The Aadhaar card holds significant importance among the various documents for citizens in India. Every Indian citizen is required to possess an updated Aadhaar card with accurate details and link the Aadhaar card number with various other documents. Among these, the bank account number is just one of many. There are multiple methods on how to link an Aadhaar number with a bank account available for users to link their Aadhaar card numbers to their respective bank account numbers. Depending on convenience and accessibility, users can choose between offline or online processes.

Ways to Link Bank Account with Aadhaar

There are several ways in which a user can link the Aadhaar card number to their bank account. We have given the easy steps that could be followed. Some of the online methods include:

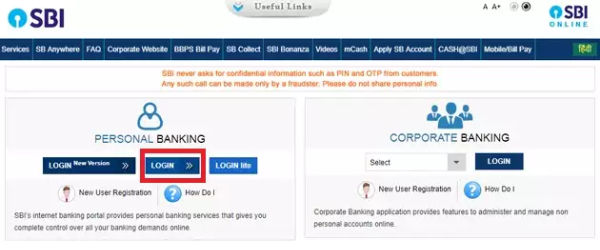

How to Link Aadhaar with a Bank Account via Internet Banking

Here is how a person can link a bank account to their Aadhaar number via the internet banking method:

- Step 1: Visit the official page of your bank’s internet banking account webpage.

- Step 2: Enter your respective user ID and password.

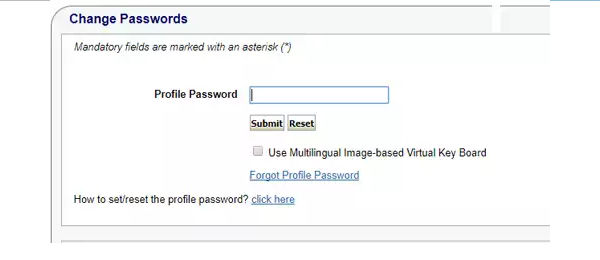

- Step 3: Next, look for a section that reads “My account,” then click on a sub-option that reads “Update Aadhaar with Bank Accounts (CIF).”

- Step 4: Enter the required profile password that will be asked for Aadhaar registration.

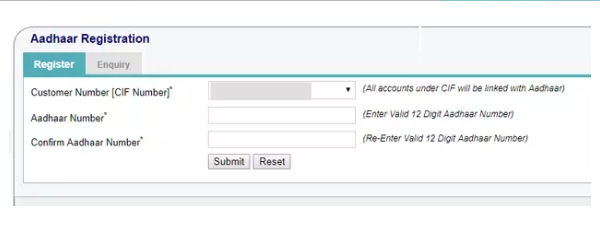

- Step 5: User will then be asked to fill in their respective Aadhaar card number twice.

- Step 6: Next, press “Submit” after entering your Aadhaar card number.

- Step 7: A message reading “Successful” will be displayed on the screens.

Also Read: How to Check Aadhaar Card Pan Card Link Status Online

Step-by-Step Process of Linking Bank Account with Aadhaar Through Mobile App (With Screenshots)

Bank’s mobile application also allows a user to generate a link between their Aadhaar number and bank account, and this can be done in the comfort of your house. Please follow these simple steps:

- Step 1: Log in to your respective bank’s application.

- Step 2: Look for the “Services” tab and then click on the “My Accounts” section. Click on it.

- Step 3: Another sub-option will be displayed, saying “View/Update Aadhaar card details.” Press on it.

- Step 4: The user will then be asked to enter his or her Aadhaar card number twice.

- Step 5: Click on the “submit” button.

- Step 6: User will then get a message indicating the successful linking of a bank account with the Aadhaar number.

Linking Bank Account with Aadhaar Through SMS

The process of linking the Aadhaar number to the bank account can also be done at the ease of the SMS option. However, it is to be noted that this option is not available for all banks. As an example, we have provided the steps of how a user holding an account in the State Bank of India, can complete the process:

- Step 1: A message in the format needs to be sent to the 567676, UID<space>Aadhaar number<space>Account number

- Step 2: The user will receive a confirmation message indicating the acceptance of the linking request.

- Step 3: The bank will then further verify the user details with UIDAI.

- Step 4: In case there are some issues with the application and the verification is unsuccessful, the user will receive a message stating that they can visit the nearest bank branch with their respective Aadhaar cards.

- Step 5: However, if successful, the user will receive a message indicating the completion of the link.

Linking Bank Account with Aadhaar Using the Missed Call facility

These days, many banks have come up with the facility to link Aadhaar numbers to bank accounts using phone calls. However, the phone call numbers for all the different banks are different but not to worry; we have given some easy steps that should be followed during this process:

- Step 1: Look for the number that is provided by your respective bank. A user can visit the official bank website or even get the number by paying a visit to the branch.

- Step 2: Give a missed call on the respective number, following this the user will receive a call-back from the bank where he/she will be asked to select an option from the IVR.

- Step 3: Next, the user will have to enter their 12-digit Aadhaar number followed by confirming it.

- Step 4: At last, a text message will be received on the registered mobile number once the linking process is complete.

How to Link Bank Account with Aadhaar via ATM

The important steps required to link a Aadhaar number to the bank account by visiting a nearby ATM, are given below:

- Step 1: The user will have to start with the process by swiping in their ATM Card and entering the ATM PIN.

- Step 2: Under the “service” menu option click on “Registration”.

- Step 3: Now, look for the “Aadhaar Registration” option and click on it.

- Step 4: Click on your respective account type from the two types, “Savings or Current” and enter hit.

- Step 5: Next, enter your respective 12-digit Aadhaar Number.

- Step 6: User will be asked to re-enter their Aadhaar card and then press “Ok”

- Step 7: A confirmation message will be received stating the successful linking.

How to Link Bank Account with Aadhaar by Visiting Branch

Bank account holders can also link their account number with the Aadhaar number by visiting the bank branch in person and by carrying out the following steps:

- Step 1: Ask for the “Aadhaar-Linking” form, which a user can also download in advance by visiting the bank’s official website or can simply ask for the form by visiting the branch.

- Step 2: Fill out the form and mention your Aadhaar card and bank account details properly.

- Step 3: The account holder will also be required to attach a self-attested copy of his/her Aadhaar card along with the form.

- Step 4: Submit your form to the concerned counter and the bank officials will then proceed with their verification process.

- Step 5: After, the submission of the application form, an additional day or two will be required for the completion of the process and once the link is generated, bank account holder will receive a message on their respective registered mobile number.

Also Read: How to Change/Update Aadhaar Card Address Online in 2023

Benefits of Linking Aadhaar Card with a Bank Account

Some of the key benefits of linking Aadhaar card with a bank account are:

- A citizen can avail of numerous government benefits, such as welfare, scholarships, and MNREGA wages, directly from their bank account.

- A valid Aadhaar link can also help direct subsidies on various items such as LPG, kerosene, and sugar.

- Aadhaar card-linked accounts also reduce the risk of potential fraud and manage to prevent leaks in official government spending.

- Not to forget, the Aadhaar-enabled payment system also allows easy access to a user’s accounts from anywhere in the country.