All Indian citizens need to have a valid Aadhaar card as well as a PAN card but what is equally important is that all the citizens should have their Aadhaar linked to their PAN card. It has been made mandatory by the Indian Government for all citizens to have their Aadhaar Card linked with their PAN card, especially if they are taxpayers. A certain penalty amount is also set out for taxpayers who have not completed the Pan-Aadhaar link yet. So, if you have not done it yet, we have laid out the simple steps to know how to check your Aadhaar Card Pan Card link status online.

Prerequisites

- Only a few documents are required to link an Aadhaar card to a PAN card.

- Necessary documents include a valid Aadhaar card, a PAN card, and an active mobile phone number.

- The mobile number should be linked to either the Aadhaar card or PAN card.

How To Check Aadhaar Card PAN Card Link Status Online?

If a person needs to check his or her Aadhaar and Pan Card link status online, then he or she should follow these 4 easy steps.

- Step 1: Firstly, an applicant needs to visit the Income Tax online portal.

- Step 2: Next, on the Dashboard of the Home Page, the applicant needs to look for the option “Link Aadhaar Status” and then click on it.

- Step 3: Fill in the respective Aadhaar number as well as the Pan number, and press “View Link Aadhaar Status.”

- Step 4: The status will be visible on the screen.

Also Read: How to Change/Update Aadhaar Card Address Online in 2023

How To Check the Aadhaar PAN card link status without logging into the Income Tax portal?

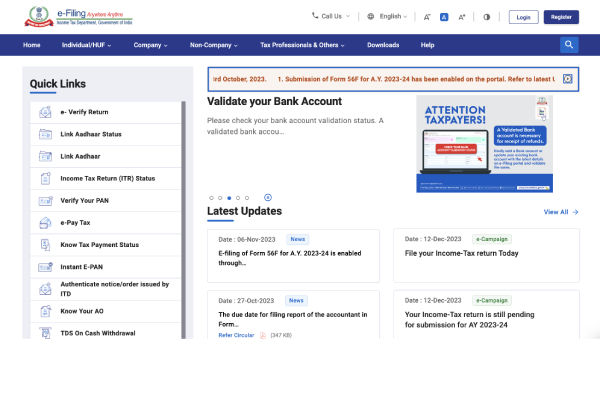

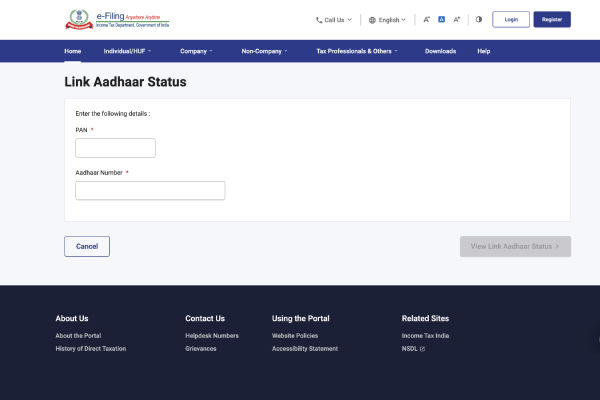

A person can also check the Aadhaar and Pan Card link status even without logging into the Income Tax Portal. All you need to do is follow these three easy steps and your status will be available in a matter of a few minutes.

- Step 1: First, the applicant needs to visit the Income Tax e-filing portal.

- Step 2: Next, look for the option that reads “Quick Links” on the left-hand side of your screens, under the several heading options, and then click on the “Link Aadhaar Status.”

- Step 3: The applicant will then be required to fill in their respective and valid “PAN number” followed by “Aadhaar number,” and then simply click on the ‘View Link Aadhaar Status’ button.

How to Check the Aadhaar PAN card link status by logging into the Income Tax portal?

A person can also check the Aadhaar and PAN card link status by simply logging into the Income Tax portal. Below, we have mentioned the quick and hassle-free steps.

- Step 1: First, an applicant needs to log in to the Income Tax e-filing portal with the help of this link.

- Step 2: Next, click on the “Dashboard” that is made available on the homepage and click on the “Link Aadhaar Status” option.

- Step 3: Another easy way is for the applicant to click on the “My Profile” option and then look for the “Link Aadhaar Status” option.

What is the Direct Link To Check the Aadhaar Card PAN Card Link Status?

The direct link to check the Aadhaar Card and Pan Card link status online is https://www.incometax.gov.in/iec/foportal/

How To Check Aadhaar Card PAN Card Link Status via SMS?

If a person really wants to avoid all the online proceedings and also wants to quickly check his/her Aadhaar Card and PAN card link status then you can easily follow these steps. Also, an applicant does not need internet connectivity for this process, However, it might take some time for an applicant to receive a response regarding his/her link status.

- Step 1: Firstly, an applicant needs to type in this message, “UIDPAN <12 digit Aadhaar number> < 10 digit PAN number>”, in this given format. Make sure that you are entering the correct digits.

- Step 2: Next, Send the SMS to ‘567678’ or ‘56161’.

- Step 3: Last, the applicant will have to wait for a certain time to wait for a response from the government.

FAQs

What is the fee for Aadhaar PAN card linking?

The fee for Aadhaar and PAN card linking is Rs.1000.

Who should link Aadhaar with a PAN card?

All the individuals who are citizens of India and have also been allotted a Pan Card on the date, 1st July 2017, and also who all are eligible for an Aadhaar card.

Is it mandatory to link an Aadhaar Card with a PAN Card?

The IT department has made it mandatory for all Indian citizens to link their Aadhaar cards with their PAN cards.

4. How long does it take to process the Aadhaar and PAN linkage?

It normally takes about 5 days to process the Aadhaar and Pan linkage. However, in certain cases it might take more than 5 days, the process is completely dependent on the Income Tax Department and the NSDL e-governance.

5. What should I do if my Aadhaar and PAN are not linked?

If your Aadhaar and Pan cards are not linked, then you must quickly complete the process by simply following the easy online steps. Also, if you are a taxpayer, then you are required to pay a penalty amount before filing for the Aadhaar and Pan click.