UPI has been a revolutionary product as it pioneered India’s journey in digital payments. Today, over half of the world’s real-time online payments happen in India. Following the same path, the Reserve Bank of India (RBI) has launched Digital Rupee, an online version of the Indian currency.

The Digital Rupee is also called ‘e-Rupee’ and is based on blockchain technology. It is a completely legal tender that is issued and recognized by the Government of India. Here’s everything that you should know about e-Rupee, and how you can use it to send and receive digital money on your smartphone.

What is e-Rupee?

e-Rupee is the digital version of the Indian Rupee. It uses the same concept of currency denomination in the form of notes and coins but in a digital format. The value of one e-rupee is the same as the regular rupee.

e-Rupee is issued by RBI in denominations of 50 paise, 1 rupee, and notes of Rs 2, 5, 10, 20, 50, 100, 200, 500, and 2000. Each e-rupee has a unique serial number similar to physical notes. These digital currencies are stored in a local wallet on the user’s smartphone.

Users can exchange e-rupees just like normal cash, using the digital rupee application of their respective bank. Since these transactions happen on a wallet level, they won’t reflect in your bank account statement.

As of now, e-rupee is only available to a limited set of users who have received an invitation from their bank for the plot program testing. RBI says that e-Rupee will soon be rolled out to all users across India.

e-Rupee should not be confused with e-RUPI. e-Rupee is the digital version of the Indian Rupee, while e-RUPI is a prepaid voucher which is issued by the Indian Government for direct benefit transfer schemes. It is important to note that the official name of e-Rupee is actually ‘Digital Rupee’ as per RBI.

How To Set Up e-Rupee?

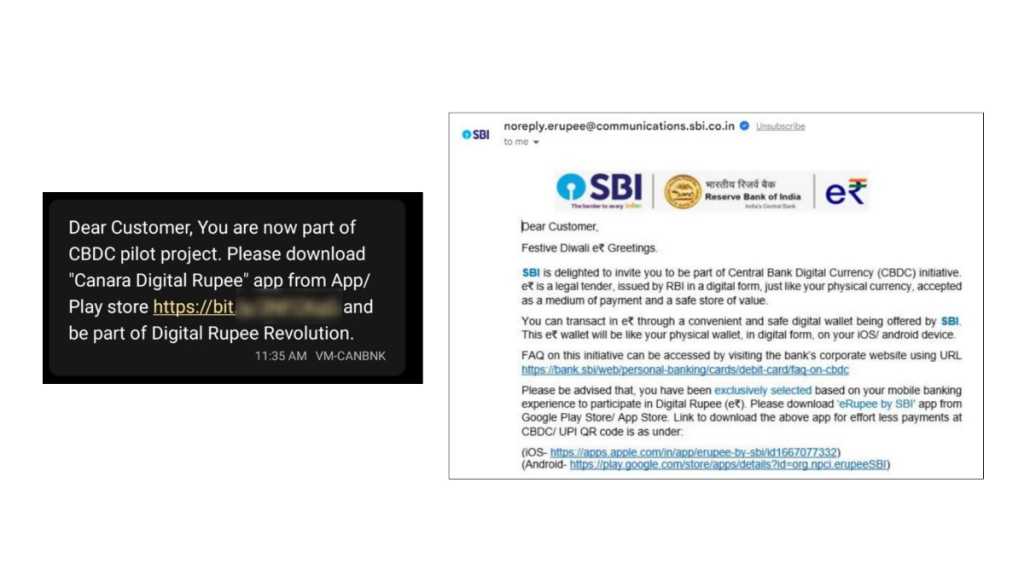

Before we start with the setup of the e-rupee, ensure that you have received an invitation from your respective bank. The invite can be in the form of an SMS or an email. Here’s a sample image for the invite to the pilot program of the e-Rupee.

Once you get the invite, download the official Digital Rupee app of your bank. Here’s a list of banks that currently support e-Rupee.

- ICICI Bank

- HDFC Bank

- State Bank of India

- Kotak Mahindra Bank

- Canara Bank

- IndusInd Bank

- Union Bank of India

- Bank of Baroda

- IDFC First Bank

- Punjab National Bank

- Axis Bank

- Federal Bank

As the pilot program progresses, more banks are expected to join the list and release support for e-rupee.

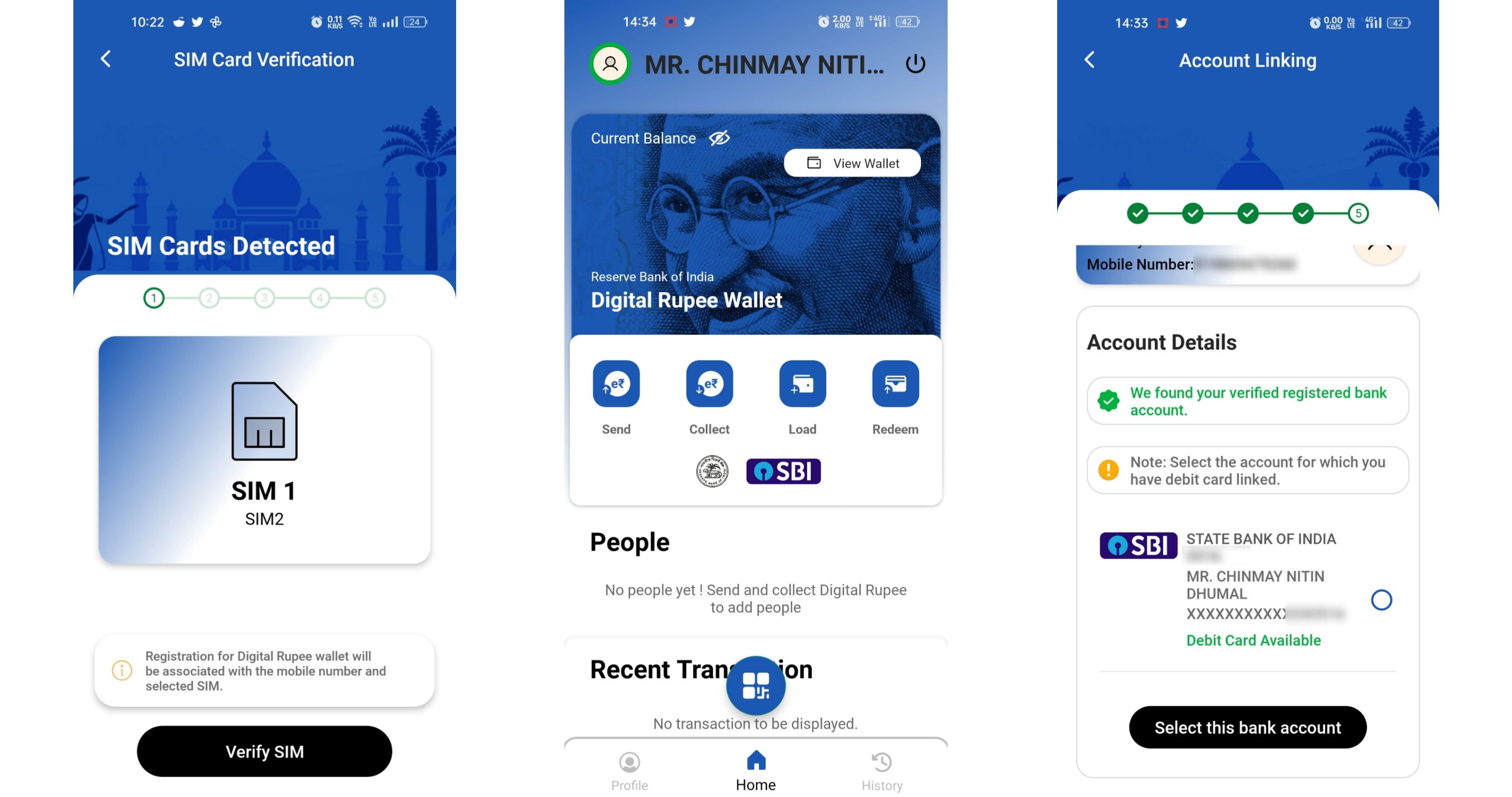

Once you have downloaded the respective Digital Rupee app for your bank, follow these steps to initiate the setup.

- Open the Digital Rupee app, and select the SIM card linked to your bank account.

- Set a 6-digit PIN which will be used for your e-Rupee transactions.

- Verify and select the bank account shown in the app.

Your initial setup for e-rupee is now complete. An on-device wallet will be created on your smartphone which will store the digital rupee currency. Here’s how you can add funds to your e-rupee wallet and use them for transactions.

How to Use e-Rupee?

To get started with using e-rupee, we will have to first add funds to your on-device wallet. Here’s how you can do that.

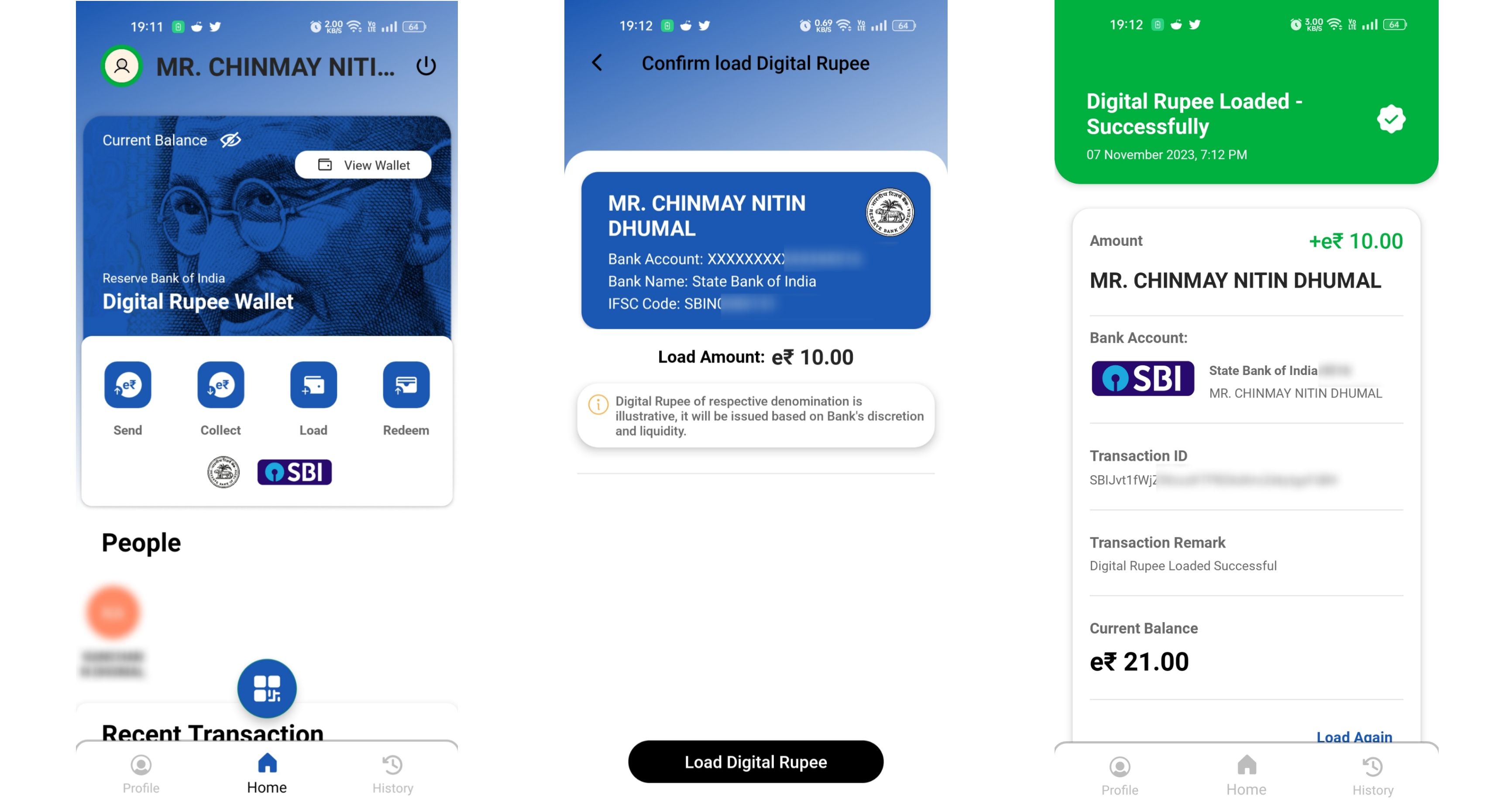

- Open the Digital Rupee app of your bank, and tap on the ‘Load’ button.

- Enter the amount that you wish to add to your wallet.

- Now tap on the ‘Load Digital Rupee’ button.

- You can choose to add funds using your e-rupee-registered bank account or any other UPI account.

- Verify the details of your bank account shown on your screen, and then proceed to add e-rupee to your wallet.

You can now see the digital rupee loaded on your wallet using the ‘View Wallet’ option. Here, the app will show you all the digital notes and coins stored on your phone, along with their unique serial number. When you send or receive e-rupees, these digital notes will be transferred to the respective user along with the same serial numbers, just like physical cash.

For transacting with the digital rupee, the sender and receiver must both be registered with the e-Rupee program. The system is interoperable with all banks, hence users can freely exchange their digital rupee currency, even if they have accounts in different banks. Note that e-rupee requires internet connectivity to work, and does NOT work offline.

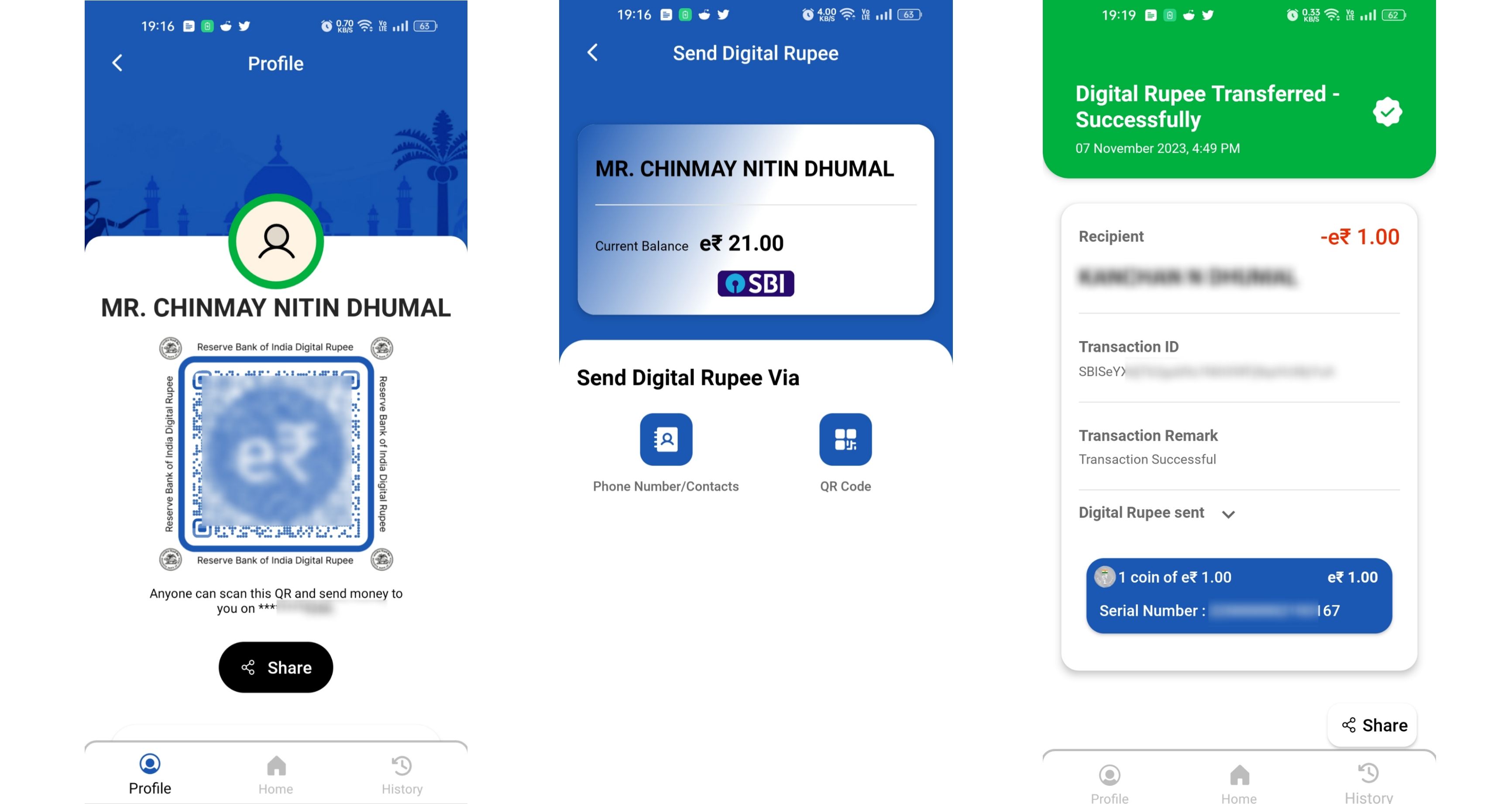

Exchange e-Rupee Using QR Code or Phone Number

- Open the Digital Rupee app on the receiver’s phone, and tap on the Profile icon.

- A QR Code will now be displayed on the receiver’s phone, share this with the sender.

- Open the Digital Rupee on the sender’s smartphone, and select the ‘Send’ option.

- The sender can choose to send using a QR code, or by directly using the receiver’s registered phone number.

- The app will then verify the QR code/phone number and display the name of the receiver. Tap on ‘Send Digital Rupee’.

- Enter the amount that you wish to send.

- You will now be asked to enter the 6-digit PIN which you created during the initial setup of e-rupee. Enter the PIN to complete your transaction.

Once the PIN is verified, the e-rupee funds will be transferred from the sender to the receiver. User can decide to keep e-rupee currency on their on-device wallet

Note that transactions done while exchanging e-rupee do not reflect in your bank account statement. However, when you load or remove funds from your wallet to your bank account, such transactions will be visible in your bank’s statement.

How is e-Rupee Different from UPI, RTGS, and other payment options?

The usage of the e-rupee is similar to UPI, where the sender and receiver both need to be registered on a select platform to exchange money. However, they are vastly different from each other.

UPI operates at a bank account level, where funds are directly transferred from the sender’s bank to the receiver’s bank. However, in this case, if either one of the sender’s or receiver’s banks is facing downtime, the transaction will not be complete.

e-Rupee is based on a blockchain network, similar to cryptocurrencies like Bitcoin and Ethereum. Here, the blockchain network is controlled and maintained by RBI. Hence, e-rupee transactions are not dependent on the availability of bank servers. Unless the blockchain network is down, the e-rupee system will continue to remain functional.

It is worth noting that transactions done using e-rupee are completely legal and recognized by RBI. Apart from the backend technology, the monetary exchange value done by using the e-rupee is the same as money exchanged using UPI, RTGS, NEFT, or any other means. 1 eRupee = 1 Indian Rupee.

Advantages of e-Rupee

- e-Rupee is based on the blockchain network, which is highly secured and almost impossible to hack.

- e-Rupee is free to use and does not have any extra or hidden charges.

- The value of the e-Rupee will always remain the same as the regular Indian Rupee.

- e-Rupee is a centralized currency, controlled and maintained by the Reserve Bank of India.

- Each e-Rupee has a unique serial number registered on the blockchain, hence faking or counterfeiting the e-Rupee is not possible.

Disadvantages of e-Rupee

- UPI allows you to send funds directly to a bank account, even if the receiver is not registered on UPI. This is NOT possible on e-Rupee as both sender and receiver need an e-Rupee wallet.

- The adoption rate of e-Rupee is expected to be slow, given the massive volume of UPI.

- e-Rupee is still in its pilot program and is running slightly behind schedule for its public rollout, which was expected earlier this year.

The Digital Rupee or e-Rupee is a huge technological leap for the Indian Rupee as it is based on the blockchain network. The Government of India is expecting more users to adopt the e-rupee, which will reduce the load on cash circulation in the country.

Since the e-Rupee is a digital currency, it can easily be tracked by the Indian Government which will prevent the misuse of money. It will also help the government to reduce scams, black money, and tax evasion.

FAQ

Is the e-Rupee safe to use?

e-Rupee is based on the blockchain network and is issued and maintained by RBI. Hence, it is completely safe to use and transact using e-Rupee.

What if I lose my phone with the e-Rupee wallet?

Even if you lose your phone with the e-Rupee wallet, your funds will remain safe. When you log in to your e-Rupee account on your new phone with the same mobile number, your funds will get transferred to the new device.

Do we get interest on the money stored in the e-Rupee wallet?

No, money stored in the e-Rupee wallet does not earn any interest.

Can we transfer e-Rupee to other crypto wallets?

No, e-Rupee cannot be transferred to a third-party crypto wallet. It will only be stored locally on your phone with the registered mobile number.

Is the e-Rupee going to replace cash?

The idea of e-Rupee is to reduce the load on cash and provide an additional method to transfer money. It will not replace cash completely. e-Rupee will co-exist with cash, UPI, and other means of money transfer.