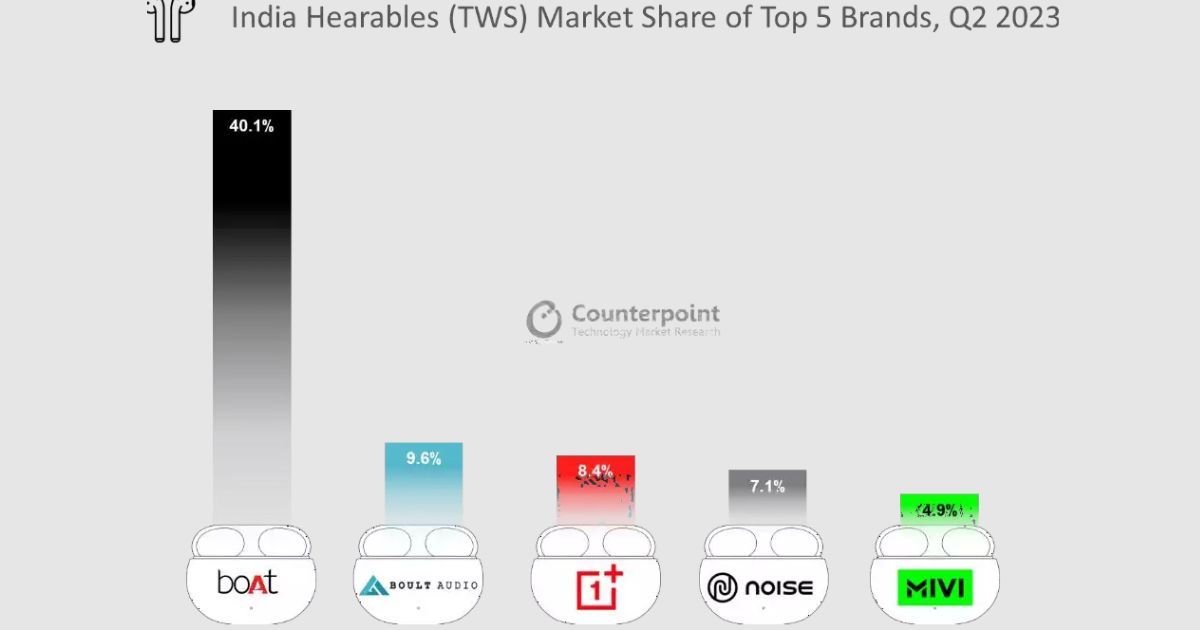

Counterpoint Research has published the Global TWS Hearables Market Analysis: Q2 2023 report, including the Indian TWS market. According to the report, the Indian TWS market recorded a 34% year-over-year growth in terms of shipments and impacted global growth. In India, the indigenous brand boAt continued to dominate the market, and OnePlus managed to grab the third spot in the Indian TWS market for the first time. Read on ahead to know all about Indian and Chinese brands’ market share in the Indian TWS market in Q2 2023.

OnePlus Becomes Third Largest TWS Brand in India For the First Time

OnePlus became the third-largest TWS brand in India for the first time.According to the Counterpoint Research report, OnePlus reported a whopping 228% growth in shipments compared to Q2 2022. The massive growth has helped the brand climb the ladder’s rungs and clinch the third spot in the Indian TWS market for the first time. The OnePlus Nord lineup of TWS earbuds was the driving factor, with over 80% of shipments from the brand. As for the market share, OnePlus is the only Chinese brand in the top 5 ranking, with 8.4% of the share.

On the number one position is boAt, which has retained the top position in the country for 12 consecutive quarters. The brand, run by Shark Tank fame Aman Gupta, recorded a YoY growth of 17%. This boost helped the Delhi-based brand secure a massive 40.1% market in the third quarter of 2023. According to the report, the brand’s success is mainly due to affordable TWS models on offer, ramped-up local manufacturing, and online-exclusive sales. The company has 6 of its products in the top 10 bestsellers list.

In the second spot is another Indian brand, Boult Audio. According to the Counterpoint report, the brand registered double growth YoY to gain a market share of 9.6 share. Noise and Mivi secured fourth and fifth spot with 7.1% and 4.9% market share in Q2 2023.

Realme was in the sixth spot with a 54% YoY growth from Q2 2022. According to the report, the Techlife Buds T100 was among the top 10 best-selling products for the second consecutive year.

In Q2 2023, Indian brands accounted for The report also revealed that the USA, India, and China were the top three countries in terms of market share globally, in that order. The Indian TWS market constitutes 15% of the global market. boAt owns a 6% global market share and stands in the third spot in the global TWS market.