Flipkart has launched its UPI services in India. The e-commerce giant has partnered with Axis Bank for its new payment services. Users can now pay merchant QR codes, electricity bills, and mobile recharges and conduct P2P money transfers directly from the Flipkart app.

Flipkart’s venture into the UPI ecosystem comes amid Paytm’s regulatory crisis in the country. The Walmart-owned company has been trying to enter the payments sector since its separation from PhonePe in December 2022. Let’s look at Flipkart UPI and how you can use it.

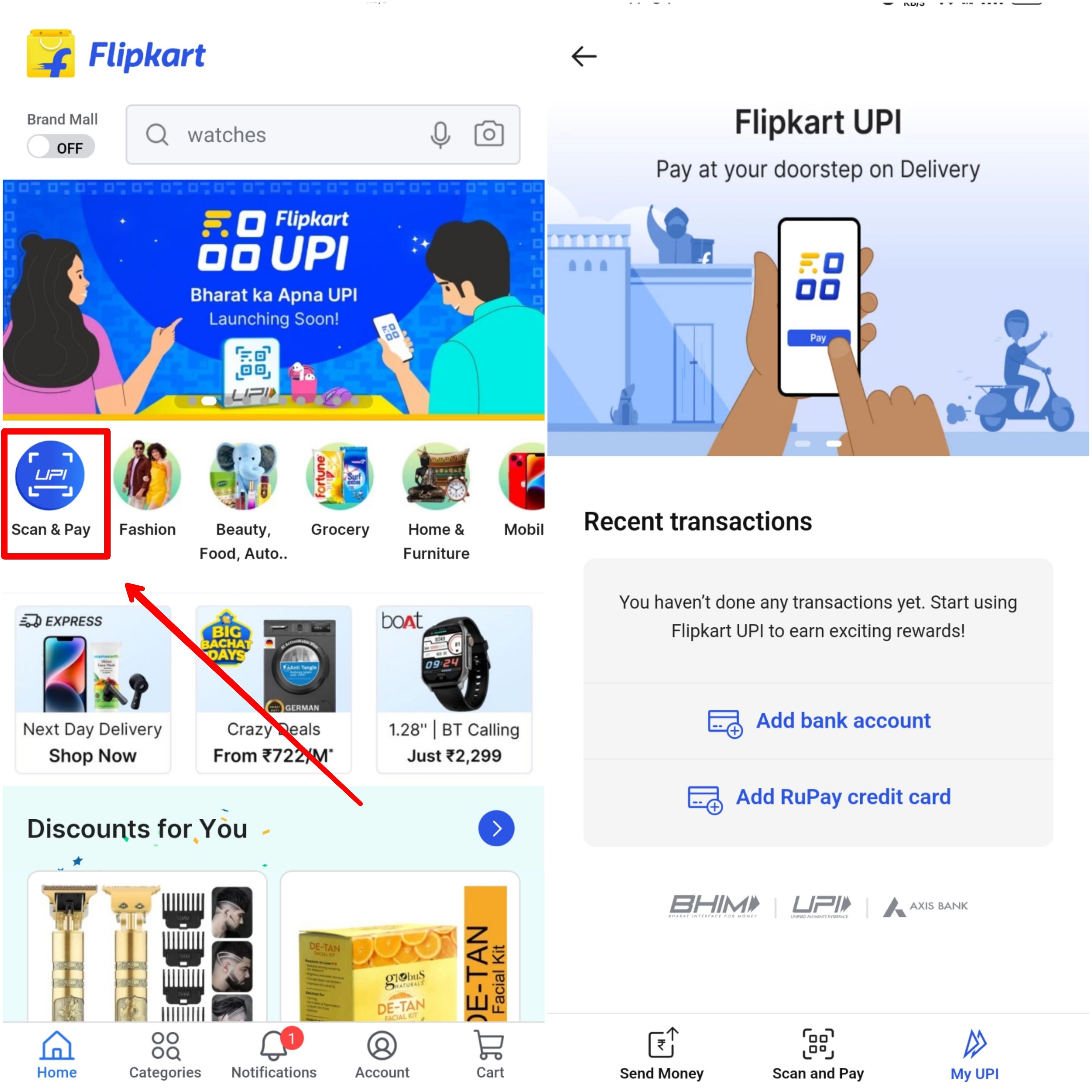

How to activate Flipkart UPI

Flipkart UPI can be enabled on the official Flipkart app on both Android and iOS platforms. Users are advised to update the app to the latest version from the Google Play Store and the Apple Store to enable the feature.

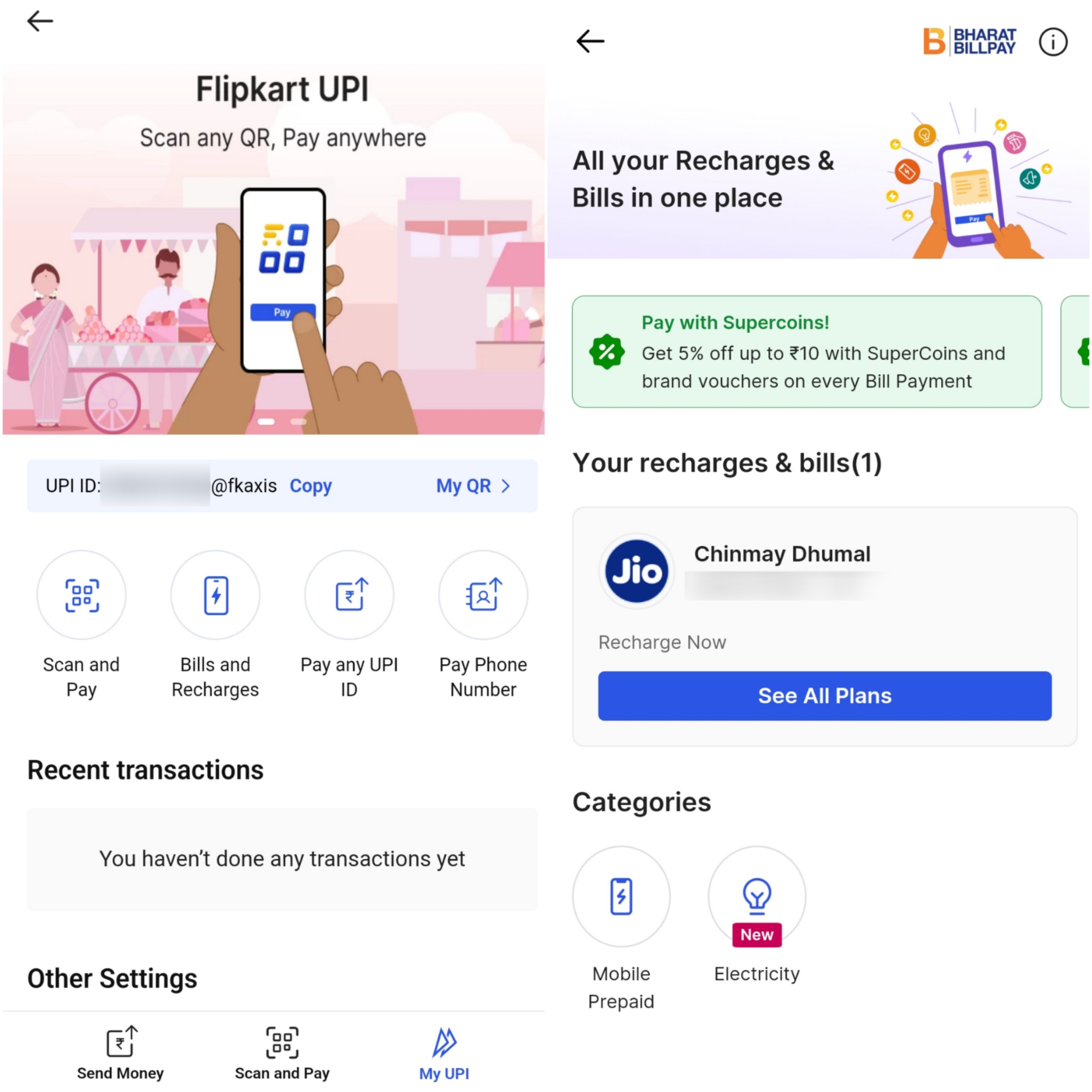

- Open the Flipkart app and select the ‘Scan & Pay’ option.

- Now go to ‘My UPI’ and choose the bank in which you have your account.

- Flipkart will verify your bank details with an SMS, after which your Flipkart UPI will be activated.

Mobile recharge and bill payment options are available under Scan & Pay > My UPI. Users can pay their bills using Flipkart UPI, credit cards, and debit cards. There are no convenience charges for bill payments on Flipkart. The company also offers discounts up to Rs 10 as a limited-time offer.

Flipkart has also added support for UPI on credit cards. Users can link their Rupay credit card on Flipkart UPI for merchant payments.

Flipkart’s Masterplan For Payment Services

Flipkart has been highly optimistic about the digital payments market in India. It purchased PhonePe in 2016 when UPI was almost non-existent in the country. Under Flipkart’s ownership, PhonePe became India’s most popular UPI payments app, with a market share of almost 50%.

However, Flipkart and PhonePe announced their separation in December 2022. Both companies cited that this would allow the entities to operate independently and maximize their growth opportunities.

Amazon, which is Flipkart’s biggest competitor, offers UPI and bill payment services to its customers, allowing the company to diversify its market in addition to e-commerce. Amazon Pay has been a huge success so far, which was also noticed by Flipkart.

The ongoing Paytm crisis could also work in Flipkart’s favour as several users are shifting to alternative UPI payment apps. We expect Flipkart to bring more payment-related services in the upcoming months.