SBI may request you to update your KYC in your SBI account at times and you need to promptly update the KYC to avoid your SBI account getting frozen. Previously, you had to visit the branch and produce the KYC documents in your home branch to complete the KYC update.

But now, SBI allows users to do SBI eKYC, with which you can do the KYC update online using SBI netbanking. In this article, we talk about the steps to do the SBI eKYC update and the documents required for doing the KYC update.

How to update SBI KYC through Internet Banking

Here’s how to update the SBI KYC online using the SBI online banking:

- Login to SBI online banking.

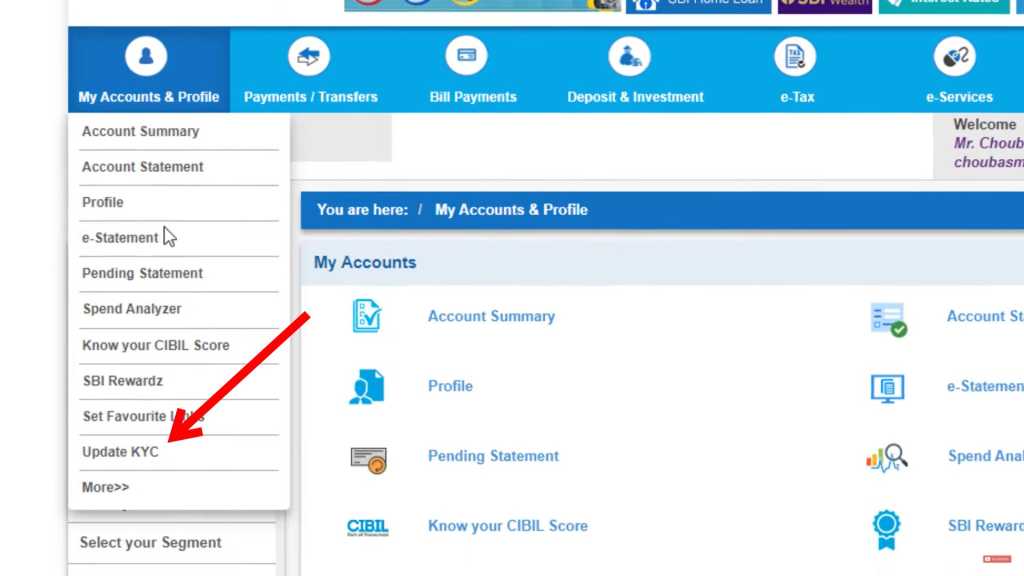

- Under the My Accounts & Profile section, click on Update KYC.

- Select your SBI account on the next page and click Next.

- Upload your supporting documents on the next page.

SBI also mentions that customers can email the supporting documents to your SBI branch requesting for KYC update. You can find the email address of your SBI branch by checking the first page of your SBI passbook. You can also find your relationship manager in your SBI branch and ask about it.

How to Update SBI KYC via YONO App

- Log in to the YONO app.

- Navigate to “SERVICE REQUEST” in the menu at the top left of the home screen (only available if KYC updation is due).

- Click on the “update KYC” icon.

- Enter your profile password and submit.

- Verify the address populated.

- Update occupation parameters (if needed).

- Update income parameters (if needed).

- Update KYC address details (if needed).

- Choose whether to update KYC address details (yes or no).

- Tick the undertaking box and press “next”.

- Enter the OTP sent to your registered phone number and submit.

Documents Required for SBI eKYC

To do the SBI KYC update, you have to provide some documents to the bank to verify your identity. The documents required are different for different types of accounts – individuals, minors and NRIs. Let’s take a look.

SBI eKYC: Documents Required for Individuals

If you’re having an individual account with SBI, these are the documents required for doing KYC (either of these):

- Passport

- Voter’s Identity Card

- Driving License

- Aadhaar Letter/Card

- NREGA Card

- PAN Card

SBI eKYC: Documents Required for Minors

If the account you want to do is minor, these are the documents required for updating KYC:

- ID proof of the person who operates the account (Passport, Voter’s Identity Card, Driving License, Aadhaar Letter/Card, NREGA Card or PAN Card)

SBI eKYC: Documents Required for NRIs

Updating KYC for NRI accounts requires documents such as:

- Foreign offices

- Notary Public

- Indian Embassy

- Officers of correspondent banks whose signatures are verifiable through an authorized(A/B category Forex handling branch) branch of the Bank

Why is it important to update KYC Information with SBI?

Keeping the KYC updated on your SBI account is important for various reasons such as:

- Required by RBI – Periodic updation of KYC is a requirement by RBI. It is an RBI mandate and all SBI customers are required to update KYC when requested by the bank.

- Account freezing – Failure to update the KYC in your SBI account will lead to the account getting frozen. You should update your KYC before that happens.

Frequently Asked Questions (FAQs)

When should I send the KYC documents?

SBI says you have to send the KYC documents only if the KYC update is due in your account and the branch has notified you of the same.

Will KYC documents be required for all account holders?

Yes, each individual must submit documents to update the KYC details. You can check out the required documents above.

How to check the status of the KYC update?

Once the mail has been sent to the branch, you might get an acknowledgement email, depending on the branch. In case you didn’t get it, you can mail them back and check for the update.

How long does it take to update KYC?

Once you have submitted the KYC documents to the bank branch, the bank will take some time to verify the details. However, there is no time limit for the same. In case you don’t get a response within a few days, you can mail them and ask for an update.

Can I update my KYC through Yono SBI?

The SBI Yono application only allows you to update your PAN card. For other documents and more, one needs to visit the SBI branch or send the details to a registered bank email address.