAN with my Aadhaar?

March 31, 2023, is the last date to link your PAN card with your Aadhaar card.

Is it necessary to link PAN with Aadhaar for an NRI?

No, linking PAN with Aadhaar is not required for NRIs.

If I don’t fall into the taxable bracket, do I still have to get an Aadhaar card or have it linked to my PAN?

Yes, every individual with a PAN card is required to link their Aadhaar with their PAN.

Can we link Aadhaar to PAN on Mobile?

It is possible to link Aadhaar to PAN in mobile via mobile browsers. You have to follow the same steps we mention above. But it is recommended to do these steps on a PC or laptop, as the official government websites are not optimised for mobile.

Is PAN automatically linked to Aadhaar?

No, you need to link your PAN and Aadhaar manually online.

Is it necessary to link PAN with a mobile number?

It is necessary to link your PAN with your mobile number, as you need to receive an OTP on your phone number to validate the link between your Aadhaar and PAN.

How many PAN can be linked with an Aadhaar number?

Only one PAN can be linked with an Aadhaar. Moreover, one person cannot have more than one PAN. It is illegal to possess two or more Permanent Account Numbers.

How many days will it take to link PAN with Aadhaar?

Your PAN and Aadhaar linking should be completed in 4-5 days once you made the payment and linked via the IT e-filing portal.

What to do if you cannot link your PAN to your Aadhaar?

If you cannot link your PAN and Aadhaar number, you must visit the nearest PAN centre and fill out a form to attach your Aadhaar and PAN.

Can I link my Aadhaar to my PAN through SMS?

Now that the time limit for free linking with PAN and Aadhaar is over, you must make the late fee payment online. It is not possible through SMS, so you need to link your PAN and Aadhaar online.

Can I get an instant PAN through Aadhaar?

Instant e-PAN is available for all individuals who possess an Aadhaar and not a PAN. It is the digital version of PAN and is equivalent to a physical PAN card.