UPI payment transaction numbers are skyrocketing as each day passes in India. What started as India-specific payment means has now crossed the Indian border and UPI is now available outside of India as well. We would not be wrong to call UPI a revolutionary fintech product. National Payments Corporation of India NPCI is the team behind UPI and the team has also developed the BHIM app, which is one of the many UPI apps available in India.

At the Global Fintech Fest 2022, which was held on September 21st, NPCI officially launched the UPI Lite. In simple terms, UPI Lite is a virtual on-device balance or a wallet created by the user from the bank account. The UPI Lite feature is now available on the BHIM app and will be available on more apps. In this guide, we will take a look at all the details of the UPI Lite, its features, how to set it up, how to use and much more.

Also Read: WhatsApp Pay: How to Add Bank Account, Set UPI PIN, Send Money to Contacts, Find Offers and More

What is UPI Lite?

Before we dive deeper, let’s understand what UPI Lite is. UPI Lite is part of UPI and works similar to how we’re used to UPI, but there are some key changes. UPI Lite is an on-device wallet for frequent low-value transactions. This means, if you are paying via UPI Lite, the money won’t be debited straight from the bank like on the UPI, instead, the money will be debited from the on-device wallet, which a user will add when you enable create UPI Lite. Another change here is that you don’t have to enter the UPI PIN before making a payment.

Another big and probably the most important feature of UPI Lite. These low-value transactions which we make for groceries, juice, cigarettes, snacks, etc. will not be printed on the passbook or won’t be available on the statement. Ever since UPI went mainstream, one of the major complaints has always been the number of pages or passbooks that a user has to go through to find some important transactions. These many value small transactions add lots of issues when you are applying for a loan or submitting statement as a proof 一 to tackle this, NPCI has introduced UPI Lite. Only the money which you add to your wallet from the bank will be shown on the passbook/password.

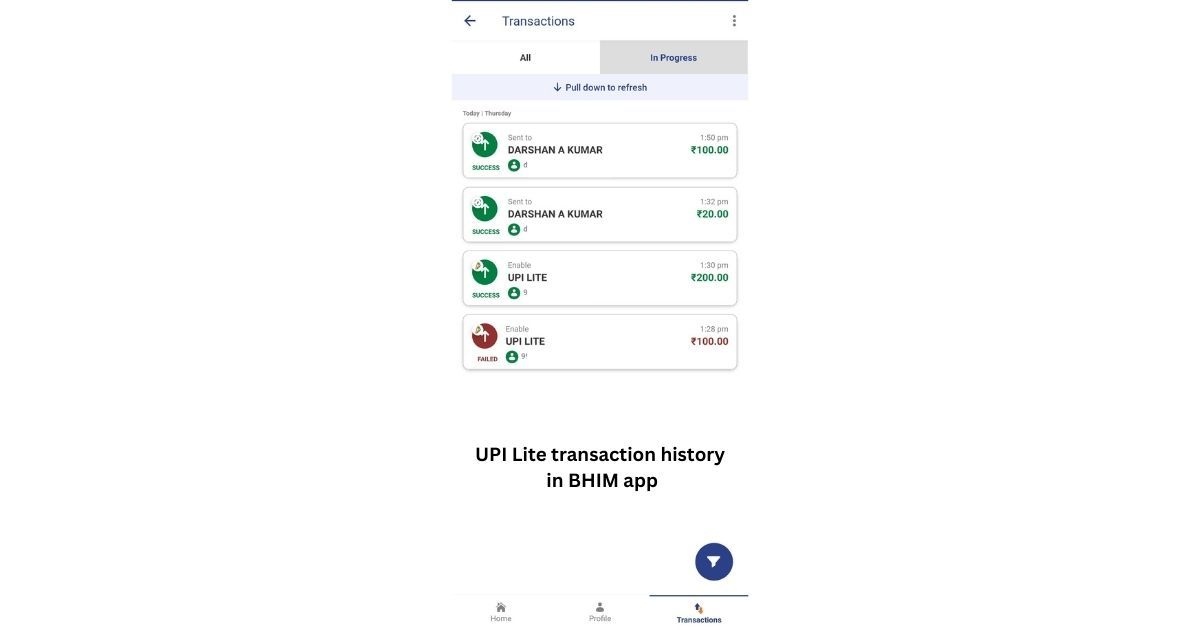

UPI Lite is similar to how the Paytm wallet works, but with UPI Lite you can use the money in the Lite wallet to scan and send to friends, and merchants and also pay with this wallet for any UPI ID, unlike the Paytm wallet. Once the UPI Lite option is enabled, you can add up to Rs 2,000 to the wallet and for any transaction below Rs 200. You can make payment of wallet money using a UPI ID, QR code, or by mobile number. The payment can be as low as Rs 1 and a maximum of Rs 200. Payments done through UPI Lite will be displayed in the BHIM app transaction history, but not on the passbook.

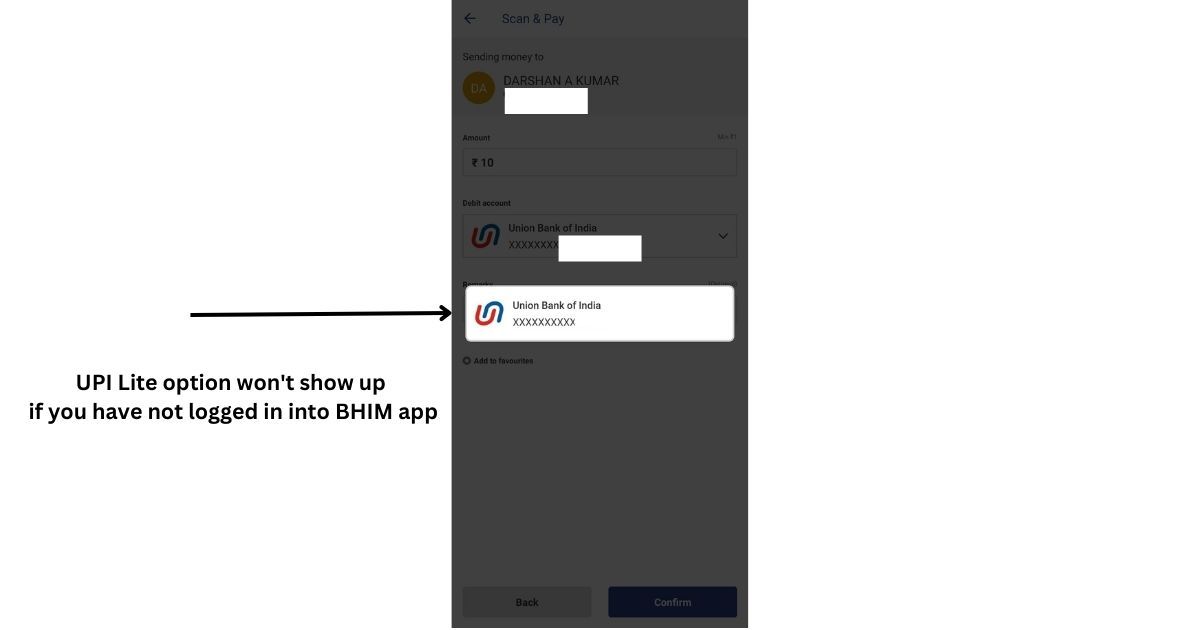

Whenever you are paying for under Rs 200, the UPI Lite wallet automatically shows up as an option to choose from. Although the UPI Lite feature does not ask you for a UPI pin before making a payment, it does not translate to lower security. While UPI Lite transactions do not require UPI PIN, the BHIM app will ask for your authentication when you open the app.

Also Read: Google Pay: How to Add or Remove Credit or Debit Card in GPay

Just to check the security, we did tap on the QR code scanner before entering the BHIM app pin and scanned the code, the UPI Lite wallet option did not show up as we did not log in to the BHIM app and instead we got UPI option only.

To wrap it off, UPI Lite is very similar to wireless payments on credit and debit cards, where you can make up to Rs 2,000 payment without having to enter the PIN, but UPI Lite uses the device’s wallet feature. This is all made for users’ convenience and with the wider rollout of the UPI Lite on more apps, users should be able to take advantage of this.

Note: UPI Lite is meant to work offline without internet connectivity, however, the feature is yet to go live at the time of writing this guide.

Also Read: Where Is UPI ID: How to Find UPI ID in Google Pay, PhonePe, Paytm?

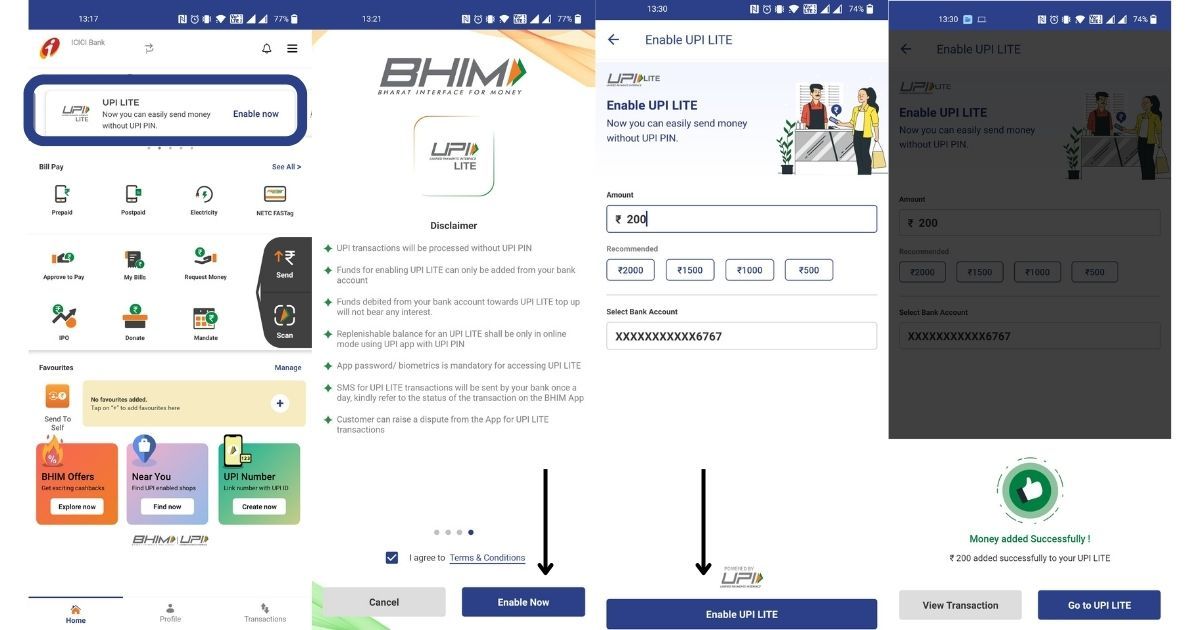

How to Setup UPI Lite on BHIM App?

- Download and install the BHIM App from Google Play Store for Android / App Store on iOS

- Log in or sign up using bank details and add a bank account for UPI transactions

- On the home screen, scroll and find the “UPI Lite” banner

- Click on Enable Now

- Read the detail and click on the Next button three times and hit the “Enable Now” button

- Now, on the next screen, you quill be prompted to add up to Rs 2,000 to your UPI Lite wallet

- Enter the amount (max Rs 2,000)

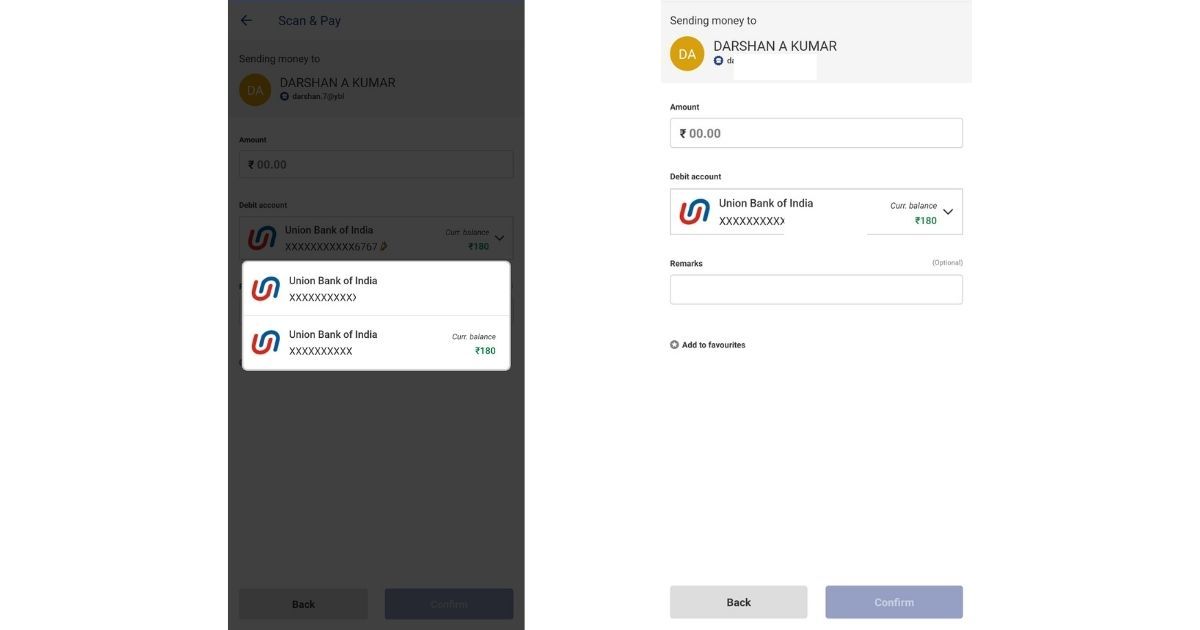

- Select bank account (if you have multiple)

- Tap on “Enable UPI Lite”

- Enter your UPI PIN and once the fund is added successfully, UPI Lite will be activated and the money will be added to the Lite wallet.

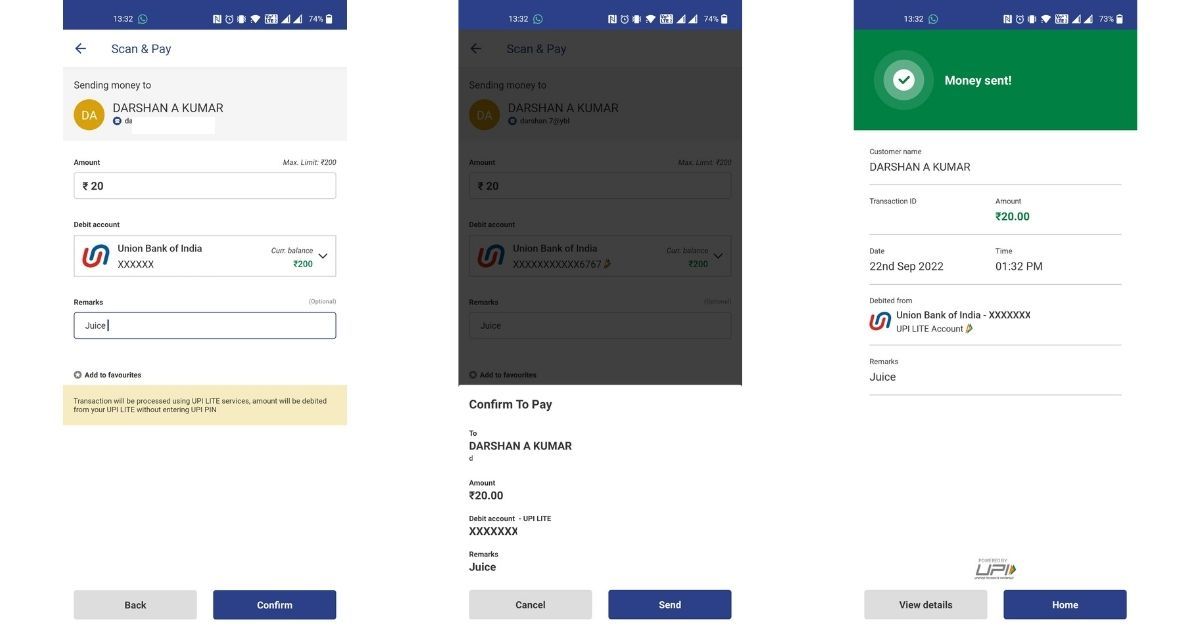

How To Use UPI Lite on BHIM App

Once you have set up BHIM Lite, the next time you go out and need to make a UPI payment of under Rs 2000, you can open the BHIM app, scan the QR code and pay from the UPI Lite wallet directly without entering your UPI PIN.

- Open the BHIM app and log in using the password on fingerprint authentication

- Scan the QR code

- Enter Amount (under Rs 200 only for Lite)

- Add remarks or comments (optional)

- Tap on Confirm

- Tap on Send and the payment will be made instantly.

Note: For UPI Lite, the current balance in the wallet will be displayed.

Also Read: How to Create UPI ID in Google Pay, Paytm, PhonePe, Amazon Pay Payment Apps

UPI Lite Features

- UPI Lite is a free-to-use feature

- UPI Lite does not require entering UPI PIN

- UPI Lite transactions won’t be displayed on the passbook/statement

- Using UPI Lite you can make a maximum of Rs 200 payment

- UPI Lite is currently available on the BHIM app and more apps will get this soon

- You can add funds to UPI Lite using your bank account

- UPI PIN is mandatory to enable the UPI Lite feature

- UPI Lite balance is set to Rs 2,000 at all the time

- You can view the balance of UPI Lite on your device

Also Read: Google Pay UPI Limit: What is the Maximum Money Transfer or Transaction Amount Limit Per Day on GPay

FAQs:

Why should I opt for UPI Lite?

UPI Lite allows you to pay up to Rs 200 without asking for UPI PIN and another advantage here is that these UPI Lite transactions will be displayed in the bank passbook. You can add up to Rs 2,000 to the UPI Lite wallet. These three are the main reasons why one should switch to UPI Lite.

What is the upper limit for UPI Lite transactions?

The upper limit for UPI Lite transactions is Rs 200 一 which means you can pay up to Rs 200 using the Lite version, the money will be debited from the UPI Lite wallet which can store up to Rs 2,000.

Will UPI Lite work without the internet?

No, UPI Lite just like regular UPI will require you to scan and pay, so having good internet connectivity is mandatory.

Will UPI Lite work on feature phones?

Since UPI Lite is available only inside the BHIM app, for now, you can use the UPI Lite feature on Android and iOS devices only.

What are the charges for UPI Lite?

UPI Lite is free of cost and you won’t be charged anything extra.

Will UPI Lite work without Internet/Offline?

UPI Lite is designed to work offline, but at the point of writing this, the feature works only with internet.

Is UPI ID safe to Use?

Yes, it is safe to use UPI Lite. Apart from the lack of a UPI PIN, the BHIM app asks you to enter pin or fingerprint authentication before opening the app or accessing any sensitivity setting options.

What apps support the UPI Lite feature?

As of September 2022, only the BHIM app offers the UPI Lite feature. More apps like Google Pay and Phonepe will get the UPI Lite in the near future.

What is the maximum amount I can add to the UPI Lite wallet?

You can store up to Rs 2,000 on the UPI Lite wallet and pay up to Rs 200 per transaction. The amount you add to your wallet will be reflected in your passbook or statement, but the UPI Lite transactions won’t be reflected.

Make sure you enable the new UPI Lite feature on the BHIM app and get the most of it. This way, you will be making faster payments as well. Once the feature will be available for more UPI apps like Google Pay and PhonePe, the feature will be even more popular.