Discover the top 15 instant personal loan apps reshaping the financial landscape in India for 2023! In today’s fast-paced world, financial flexibility is key, and Indian markets have responded with a surge in personal loan apps tailored to meet your diverse financial needs. Whether it’s funding a dream vacation, settling medical bills, investing in your business, or simply managing expenses until your next paycheck, these apps have your back. Join us as we explore these 15 instant personal loan apps, understanding their unique features and advantages.

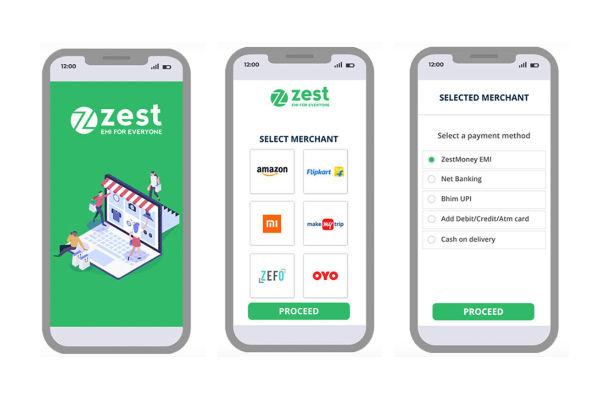

Zest Money App

ZestMoney is a smartphone application that makes it possible for users to buy goods and repay them through reasonable monthly installments. The app is simple to use, and after approval, you can shop at a variety of partner retailers. It’s especially useful if you don’t have or prefer not to use a credit card.

Interest Rate: 14%

Minimum Loan Amount: Rs.10000

Maximum Loan Amount: Rs.300000

Repayment Tenure: 6 months up to 24 months

Download app name: Android, iOS

Play Store Rating: 4.2

Also Read: UPI Now, Pay Later: What Is It, How It Works And More

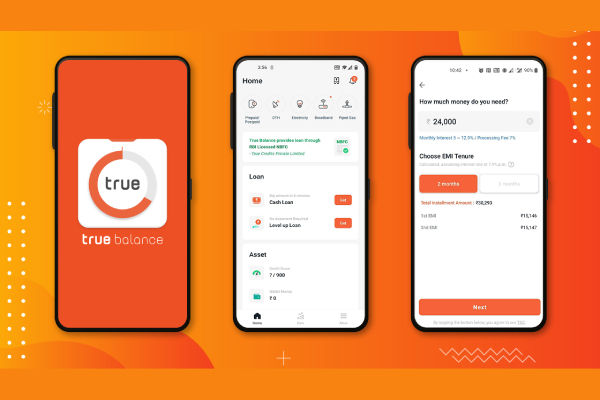

TrueBalance- Personal Loan App

TrueBalance is a smartphone app that makes it possible for its customers to obtain personal loans effortlessly and quickly. It is a useful tool for that can be taken into use while dealing with unforeseen bills or making important payments, giving the best possible financial assistance you need just when you are in need of it.

Interest Rate: 2.4% to 36%

Minimum Loan Amount: Rs.1000

Maximum Loan Amount: Rs.100000

Repayment Tenure: 62 days up to 12 months

Download app name: Android, iOS

Play Store Rating: 5

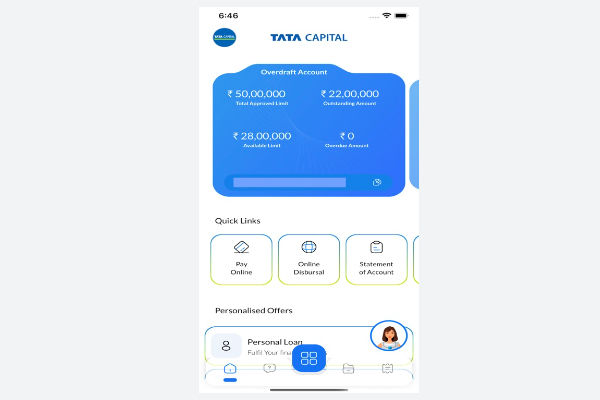

Tata Capital Personal Loan App

The Tata Capital Personal Loan app is an easy way which enable clients to access and request Tata Capital personal loans. These EMI calculators make it incredibly simple for you to figure out what it takes to repay your loans. Tata Capital’s rapid personal loans are able to be utilized to purchase anything you need, with no limits or queries about how the money will be used.

Interest Rate: 10.99%

Minimum Loan Amount: Rs.40000

Maximum Loan Amount: Rs.150000

Repayment Tenure: 12 months to 60 months

Download app name: Android, iOS

Play Store Rating: 4.6

Also Read: Bank Holidays 2023 in India: Date, Day and Types of Holidays

PaySense Personal Loan App

PaySense Personal Loan App is a useful app that allows you to easily check your eligibility, choose an appropriate loan plan, and submit your application. The EMI calculator on the PaySense fast loan app and website may help you figure out how much you will have to shell out each month.

Interest Rate: 16% and 36%

Minimum Loan Amount: Rs.5000

Maximum Loan Amount: Rs.500000

Repayment Tenure: 3 and 60 months

Download app name: Android, iOS – N/A

Play Store Rating: 3.7

Navi Loans App

Navi offers rapid personal loans with minimal documentation. Simply download the Navi App, enter your information, complete a quick digital verification, and connect your bank account. If everything is in order, the funds will be transferred to your bank account in a matter of minutes.

Interest Rate: 9.9% – 45% p.a.

Minimum Loan Amount: Rs.10000

Maximum Loan Amount: Rs. 20 lakhs

Repayment Tenure: 60 months

Download app name: Android, iOS

Play Store Rating: 3.8

Moneyview App

The MoneyView Loans app provides instant personal loans to meet all of your needs. Loans can be obtained quickly and easily. The consumer only needs to choose from a variety of EMI repayment plans starting at 3 months and going up to 5 years.

Interest Rate: 2%

Minimum Loan Amount: Rs. 5000

Maximum Loan Amount: Rs. 500000

Repayment Tenure: 3 months to 60 months

Download app name: Android, iOS – N/A

Play Store Rating: 4.7

MoneyTap App

MoneyTap is an Indian app that provides Credit Lines and Instant Personal Loans. You can get authorized for a credit line quickly, giving you access to money of up to Rs.500000. What’s even better is the fact that you only have to pay interest on the funds that you use from the maximum permitted amount. It is a straightforward solution for those who want economic freedom and authority over how much they spend.

Interest Rate: 12.96% p.a.

Minimum Loan Amount: Rs. 3000

Maximum Loan Amount: Rs. 500000

Repayment Tenure: 3 years

Download app name: Android, iOS

Play Store Rating: 4.1

KreditBee App

KreditBee is a top online personal loan app. You can get money in your bank account in 10 a matter of minutes. What sets it apart from the other thriving loan apps is the fact that it is a super effortless way to receive a personal loan with low costs, and the money is paid directly to your bank account. It’s trusted by over 5 crore customers around the country.

Interest Rate: 12.25% – 30.00% p.a.

Minimum Loan Amount: Rs. 1000

Maximum Loan Amount: Rs. 400000

Repayment Tenure: 62 days to 2 years

Download app name: Android, iOS

Play Store Rating: 4.4

InCred App

InCred represents a revolutionary financial services firm that facilitates lending by means of the use of information technology and science. They provide regular customers with small unsecured personal loans ranging from Rs 50,000 to Rs 7.5 lakhs. In addition, InCred provides larger, longer-term loans to students seeking higher education in India or overseas.

Interest Rate: 11.49% and 24.00%

Minimum Loan Amount: Rs 50,000

Maximum Loan Amount: Rs 7.5 lakhs

Repayment Tenure: 60 months

Download app name: Android, iOS

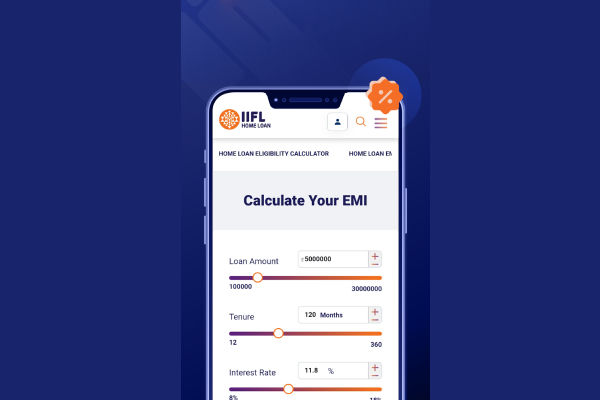

IIFL Loans App

IIFL Finance is a one-stop shop for all things financial. They make it very easy to get a loan through your gold, whether or not for your own use, for your company, or for the purchase of an investment property. Individuals have the ability to sign up and schedule an appointment at their home for gold handling and loaning. They even assist with insurance and investing, so you can keep all of your financial affairs in one location.

Interest Rate: 2% – 6% + GST

Minimum Loan Amount: Rs. 5000

Maximum Loan Amount: Rs. 500000

Repayment Tenure: 3 months to 42 months

Download app name: Android, iOS

Play Store Rating: 4

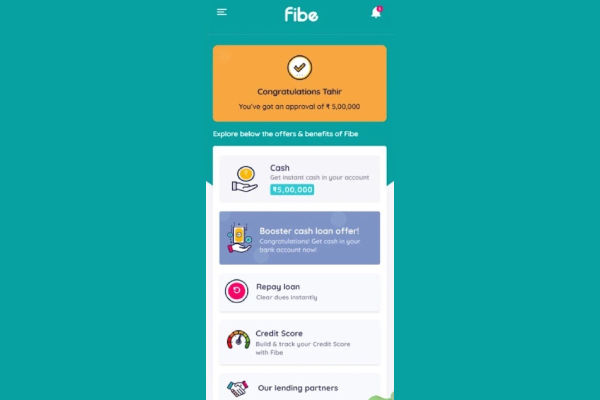

Fibe Personal Loan App

Fibe allows its customers to opt for an easy and hassle-free loan service. All they have to do is to get their documents verified and get the loan approval done in a matter of time, and then they can quickly deposit the funds directly into their bank account. The users can repay it in their own time and at a reasonable interest rate.

Interest Rate: 12%

Minimum Loan Amount: Rs. 8000

Maximum Loan Amount: Rs. 500000

Repayment Tenure: Up to 2 years

Download app name: Android, iOS

Play Store Rating: 4.4

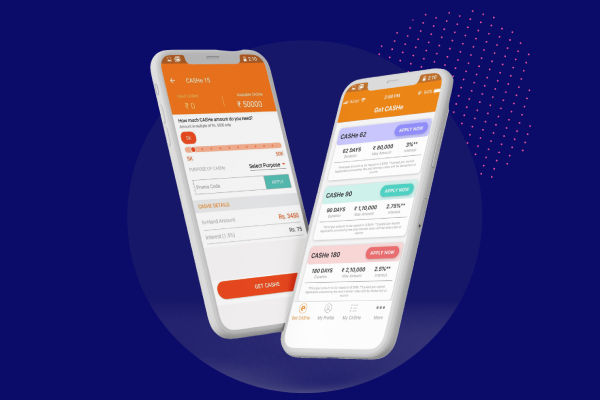

CASHe Personal Loan App

CASHe is a smartphone application that assists you in obtaining personal loans rapidly and without the requirement for any security or assets. You are able to borrow sums ranging from Rs.15,000 to Rs. 400,000. The app is simple to use, making the mortgage application procedure quick and simple. It is a simple approach to get the money you need to cover different personal expenses.

Interest Rate: 2.25% per month

Minimum Loan Amount: Rs.15000

Maximum Loan Amount: Rs. 400000

Repayment Tenure: 3 to 18 months

Download app name: Android, iOS

Play Store Rating: 2.7

mPokket App

mPokket is an app that provides students and young professionals in India with immediate small personal loans. What distinguishes this loaning app from others on the market is that it is intended to provide immediate financial aid, allowing users to borrow very little sum of money.

Interest Rate: 2% to 4% per month

Minimum Loan Amount: Rs. 3000

Maximum Loan Amount: Rs. 30000

Repayment Tenure: 90 days

Download app name: Android, iOS – N/A

Play Store Rating: 4.4

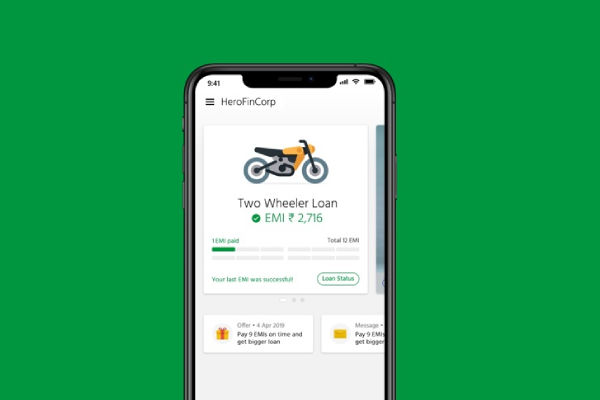

Hero FinCorp Instant Personal Loan App

The Hero FinCorp personal loan app has been created to be easy and simple to use by its customers. A user who is looking for an easy way to get access to a loan can quickly grasp how one can sign up for and operate the service. What makes this app unique is that you may apply for a loan without having to provide any paperwork or documentation in person. It makes use of the technology at its best possible way.

Interest Rate: 2.08% per month

Minimum Loan Amount: Rs. 50000

Maximum Loan Amount: Rs. 300000

Repayment Tenure: 6 months to 24 months

Download app name: Android, iOS

Play Store Rating: 4.3

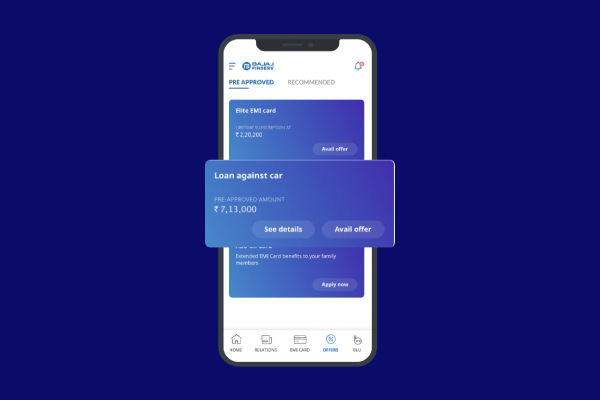

Bajaj Finserv App

A user can effortlessly request a loan using a smartphone with the help of the Bajaj Finserv loan app. You only need to touch a few times for your loan to be accepted. This software allows you to apply for several types of loans, such as personal loans or home loans. It also notifies you whether you’ve already been approved for anything, providing you with relevant information.

Interest Rate: 8.45%

Minimum Loan Amount: Rs. 25000

Maximum Loan Amount: Rs. 40 Lakhs

Repayment Tenure: 1 month and 60 months.

Download app name: Android, iOS

Play Store Rating: 4.3

List of Best Loan Apps in India

| App Name | Loan Amount | Interest Rate | Repayment Tenure |

| Zest Money App | Rs.300000 | 14% | 6 months up to 24 months |

| TrueBalance- Personal Loan App | Rs.100000 | 2.4% to 36% | 62 days up to 12 months |

| Tata Capital Personal Loan App | Rs.150000 | 10.99% | 12 months to 60 months |

| PaySense Personal Loan App | Rs.500000 | 16% and 36% | 3 months to 60 months |

| Navi Loans App | Rs. 20 Lakhs | 9.9% – 45% p.a | 60 months |

| Moneyview App | Rs.500000 | 2% | 3 months to 60 months |

| MoneyTap App | Rs.500000 | 12.96% p.a. | 3 years |

| KreditBee App | Rs. 400000 | 12.25% – 30.00% p.a. | 62 days to 2 years |

| InCred App | Rs 7.5 lakhs | 11.49% and 24.00% | 60 months |

| IIFL Loans App | Rs.500000 | 2% – 6% + GST | 3 months to 42 months |

| Fibe Personal Loan App | Rs. 500000 | 12% | Up to 2 years |

| CASHe Personal Loan App | Rs. 400000 | 2.25% per month | 3 months to 18 months |

| mPokket App | Rs. 30000 | 2% to 4% per month | 90 days |

| Hero FinCorp Instant Personal Loan App | Rs. 300000 | 2.08% per month | 6 months to 24 months |

| Bajaj Finserv App | Rs. 40 Lakhs | 8.45% | 1 months and 60 months. |

FAQs

1. How do I choose the best instant personal loan app for my needs?

To choose the best instant personal loan app, consider factors such as interest rates, fees, repayment terms, customer reviews, app interface, and customer service. Compare multiple apps, read reviews, and select the one that aligns with your financial requirements and preferences.

2. Are these apps safe and secure to use for financial transactions? Reputable instant personal loan apps utilize advanced encryption and security measures to ensure the safety of financial transactions and protect user data. Look for apps with robust security protocols, transparent privacy policies, and positive user reviews to ensure a secure experience.

3. What are the eligibility criteria for obtaining a loan through these apps?

Eligibility criteria vary by app but typically include age, income, credit score, employment status, and nationality. Common requirements include being a citizen of India, aged 18-65, having a steady income, and meeting the minimum credit score criteria set by the app.

4. How quickly can I expect to receive funds after applying through these apps?

The time taken to receive funds varies by app and can range from a few minutes to a couple of days. Some apps disburse funds within hours of approval, while others may take slightly longer for verification and processing. It’s advisable to choose an app that offers the desired speed of fund disbursement.