The Union Bank Mini Statement provides a concise summary of your bank transactions, including dates, descriptions, amounts, and your current account balance. Accessing this information has become effortless, thanks to advancements in science and technology. Various convenient methods exist for checking the Union Bank mini statement, allowing individuals to quickly review their recent account activity without going through the entire statement.

In this article, we will discuss the available options for accessing the Union Bank Mini Statement. If you’re interested, keep reading to gain a comprehensive understanding of the process.

How to Check Union Bank Mini Statement using Missed Call Number

Checking your Union Bank mini statement using a missed call number is indeed a convenient and hassle-free process. As long as you have a registered mobile number with the bank and a good mobile network connectivity, you can quickly obtain your mini statement by following the mentioned steps:

Step 1: A user must first ensure that his/her respective mobile phone number has been linked to their Union Bank account. If it fails to be already registered, then they need to visit a nearby Union Bank branch and update the phone number.

Step 2: Once this has been made sure, the user needs to give a missed call to 09223008586.

Step 3: Allow the call to be disconnected shortly after dialling.

Step 4: The user will then start getting an SMS containing the Union Bank mini statement on the registered mobile number shortly. All the current transactions and account balance details are going to be included in the statement.

How to Check Union Bank Mini Statement by Sending SMS

Another convenient alternative to verify the Union Bank statement is by traditional messaging. All the user needs are a registered phone number registered to their Union Bank account. Here’s how:

Step 1: Type “MINI space> Account Number” (without the quotations) to 09223008486, where “Account Number” indicates the user’s Union Bank account number.

Step 2: Send the text message to the Union Bank SMS number. The SMS number might vary in accordance with the respective region and the Union Bank branch.

Step 3: The user will then shortly receive an SMS containing the Union Bank mini statement on their registered mobile number. The most recent activity and account balances will be present in the statement.

How to Check Union Bank Mini Statement by Using Net Banking

One thing that must be made sure of while using checking the union bank statement by making use of the Internet banking option is that the user must have good Internet connectivity and should have registered to the Internet banking facilities provided by the Union Bank.

If not, then a user should first complete the registration process, and then they can easily proceed with the entire process. Below we have mentioned the steps that need to be followed if a user wants to gain access to their account statement via the Net Banking facility:

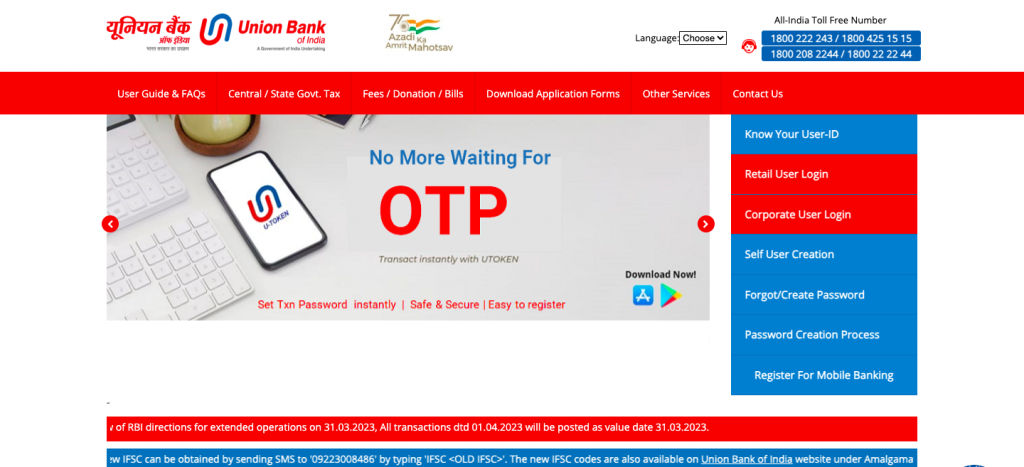

Step 1: Access the Union Bank of India’s online net banking portal.

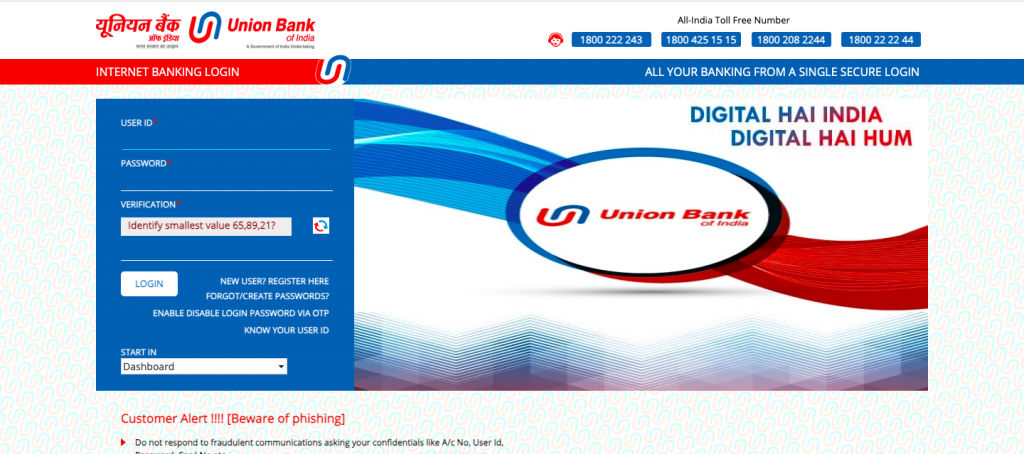

Step 2: Sign in using your User ID and password.

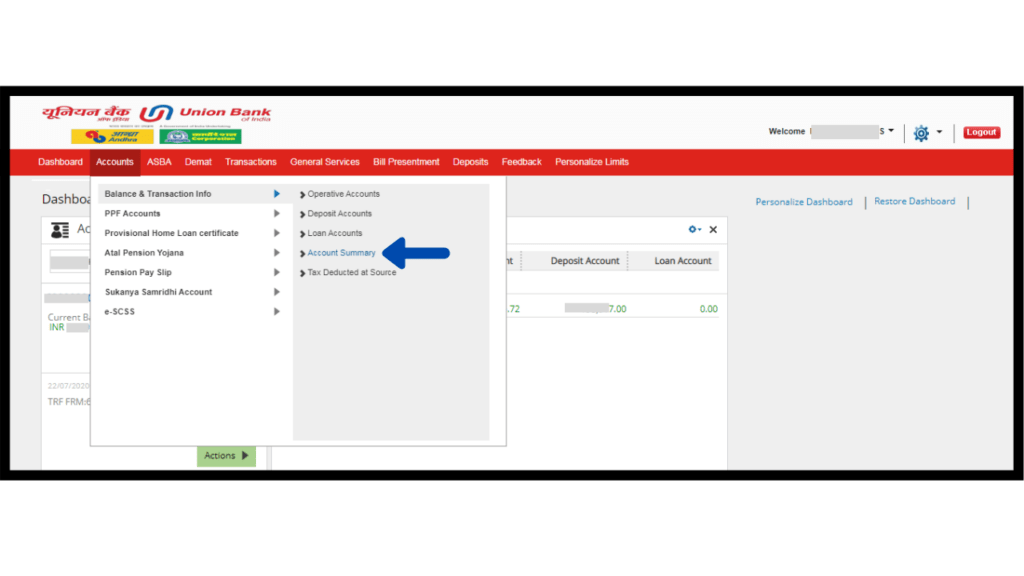

Step 3: Navigate to the header section and locate the “Accounts” category. Click on “Account Summary.”

Step 4: Choose the desired account type and select “View Statement.”

Step 4: Choose the desired account type and select “View Statement.”

Any user ought to be able to see and access their Union Bank statement via the net banking service if they follow the above steps. If they happen to run into any problems or have specific questions concerning the net banking process, please feel free to contact Union Bank’s customer service.

How to Check Union Bank Mini Statement by Union Bank mBanking App

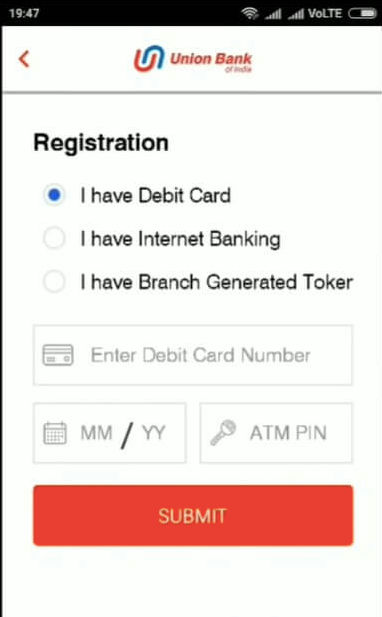

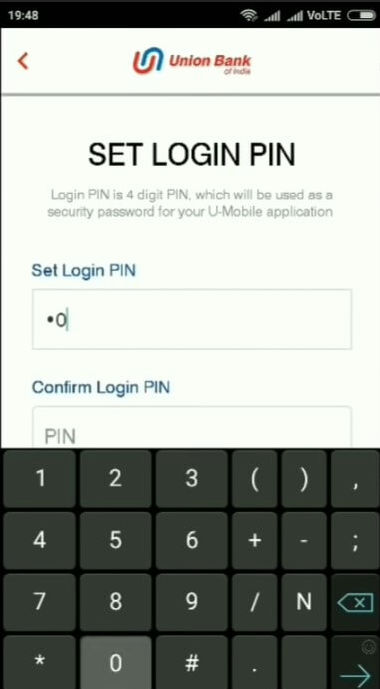

To check the Union Bank statement by making use of the Union Bank mBanking application, a user must ensure that they have good internet connectivity followed by an installed running application called Union Bank mBanking app in their respective devices. Once the application has been installed, the following steps should be followed to further proceed with the process:

Step 1: On your mobile device, launch the app.

Step 2: The user then needs to enter his/her respective net banking credentials. If they have not already registered for the facility, then first a registration must be made.

Step 3: Once the application’s home screen pops up, look for the “Account” or “Accounts” tab.

Step 4: Select the account for which you want to view the mini-statement.

Step 5: Select “Mini Statement” or a comparable choice.

Step 6: The smartphone application will display the most recent transactions as well as your account balance.

Step 7: To discover individual transactions, scroll through the mini-statement option or use the search/filter tools.

How to Check Union Bank Mini Statement through ATM

Customers can choose to visit either a Union Bank ATM or any other ATM to obtain a mini statement. While the process demands the user to make a trip to their nearest ATM facility, the significant advantage is that the task can be completed within seconds.

Step 1: The user must insert his/her Union Bank of India Debit Card into the ATM machine.

Step 2: Next, click on the “Mini Statement” option from the main menu.

Step 3: A mini statement will be available on the screen.

n the era of digital banking, staying updated with your financial transactions has become easier than ever. Union Bank of India, a trusted name in the banking sector, offers multiple convenient methods to access your mini statement, enabling you to keep track of your recent transactions. In this guide, we’ll explore how you can efficiently check your Union Bank mini statement using missed call, online methods, SMS, and more.

Using the Missed Call Number:

The missed call facility provided by Union Bank is a quick and convenient way to access your mini statement. Here’s how to do it:

- Ensure your mobile number is registered with the bank.

- Dial the Union Bank mini statement missed call number: +91-9223008486.

- Let the call ring and disconnect after a few rings.

- You will receive an SMS shortly containing your mini statement details, including recent transactions, balance, and more.

Accessing Mini Statement Online:

Union Bank also offers an easy-to-use online banking portal that allows you to view your mini statement. Here’s how:

- Log in to your Union Bank internet banking account using your credentials.

- Navigate to the “Account Statements” or “Transaction History” section.

- Select the account for which you want to view the mini statement.

- Specify the date range for the transactions you want to see.

- The online portal will display your mini statement, showing recent transactions, debits, credits, and more.

Checking Mini Statement via SMS:

For those who prefer the convenience of SMS, Union Bank provides an SMS banking service to retrieve your mini statement:

- Ensure your mobile number is registered with the bank.

- Compose a new SMS in the following format: MSTMT <Account Number>

- Send the SMS to the Union Bank SMS banking number: 09223008486.

- You will receive an SMS containing your mini statement details, including recent transactions and balance.

Using Mobile Banking App:

Union Bank’s mobile banking app empowers you to manage your finances on the go. Here’s how you can access your mini statement through the app:

- Download and install the Union Bank mobile banking app from your device’s app store.

- Log in using your credentials or register if you’re a first-time user.

- Navigate to the “Accounts” or “Transactions” section within the app.

- Select the account for which you want to view the mini statement.

- The app will display your mini statement, providing a comprehensive overview of recent transactions and account activity.

ATM Mini Statement:

Union Bank’s ATMs also offer the option to print a mini statement. Follow these steps:

- Visit a Union Bank ATM and insert your debit card.

- Enter your ATM PIN to proceed.

- Select the “Mini Statement” option from the menu.

- The ATM will print a receipt containing your mini statement, showcasing recent transactions and available balance.

In conclusion, Union Bank of India ensures that keeping track of your transactions and account activity is a hassle-free experience. Whether you prefer the simplicity of missed call banking, the convenience of online methods, the efficiency of SMS banking, or the versatility of mobile banking and ATM options, Union Bank has you covered. These methods empower you to access your mini statement promptly, enhancing your financial awareness and helping you make informed decisions. As you choose the method that suits you best, remember that Union Bank’s commitment to customer convenience remains unwavering, making your banking experience seamless and efficient.

FAQs

1) What information is included in a Union Bank mini-statement?

A Union Bank mini statement is an edited version of the statement you receive from the bank, which primarily concentrates on the most recent transactions that the account holder has made. Not just this, but it also gives an overview of the five most recent debit/credit card transactions, as well as various other kinds of transactions, including NEFT, RTGS, IMPS, UPI, and others. It provides an extreme summary of the latest bank account activity.

2) How often can I request a Union Bank mini statement?

A user can quickly request his or her Union Bank mini statement as often as necessary. There is normally no restriction on the number of instances someone wishes to obtain a brief statement. It’s merely a simple process that allows you to get a rapid overview of the most current Union Bank account activity.

The frequency with which you can request a Union Bank mini statement can depend on the bank’s policies and the specific method you’re using to access the mini statement. Generally, banks allow customers to request mini statements multiple times a day through various channels like missed call, SMS, online banking, and ATMs. However, there might be certain limitations in place to ensure efficient use of the service and to prevent misuse.

For example:

- Missed Call: You can usually request a mini statement through missed call banking multiple times a day, often without any specific restrictions. However, continuous frequent requests might be monitored for security reasons.

- SMS Banking: Similar to missed call banking, you can typically request mini statements via SMS multiple times a day. Just remember that sending SMS commands too frequently might be subject to limitations to prevent spam.

- Online Banking and Mobile App: With online banking and mobile apps, you can often view your mini statement whenever you want, provided you have an internet connection. There’s usually no specific limit on how often you can access it.

- ATM: If you’re using an ATM to print a mini statement, you can usually do so multiple times a day, as long as the ATM is functioning and you have the necessary funds in your account to cover the service.

Keep in mind that banks may have updated their policies since my last update, so it’s always a good idea to refer to the official Union Bank of India website or contact their customer service for the most current information regarding the frequency of requesting a mini statement through different channels.

3) How can I report errors or unauthorized transactions in my Union Bank mini statement?

In case of any errors or unauthorized transactions being recorded or witnessed with the valid Union bank mini statement, it is considered extremely important for the respective user to resolve the issue as soon as possible. A user can simply either reach out to Union Bank’s customer support by giving them a call on 1800222244, or they can visit and inform the nearest branch of Union Bank of India about the errors or unauthorized transactions and provide them with the necessary details.

A user can also get access to a valid email address and further connect to customer service people through emails. Remember that reporting any inaccuracies or unauthorized transactions as soon as possible is critical to protecting the account and minimizing any potential financial damages.

4) Are there any charges for accessing a Union Bank mini statement?

Union Bank account holders can access their Union Bank mini statement for free. There are no expenses associated with obtaining a mini statement or using SMS services. SMS services are available around the clock and can be used from any location. It is critical to ensure that the SMS demanding the mini statement is issued from the account’s registered cellphone number.

Union Bank of India offers the facility to access a mini statement through methods like missed call, SMS, or online banking free of charge. This was often seen as a convenient service provided to customers to help them stay updated with their recent account transactions without incurring any additional fees.

However, banks can update their policies and services over time, and it’s possible that there might have been changes since then. To get the most accurate and up-to-date information about any charges associated with accessing a Union Bank mini statement, I recommend visiting the official Union Bank of India website or contacting their customer service directly. They will be able to provide you with the latest information about any potential fees or charges related to using the mini statement service through various channels.

5) How long do mini statements typically show transaction history?

Mini statements often provide a restricted transaction history, usually consisting of all the recent transactions within a certain time range, typically a few days to a few weeks. The length of the transaction history presented in a mini statement might fluctuate based on the bank’s policies and the banking platform or services used.

6) How far back does the mini-statement show transactions?

The mini statement is a subset of the full statement that only includes the user’s most recent 5-10 transactions. The length of the transaction history presented in a mini statement differs based on the bank’s guidelines and the particular banking platform or services.

The extent to which a mini statement shows past transactions can vary based on the bank’s policies and technological capabilities. In general, a mini statement typically displays a limited number of recent transactions, often covering the last 5 to 10 transactions, depending on the bank’s setup and systems. This limitation is in place due to the concise nature of a mini statement, which is designed to provide a brief overview of recent account activity rather than a comprehensive transaction history.

It’s important to note that a mini statement is not meant to replace a full-fledged account statement, which provides a detailed record of all transactions over a specified period, usually a month. If you require a more extensive transaction history, you might need to access your account statement through online banking, a mobile app, or by visiting your bank’s branch.

To obtain a complete picture of your financial activities, including transactions that may have occurred beyond the scope of a mini statement, you should consider requesting a comprehensive account statement or using your bank’s online banking platform to view a detailed transaction history. This will provide you with a thorough record of your financial interactions and help you manage your finances effectively.