Paytm is trying to save its core businesses after being penalised by the Reserve Bank of India for failing to comply with regulatory guidelines. In the latest move to revive its UPI payments business in the country, Paytm’s parent company, One97 Communications, has requested the RBI to grant a Third-Party Application Provider (TPAP) status to the company.

So what does TPAP mean, and how can it protect Paytm users and merchants across India on the UPI front? Let’s take a deeper dive to understand this.

Understanding TPAP and PSP in UPI

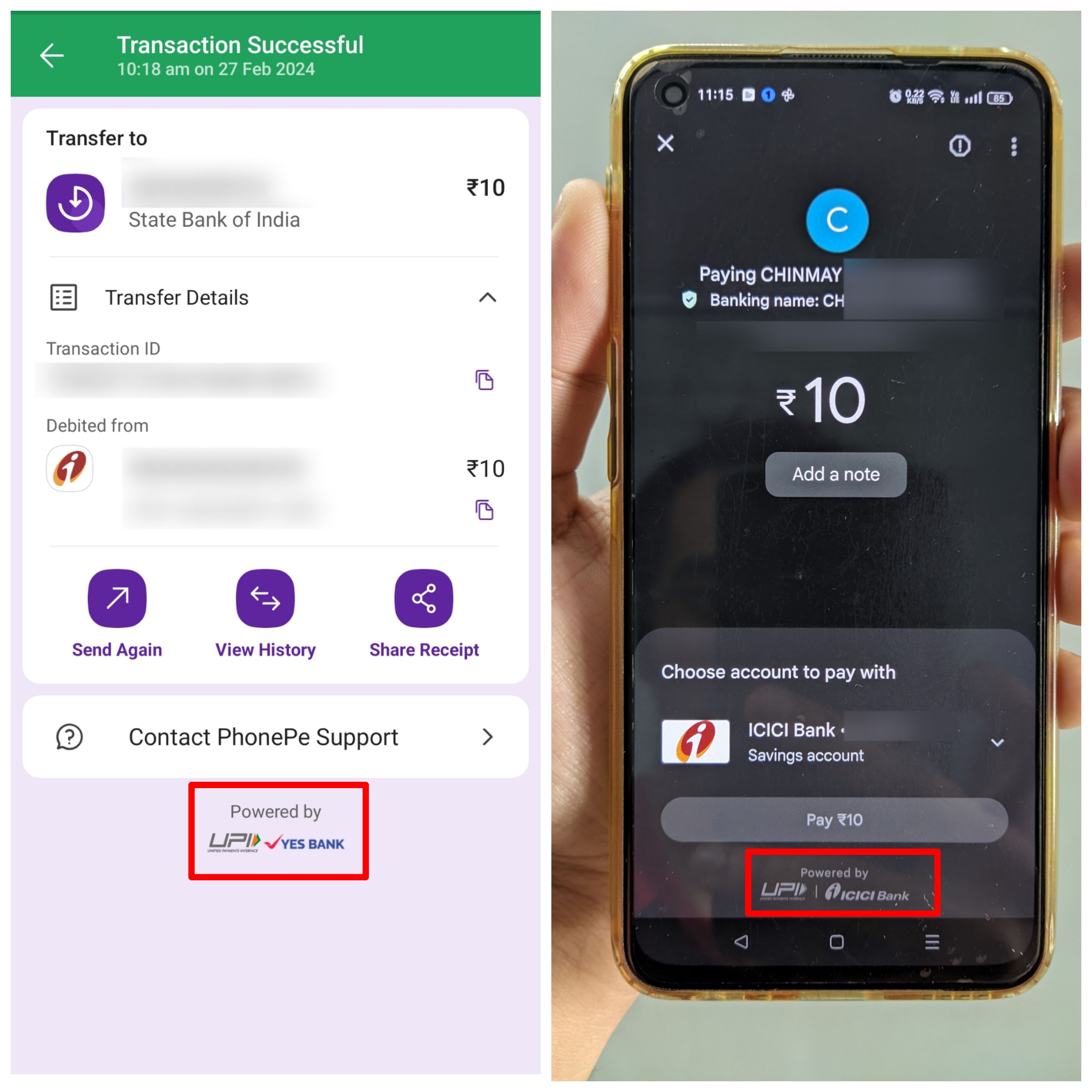

UPI functions on two major factors. First is the Payments Service Provider (PSP), which is usually a bank such as SBI, ICICI, etc., and second is the third-party Application Provider (TPAP), which is the payment app itself such as PhonePe, Google Pay, etc.

The TPAP and PSP have to work together to complete a UPI transaction. Examples are references like ‘Powered by Yes Bank’ in PhonePe and ‘Powered by ICICI Bank’ in Google Pay.

However, Paytm works differently from its competitors. Instead of partnering with an external bank, Paytm processes all UPI transactions via its in-house Paytm Payments Bank. This is why all virtual payment addresses (VPA) or UPI handles in the Paytm app end with ‘@paytm’. Paytm is an independent PSP and does not need an external bank for its UPI operations, unlike Google or PhonePe.

This also gave Paytm a huge advantage over PhonePe and Google Pay, as it does not have to rely on the availability of servers from its partner bank. For this reason, downtime complaints are far less on Paytm than on other UPI apps.

While this system was working great for Vijay Shekhar Sharma’s company, it has now become the reason which can lead to service disruption for millions of Paytm users across India.

As RBI has sanctioned the Paytm Payments Bank and asked it to wind up operations by March 15, users with an @paytm UPI handle may face certain restrictions for regular payments. This issue will be present even if they have linked an external bank account in the Paytm app.

Hence, Paytm’s Plea For TPAP Status

To prevent a complete halt of its UPI operations, One97 Communications has now requested the RBI for a TPAP status. If the plea is approved, Paytm will partner with other PSPs in India, such as HDFC Bank, ICICI Bank, SBI, and others. This will allow it to keep running its regular UPI transaction services.

This also means that the UPI handles (VPA) of Paytm users will also be migrated from @paytm to something else, depending on the bank with whom Paytm decides to partner.

The responsibility and power to grant the TPAP status lies with the National Payments Corporation of India (NPCI). In its latest press release, RBI confirmed that it advised the NPCI to examine One97’s request for a TPAP status. The NPCI has not disclosed its decision on the same yet. Without a TPAP license, Paytm might be unable to offer normal UPI services to its users after March 15.

Paytm recently partnered with Axis Bank to keep its merchant QR codes active. Business owners across India can continue using Paytm QR codes and soundboxes to accept online payments from customers. The RBI also confirmed the same.

Will my Paytm UPI work after March 15?

Your Paytm UPI will not work after March 15 until this TPAP request is approved. Although Paytm says their app will continue working even after the deadline, they must partner with external banks to facilitate UPI services.

RBI says the sanctions will only affect Paytm users with an @paytm UPI handle. However, the Paytm app does not offer the option to switch to a different PSP. Unless Paytm starts issuing new VPAs and migrates its existing @paytm UPI ID users to other PSPs, your Paytm UPI will stop working after March 15.

Recently, Paytm posted on their X (formerly Twitter) account that the company is working with third-party banks to ensure seamless UPI operations. However, Paytm has not announced any updates on the same yet.